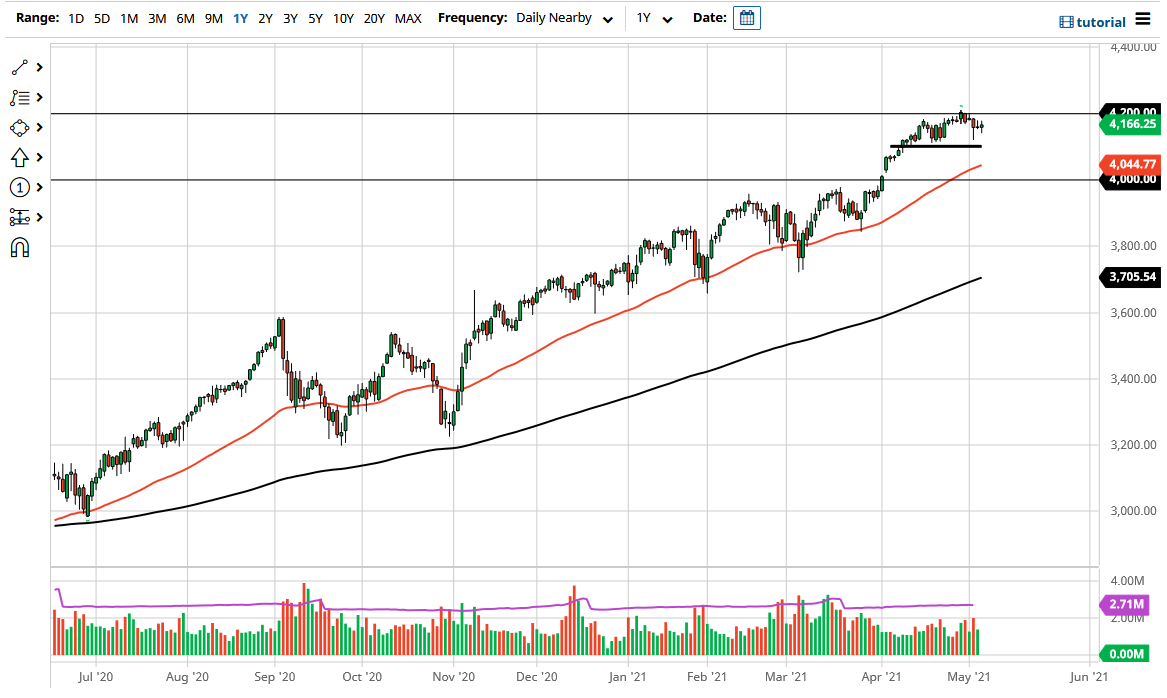

The S&P 500 went back and forth during the course of the trading session on Thursday as we await the results of the jobs figure in the United States. After all, the market is likely to see a lot of volatility as we get the figures, as it gives us an idea as to what the Federal Reserve could do. Ultimately, this is a market that I think continues to see upward pressure over the longer term, but all things being equal this is a market that has a significant amount of bullish pressure in it, and as a result it is likely that any time, we dip there is going to be a lot of value hunting going on.

Underneath, the 4100 level should be supportive, as it had been over the last couple of weeks. That of course is a large, round, psychologically significant figure, but at this point in time the 4000 level is significant support, as we not only have the large, round, psychologically significant figure, but we also have the 50 day EMA sitting just above a small gap as well, leading to a significant amount of interest in this area.

If we were to break down below all of that, then I think it is likely that the market goes a bit lower, reaching down towards the 3800 level. At that point, I would be more of a buyer of puts than anything else, as I would not short an index in the United States due to the fact that the Federal Reserve is going to do everything, they can inflate assets, and then of course includes the stock market. The S&P 500 is in the midst of earnings season, so that in and of itself will cause a bit of value but the same play has been working for 13 years: that you buy dips when they show signs of support. Longer-term, I believe that if we can break above the 4200 level, then it is likely that we go looking towards the 4400 level, as the market does tend to move in 200 point increments overall. It might be noisy, but this is a market that eventually finds a way to go higher one way, or another based upon the latest narrative, or just comments coming out of the Federal Reserve.