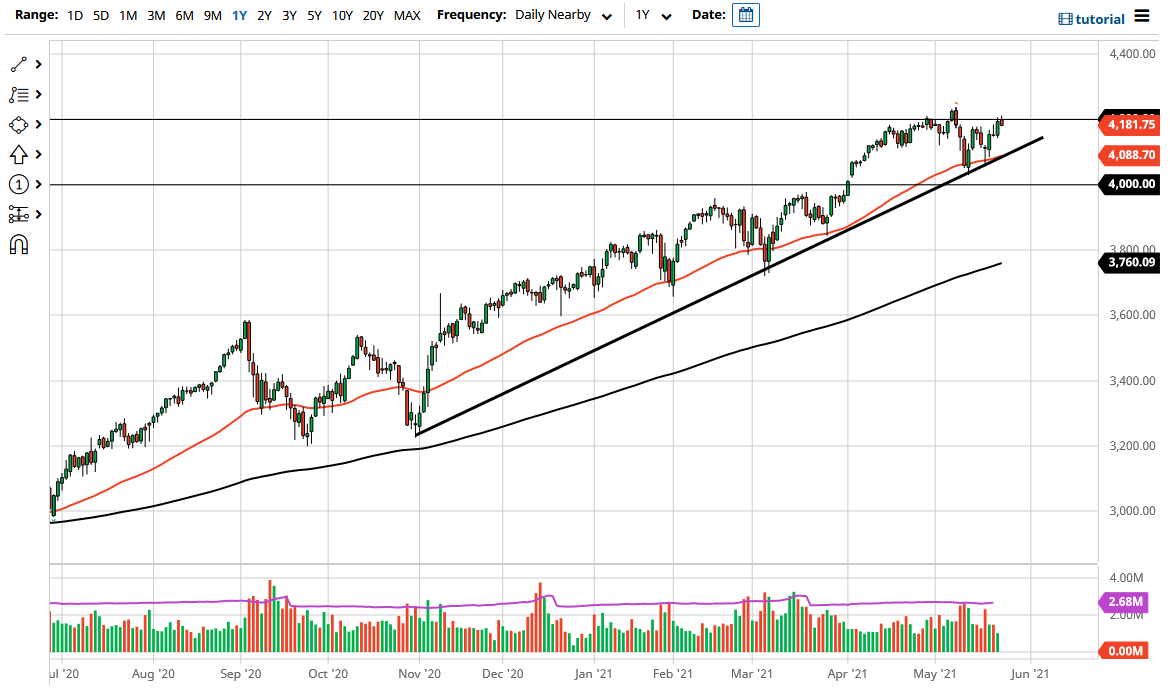

The S&P 500 rallied initially to kick off the trading session only to give up those gains. At this point, the 4200 level continues to offer resistance, which is a large, round, psychologically significant figure, and an area where we have seen a little bit of selling pressure previously. With this being the case, the market looks as if it is trying to build up the momentum to finally break out for a bigger move.

Ultimately, I think that we could get a bit of a pullback, but that pullback should find plenty of buyers near the 50-day EMA and the uptrend line that I see near 4100. The shape of the candlestick is a bit of a shooting star, which suggests that we could get that pullback as well. Nonetheless, I think there are plenty of buyers underneath that could come into the picture and try to take advantage of the longer-term trend. At this point, it looks to me as if the market is simply trying to build up the momentum to go higher. At this point, if we can break out to a fresh, new high, then it is likely that we will go looking towards the 4400 level.

Looking at the chart, if we were to break down below the 50-day EMA and the uptrend line, then it is likely that we would look at the 4000 handle, which is a large, round, psychologically significant figure, as well as the scene of the previous gap that has yet to be filled. Ultimately, we are in an uptrend, and that is the most important thing to pay attention to. I do think that eventually we will go much higher, and you should keep in mind that the market tends to move in 200-point increments, so you need to pay attention to 200 points from here in both directions. In the short term, I think you simply look it dips as buying opportunities that you should take advantage of one way or another, as we will start to see buyers jump back into a market that has no interest in falling for a longer timeframe. If we were to break down below the 4000 level though, then I might be a buyer of puts; but that is about as bad as it goes.