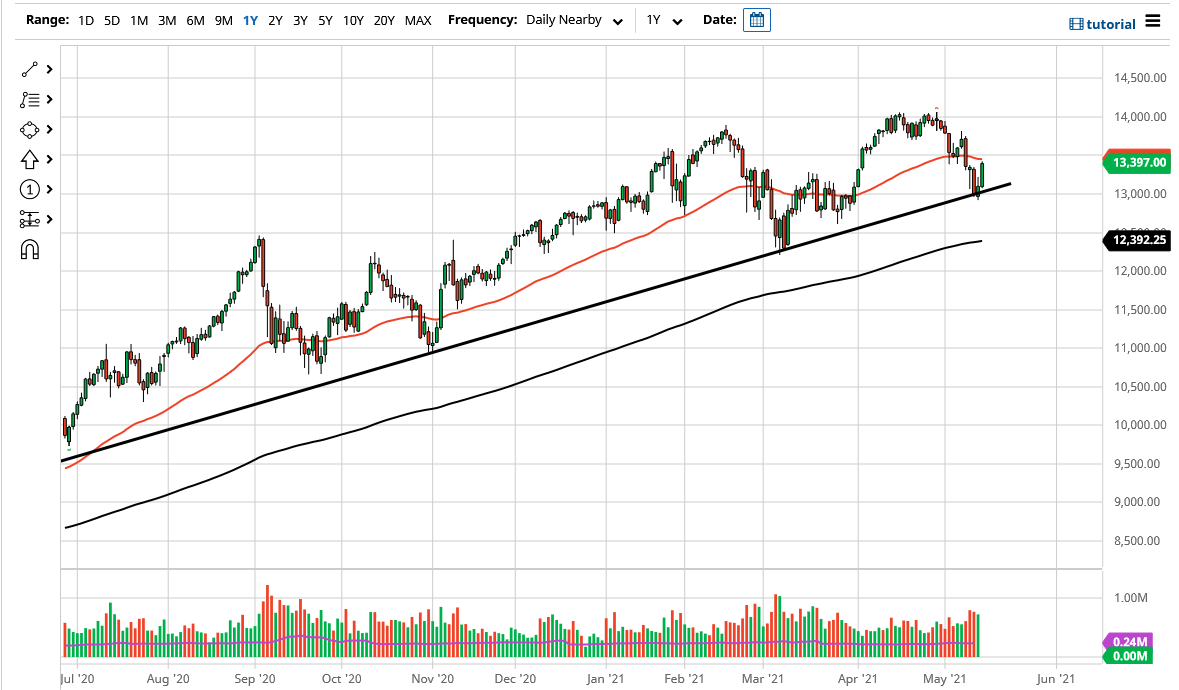

The NASDAQ 100 has rallied significantly during the course of the trading session on Friday to reach towards the 50 day EMA. At this point in time, it is likely that we will continue to see the upward momentum come into play, with the 50 day EMA the next resistance barrier. If we can break above that level, then it is likely that we go looking towards the 13,750 level, followed by the 14,000 level. The 14,000 level has been a major level of resistance as of late, but the pullback certainly should have people looking to take advantage of value that has just reentered the market.

With that being the case, and the fact that we are closing towards the top of the range, I believe that the NASDAQ 100 is going to start to perform quite well again. In fact, the Thursday candlestick has now become an “inverted hammer”, showing strength coming back in as we broke through the resistance of the previous session. The trend line of course is something that is worth paying attention to in the fact that we bounced from the 13,000 level is something that should not be ignored either.

If we can break above the 14,000 level, then I think it is likely that we will go looking towards the 14,050 level immediately, and then one would have to think that sooner or later we would be looking towards the 15,000 level as it is the next large, round, psychologically significant figure. I do believe that we get there eventually, because the liquidity measures will continue to come into play and push this market one way or another. The Federal Reserve is light years away from doing anything remotely close to tightening monetary policy so with that I believe that it is the same game we have been playing for 13 and half years, and therefore shorting this index is a suckers game.

If we did break down below the uptrend line, then you could be looking at an opportunity to buy puts at best, but the 200 day would almost certainly come into play and offer support as well. Longer-term, this market will continue to behave as it has, because quite frankly “there is no alternative.” At least that is the mantra we have been told for over a decade as there is a serious lack of yield in the world.