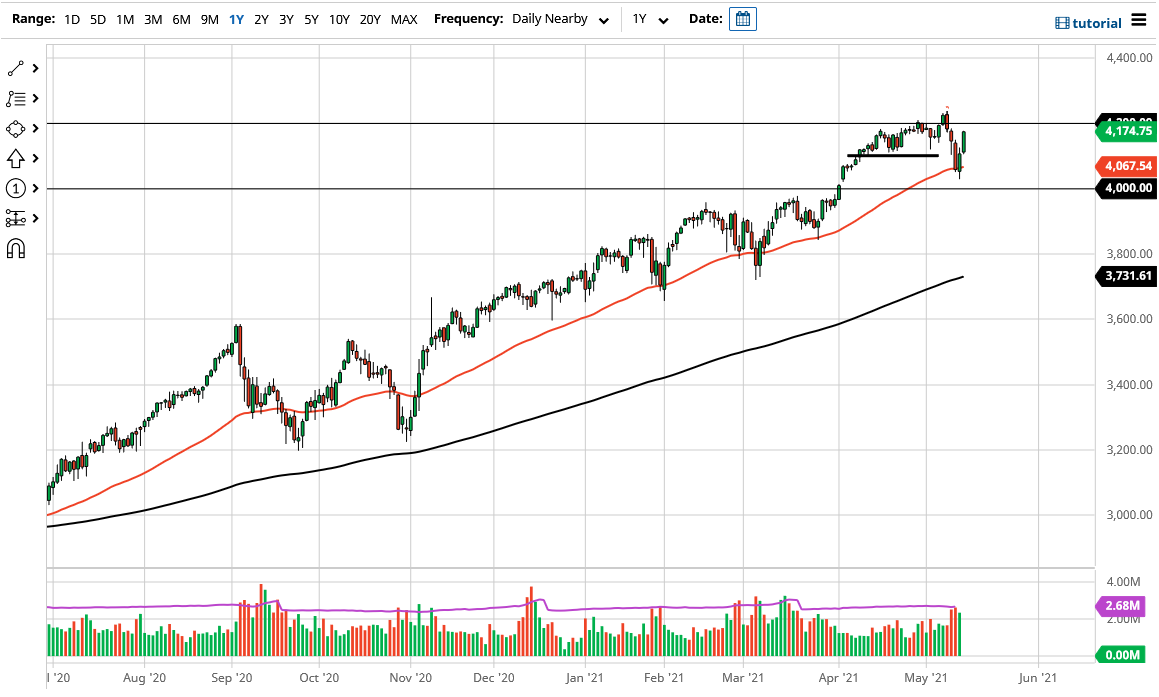

The S&P 500 rallied quite significantly during the trading session on Friday as we have broken significantly above the 4100 level. By doing so, it looks like the market is ready to go looking towards the 4200 level. Furthermore, we are closing at the very top of the range which of course is a very bullish sign. The market is likely to continue to see the highs be tested, and I think that short-term pullbacks will attract a lot of value hunters, as the 50 day EMA has been so supportive and of course has been very widely followed more than once, and therefore you can see that the market breaking to a fresh, new high is very likely.

If we can break out above the recent all-time highs, then it opens up the S&P 500 to go looking towards the 4400 level. At this point in time, this is a market that has offered value of the last couple of days as a lot of traders worried about inflation picking up in the United States, and then perhaps the Federal Reserve tightening monetary policy. However, people had started to realize that the Federal Reserve is in fact going to stay loose for quite some time, as they have been stating all along. Beyond that, the Friday session also featured the retail sales number coming in much lower than anticipated, so with that being the case it is very likely that we will see more liquidity come into the market than it else. Remember, the last 13 ½ years have been all about liquidity, so it is hard to imagine that suddenly changing in the last couple of days.

Underneath, the 4000 level is now going to be the “floor the market” as we have tested it and of course there is a gap there that has now been somewhat filled. Furthermore, those gaps do tend to hold as support, so at this point in time it looks like we are ready to go higher. I have no interest in shorting this market, and I look at short-term pullbacks as a little bit of a value play more than anything else. Ultimately, I do think that will make all-time highs again, so therefore this is a “one-way trade” as far as I can see, and I am not even sure how that changes anytime soon.