The S&P 500 rallied quite significantly during the trading session on Friday to reach towards the 4200 level. By doing so, the market suggests that it is ready to go higher given enough time. This is especially poignant, due to the fact that we formed a shooting star during the Friday session, only to blow through the top of it. That is always a fairly bullish sign in and of itself. Because of this, the market is likely to see plenty of momentum-chasing traders out there.

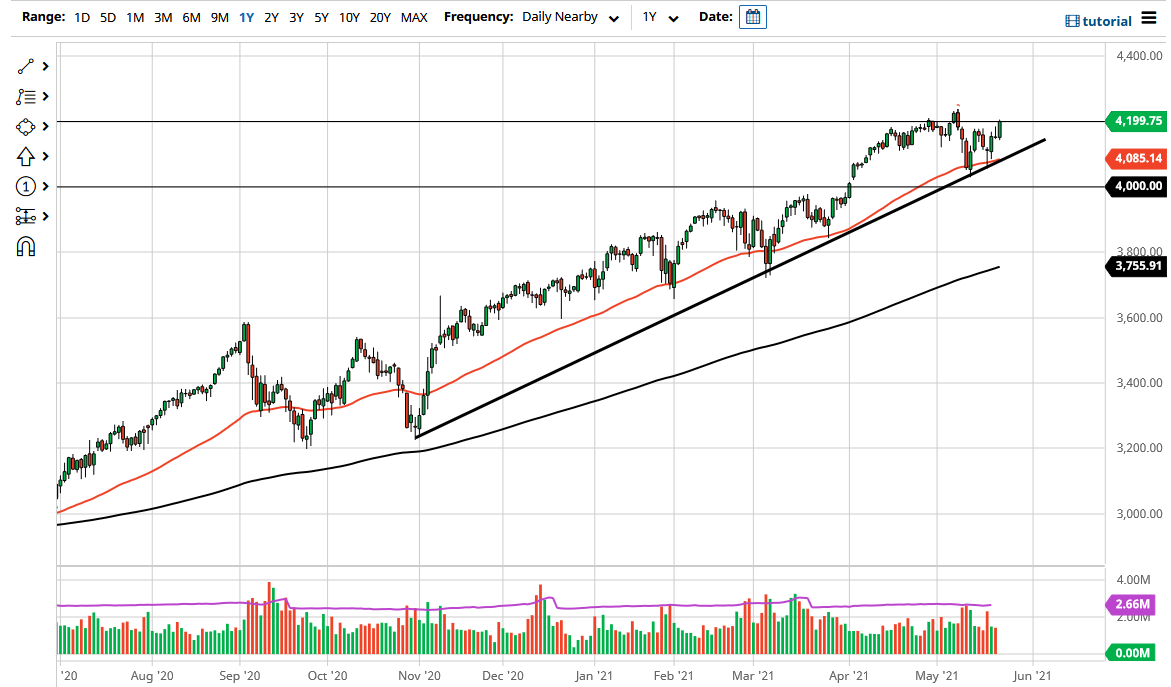

When you look at the chart, you can see plainly just how bullish this market has been, and even though we have had a bit of a pullback as of late, you can also make a huge argument for a double bottom near the 50-day EMA. That suggests that we have plenty of buyers in that area, and it is also worth noting that the uptrend line has held as well. I do believe that eventually we will break out to the upside and simply continue the overall bullish attitude that we have seen.

With the Federal Reserve out there willing to add plenty of liquidity into the marketplace, it does make sense that the stock market continues to rally as traders do everything they can to get ahead of inflation. At this point, if we can break above the recent all-time highs, I believe that the market will then go looking towards the 4300 level, followed by the 4400 level. My target would be 4400, due to the fact that the S&P 500 tends to move in 200-point increments, something that you can plainly see if you look back a historical chart. With that, I do think that it is only a matter of time before we get there.

At this point, even if we break down below the 50-day EMA and the uptrend line, it is very possible that we will see 800 of support near the 4000 handle, as it is a large, round, psychologically significant figure, and an area where we have seen a nice gap form as well. I would be a bit surprised if we broke down through there, but if we did then I would look to “reset the uptrend” at the 200-day EMA.