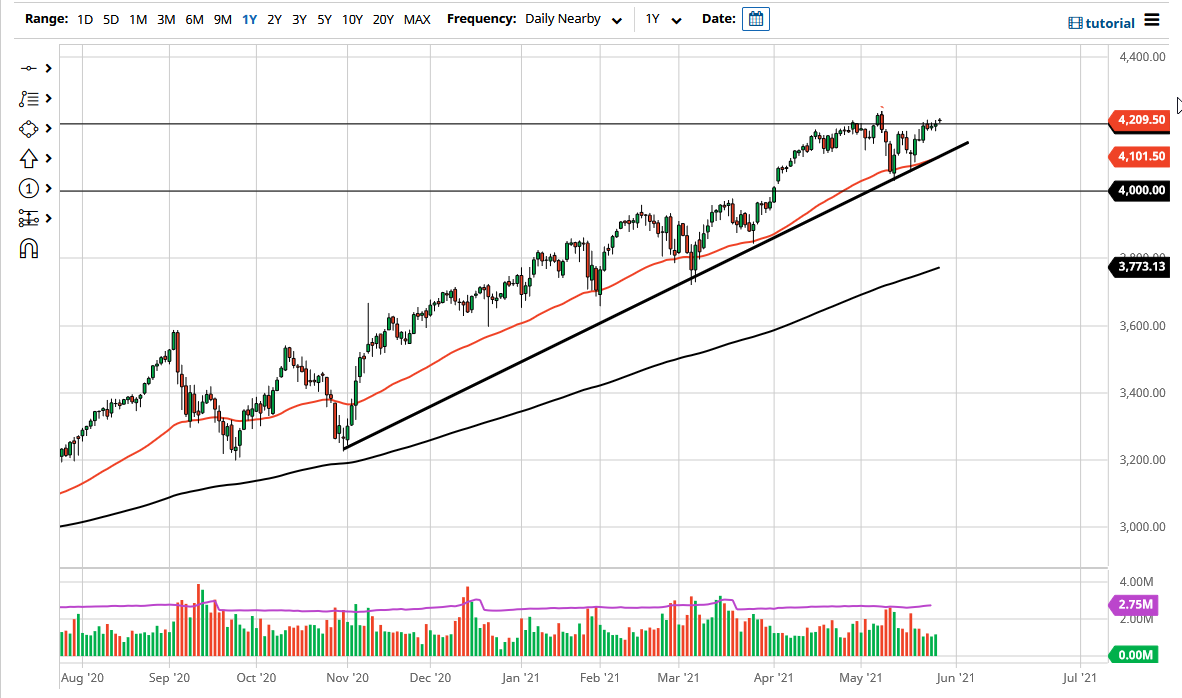

The S&P 500 fluctuated during the trading session on Friday in very quiet trading, which is no surprise considering that it was Memorial Day weekend. That means that banks in the United States and the underlying index itself will not be moving, but that does not mean that there will not be trading in the futures market. At this point, I would suspect that any significant pullback will probably get bought, as we are most certainly in an uptrend and have seen a squeezing to the upside.

There is an uptrend line underneath that should continue to support this market, and it is being walked upon by the 50-day EMA. In other words, there is a whole litany of reasons to think that we are going to go higher over the longer term. In fact, even if we break down below there, I think there is plenty of support near the 4000 level, which is my “floor in the market”, as we not only have the large, round, psychological significance of the figure, but we also have a major gap there that could come into play as well. It is not until we get below that level that I would even start to consider being bearish this market, and even at that point in time I would only be a buyer of puts, as shorting the US indices over the last 13 years has been a great way to lose a lot of money very quickly by a handful of words coming out of the Federal Reserve.

To the upside, I believe that we will probably go looking towards the 4400 level, as it is a market that tends to move in 200-point increments. Because of this, I like the idea of aiming for 4400 and then taking profits only to wait for some type of pullback to offer value. Furthermore, the market has come a long way in a very short amount of time, so this digestive and consolidated attempt to work off the froth probably makes sense anyways. I have no interest in shorting this market like I said, so I am looking for dips as potential opportunities to get in at a good price.