The NASDAQ 100 has gone back and forth during the course of the trading session on Thursday as we await the all-important Non-Farm Payroll figures on Friday. Obviously, this will have a massive influence on the US dollar and of course the interest rates in America, so this of course will have an influence on technology stocks in the NASDAQ. Nonetheless, this is a market that is very bullish of the longer term, even though we have been hanging about in this area for the last couple of days after a significant selloff.

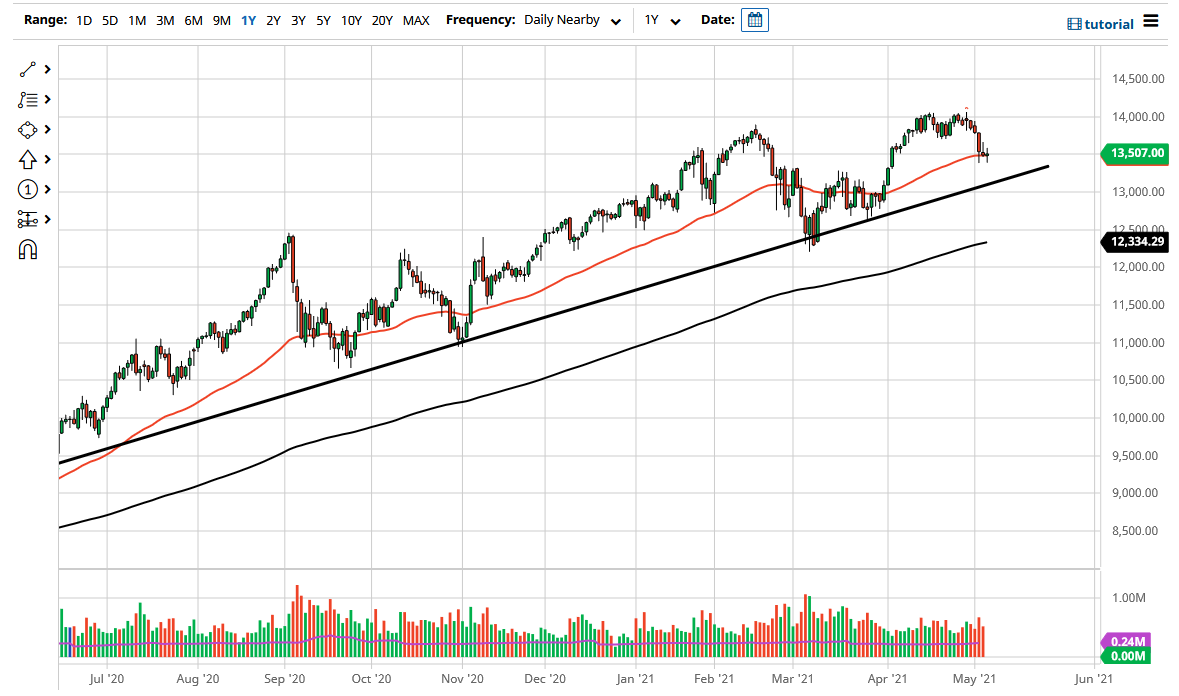

The uptrend line underneath also offers a significant amount of support as we have seen this come into play multiple times, and it should be worth noting that the 50 day EMA has also flattened out. Looking at this chart, we have recently made a “higher high”, and therefore whether or not we see support underneath could give us an opportunity to have a “higher low” as well. All things been equal, this is a market that has been grinding higher for several months, and therefore there is no reason to fight this. Nonetheless, we could see a lot of volatility, but I do believe that the uptrend line truly comes into play.

It should not be a huge surprise that we have seen the market do very little over the last couple of days, due to the fact that the jobs number will have a major influence on where we go next, at least in the short term. All things being equal, this is a market that looks like it is trying to find a bit of a springboard somewhere in this general vicinity, so I like the idea of taking advantage of value if and when we get an opportunity to do so.

This is a market that will continue to see a lot of choppy behavior but in general this is a situation where you cannot short this market as the central bank will not allow it to happen for any significant amount of time. The candlestick for both of the sessions for Wednesday and Thursday will form a little bit of a short-term consolidation area that we are waiting to break out of. Because of this, I think you probably have to play your entry from the shorter time frames, but clearly you have to be looking for the breakout, not some type of shorting opportunity. Otherwise, I think that uptrend line would be a very interesting place to find a bounce.