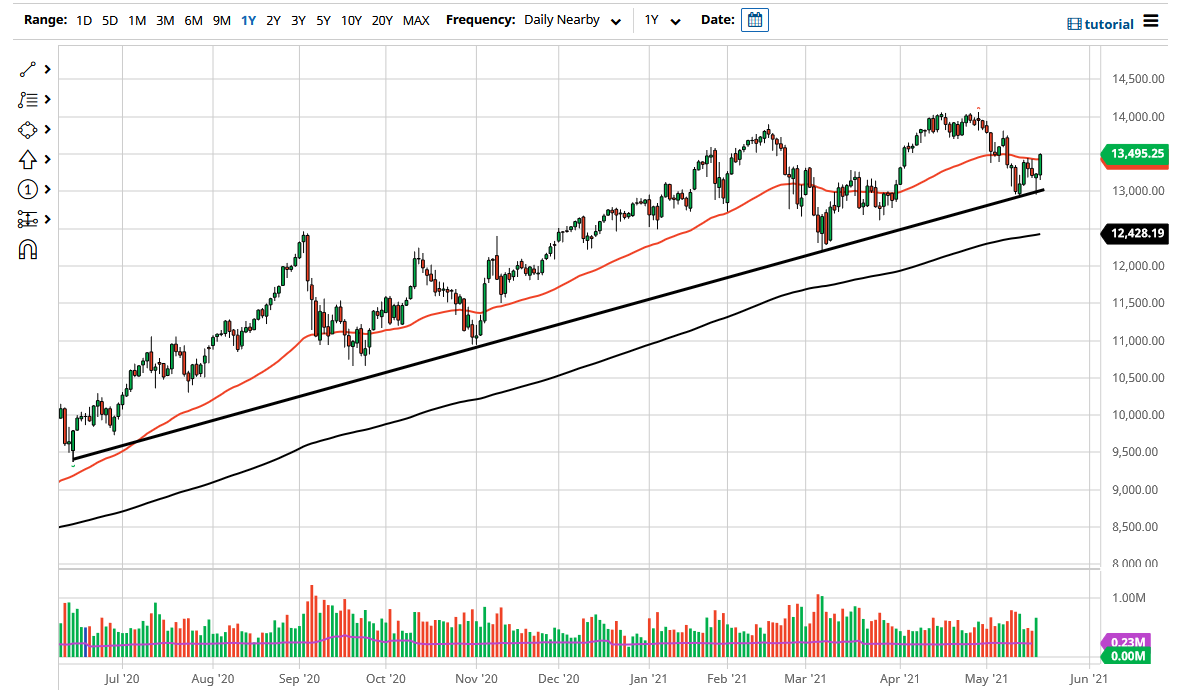

The fact that we are closing towards the top of the range suggests that we are in fact going to continue to go much higher, as it typically means that there is a bit of follow-through. At this point, the market is likely to go looking towards the 14,000 level, which was the most recent high.

It is also worth noting that we have recently bounced from the uptrend line and even formed a hammer from the Wednesday session. Because of this, it looks as if we are ready to continue going higher and I am bullish of this market yet again. In fact, you can make a bit of an argument for the fact that we are forming an ascending triangle, so all things been equal if we do break to the upside, it could be looking at a move of the NASDAQ 100 towards the 16,000 level based upon the “measured move.”

Pullbacks at this point in time should be a nice buying opportunity, and I do think that there will be plenty of buyers looking to get involved unless of course there is some type of catalyst. If we were to break down below the 13,000 level, that could be a very negative turn of events as it would slice through an uptrend line and of course a large, round, psychologically significant figure so that would possibly open up a move down towards the 200 day EMA. If we were to break down below that, then things get a very ugly and I would be a buyer of puts.

The scenario where I see this market breaking down below the 200 day EMA would be when interest rates spike too much in the United States, because then tech stocks tend to get hammered in general. That being said, the Federal Reserve is likely to do something to save the market sooner or later, so I would not get aggressively short anyway. Buying puts could be the way to go, but that is about as aggressive as I would get. Liquidity continues to be a big driver of where we are going, so that is something worth paying attention to.