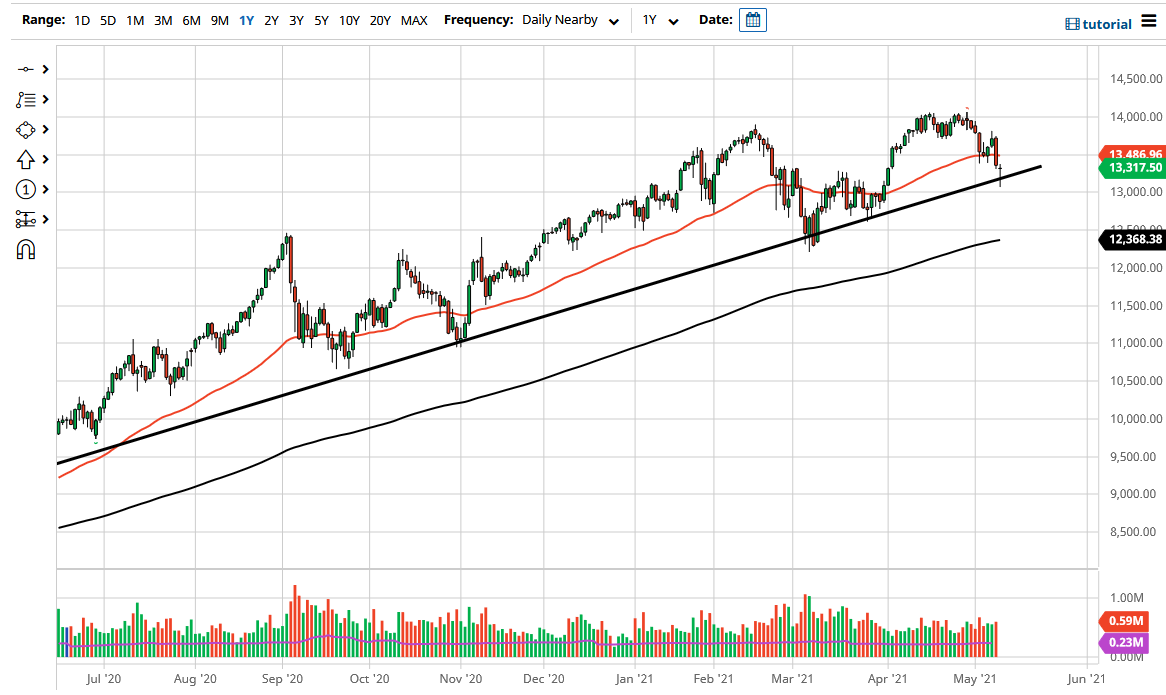

The NASDAQ 100 initially sold off quite drastically during the trading session on Tuesday to slice through a major uptrend line but turned around to form a massive hammer. This is a very bullish sign, and if we can break above the top of the candlestick for the trading day, it is very likely that the NASDAQ will save itself. This is not a huge surprise considering that the market has been in a massive uptrend for quite some time. With that being the case, I think will continue to see buyers on dips as the algorithms jump into the market.

If we did break down below the bottom of the hammer for the trading session on Tuesday, that could open up a deeper correction down to the 12,500 level which sits at the 200 day EMA as well. That is not my best case, but it is most certainly something worth paying attention to. On the other hand, if we break above the top of that candlestick then I think the first area of interest will be the 13,500 level, followed by the 13,750 level. Ultimately, this is a market that I think will continue to attract inflows due to the fact that the biggest names are all the main drivers of this market. After all, everybody on Wall Street goes to the dip fact oh position of buying Amazon, Apple, etc. when they do not know what else to do.

The massive amounts of liquidity continue to push the market higher, so I think what we are more than likely going to see is a recovery. I do not necessarily think that the 14,000 level will be easily broken, but now that we have had a nice correction a lot of people will be looking to get involved and take advantage of “cheap stocks.” Furthermore, it looks like the significant rally in the US dollar was beaten back, so that gives traders yet another reason to buy stocks as stocks Tindall of a weakening greenback. At this point, even if we do break down from here, I would only be a buyer of puts, and nothing more bearish than that as this market tends to be somewhat manipulated in the sense that liquidity drives it more than anything else.