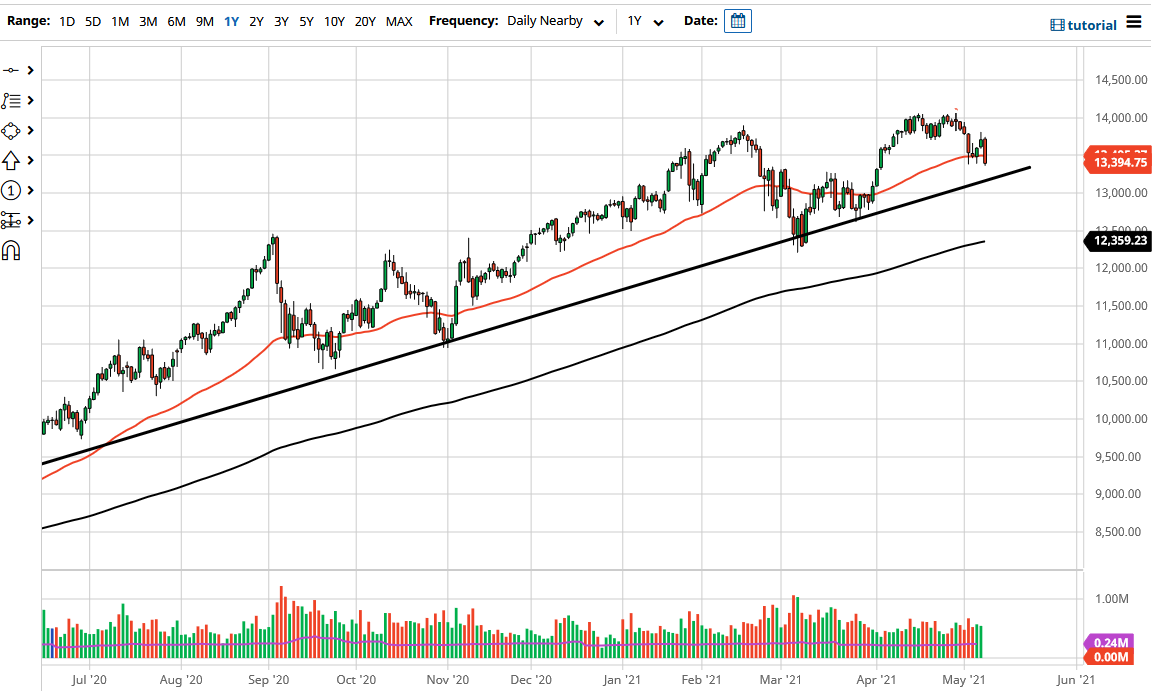

The NASDAQ 100 broke down rather significantly during the trading session on Monday below the 50-day EMA. At this point, there are multiple areas that could come into play as far as support is concerned, not the least of which is basically where we closed. If we crash through the uptrend line, then I believe that the market will probably go much lower, perhaps down to the 200-day EMA. Slicing through that would be a very negative turn of events and have me buying puts. Remember, I do not short these US indices due to the fact that they are so heavily manipulated by the liquidity measures coming out of the Federal Reserve.

This is a market that recently made an all-time high and it is still rallying overall. Granted, the candlestick for the trading session on Monday was quite ugly, but at the end of the day it has not changed the overall attitude of the market. The 14,000 level above should continue to be a major barrier to overcome, so I would not be surprised at all if it took multiple attempts. If we do break above the 14,000 level, then it allows the longer-term uptrend to continue.

I believe that the NASDAQ 100 will have to deal with the idea of what is going on in the bond market, because if yields start to fall again, that should help the market rally, as tech stocks tend to do better in low yield environments as traders stretch for gains across the risk spectrum. It is probably only a matter of time before some of the bigger technology stocks come to the forefront yet again, as Wall Street and retail traders are creatures of habit, and therefore it is probably going to continue to push the market higher over the longer term. After all, all one has to do is look at the last 13 years to see exactly how this is played out, with the liquidity measures going directly into the stock market yet again. If we do get some type of massive selloff, you could be a buyer of puts; but as far as shorting is concerned, it is all but impossible. The market could use a nice correction, but that will only end up being a buying opportunity.