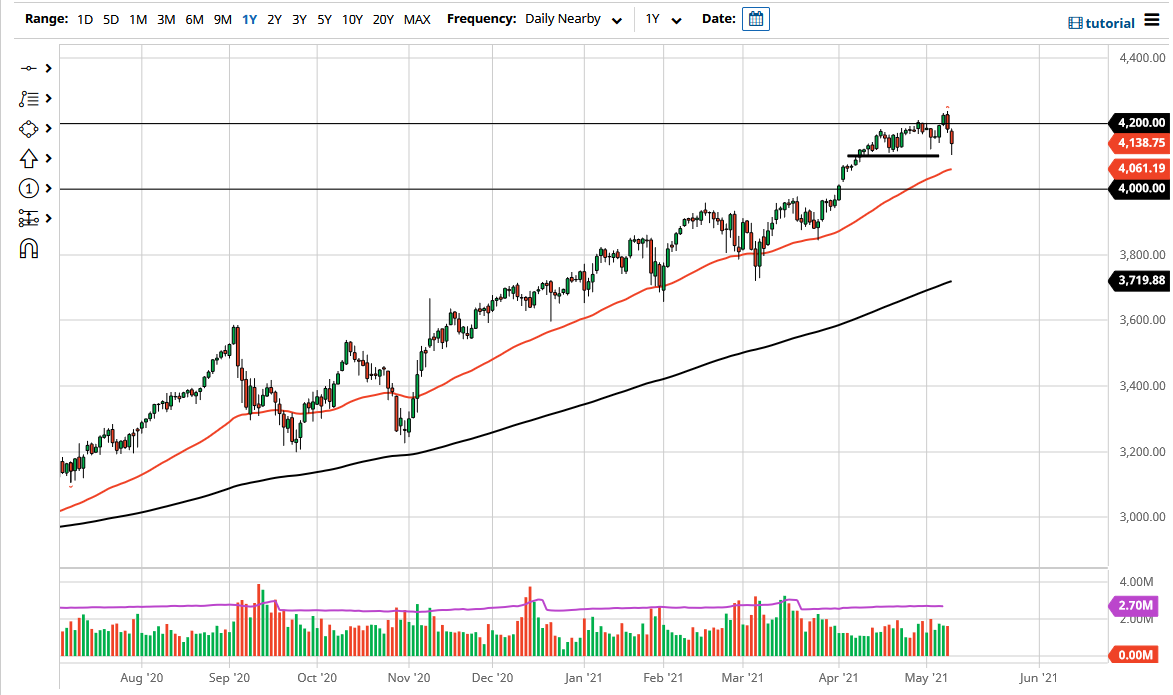

The S&P 500 has fallen initially during the trading session on Tuesday but found enough support near the 4100 level to turn things around and show signs of life again. The fact that we ended up forming a candle that is somewhat shaped like a hammer is a good sign, perhaps opening up the possibility of a move to 4200 over the next couple of days. After all, this is a market that goes higher over the longer term, so I think it is only a matter of time before we would have value hunters coming into pick up the dip.

Earnings season went fairly well, and it certainly looks as if we will continue to see plenty of liquidity out there to drive the market higher. As long as the rate of change when it comes to the bond yields in America remain somewhat stable, then it is likely that we will continue to see stocks rally. Furthermore, rates will only rise so much before the Federal Reserve gets involved, and it is very likely that is what a lot of people are banking on. That has been the case for quite some time, and it does make sense that continues going forward.

If we did break down from here, then it is possible that the 4000 level would be an area that people pay close attention to, as it is a large, round, psychologically significant figure, and of course will have a gap. I do think that the 4000 level would be enough for traders to get involved based upon the psychology of it, and of course the fact that there is probably a significant amount of option premium sitting in that general vicinity. If we were to break down below there, then it is likely that the market goes looking towards the 3800 level underneath, as the 200 day EMA is racing towards it. If we do get that breakdown, I would be a buyer of puts but I would not short this market because that has been a great way to destroy your account over the last 13 years. Because of this, I would be a buyer of puts but then look to be buying a bit of a rally from that area. All things been equal, I do think that will recover from here given enough time and we should continue to go higher.