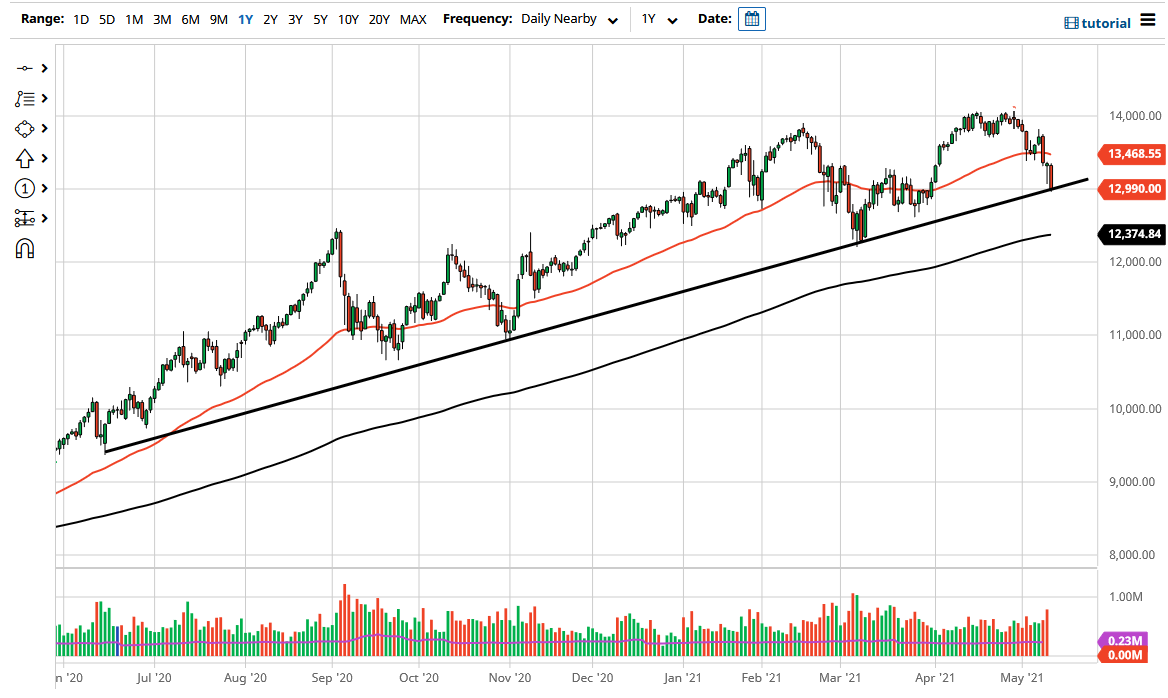

The NASDAQ 100 broke down rather significantly during the trading session on Wednesday as we have seen inflation fears cause a massive selloff in what is a very sensitive stock market index. The market has been very noisy over the last couple weeks, but the close for the trading session on Wednesday suggests that we could see further downside. I also find that it is interesting that we have stopped right at a major uptrend line in congruence with the 13,000 level.

Furthermore, we have broken down below the bottom of the hammer from the previous session, so this is also very negative. Pay close attention to the yields in America and how quickly they move. If those yields take off rather quickly, that will be yet another blow for this market. If we break down below the uptrend line, then I believe there should be a significant amount of support at the 200-day EMA which is currently sitting at roughly the same level of the last major swing low.

I do in fact expect this market to turn around and rally, but you do not necessarily have the setup quite yet. I need to see a daily candle of strength or at least stability in order to get long again, as clearly you cannot be a seller of this market as the Federal Reserve is going to keep rates low given enough time. They will step into the market and drive yields down as they are more than willing to let inflation run hotter than anticipated. Do not get me wrong, I know that the yields in America will rise going forward, but it is the rate of change that traders pay the most attention to. As long as it is slow and steady, that should continue to allow stocks to rally.

On the other hand, if we get some type of massive drop in rates, that will be a bullish catalyst for the NASDAQ 100, as it tends to be very sensitive to those external influences. Ultimately, it is the bond market that will decide where this market goes next, but from a technical standpoint, we are most certainly sitting at a major decision point. I would be a buyer of puts if we break down, but not a seller, as jawboning by the Federal Reserve could have your position flip on you rather quickly.