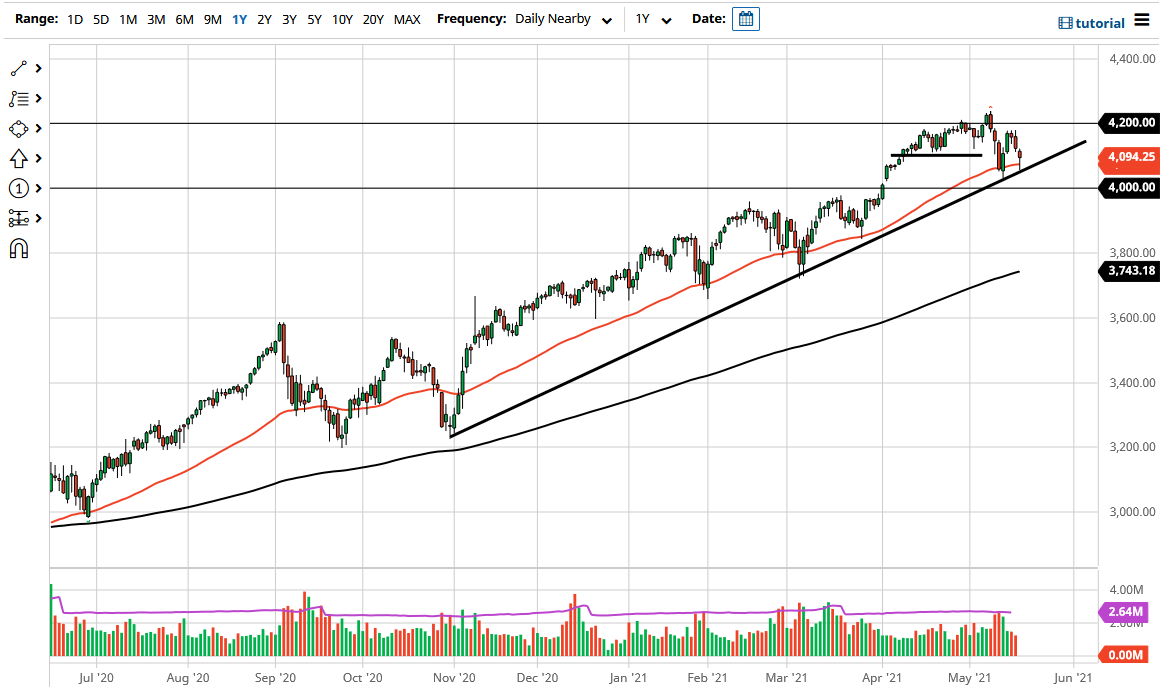

The S&P 500 fell rather hard during the trading session on Wednesday to reach down towards the uptrend line that has been so crucial in this market. Furthermore, we broke down below the 50-day EMA, only to turn around and find buyers come back in. The hammer that ended up forming for the trading session suggests that we are going to go to the upside, perhaps reaching towards the 4200 level given enough time. That does not mean that is going to be easy, and the markets are trying to work off a lot of excess froth. The nonsensical headline of the day continues to cause issues, but at the end of the day, you can see clearly that we are still in an uptrend, so there is no point in trying to fight it.

If we do break down below the uptrend line, the 4000 level comes into the picture, as it is not only a large, round, psychologically significant figure, but it is also an area where there is a gap that has held up so far. That gap should continue to be a bit of a “floor in the market” and breaking down below there would be a major event. If that happens, then it is likely that I would be buying puts, but not shorting this market, as it is far too strong to think about shorting.

At this point in time, I think that if we break above the highs of the trading session on Wednesday, then the market is likely to go looking towards those highs again. I do think that will happen if we get some type of catalyst, perhaps just simple calculus with the VIX dropping a bit from the spike that we had seen during the trading session. In general, I think that nothing has changed, especially as the market recovered so nicely later in the session. Remember, a lot of times the big institutional money comes in late during the session, and that typically means that real conviction and larger amounts of capital get deployed during the last hour. With this, I like the idea of going long based upon the nice-looking hammer that we have seen, as it occurred right where you would wish to see it happen in a major uptrend.