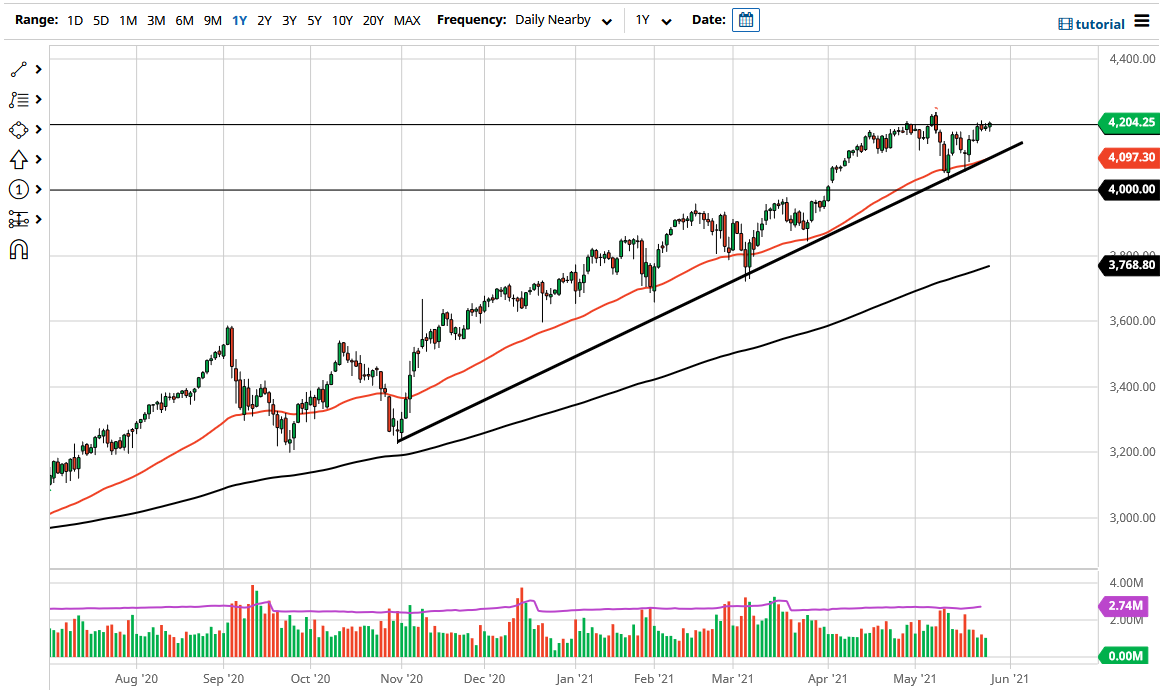

The S&P 500 has initially pulled back during the trading session on Thursday but found enough interest in the market to turn things around and send it back above the 4200 level. Ultimately, this is a market that is trying to find buyers to push to the upside, and break above the most recent all-time high. If we do, that opens up the possibility of a much bigger move, perhaps to the 4400 level as this market tends to move in 200 point increments.

To the downside, you can see that there is a significant uptrend line that has been important, and we have seen the 50 day EMA walk right along that uptrend line to show signs of resiliency. I think that is going to be very difficult to break through, but if we do break down below there, we could go looking towards the 4000 handle underneath, which of course is a large, round, psychologically significant figure, and an area where we see a nice gap. Ultimately, this is a market that will continue to go higher based upon the fact that the Federal Reserve will liquefy the markets and quite frankly it is what we have been doing for 13 years.

As long as there are excess amounts of liquidity in the markets, it is likely that we will continue to see buyers coming into the market as are simply will be much of a way in returns in anything that is not risky. Bond markets offer a very paltry return, and therefore it makes sense that if those rates can continue to slide a bit, that should help the S&P 500 as it is highly sensitive to those rates and what is going on. Technology stocks have gotten a little bit stronger as of late, and that should help continue to lift this index.

As far as selling is concerned, it is not until we break down below the uptrend line and the 4000 level that I would even consider doing so, and even then, I would only be a buyer of puts. This is because the market always seems to find a way to go higher, so there is no point in trying to fight the overall attitude of the market so with that being said, I look at pullbacks as value opportunities that I should be taking advantage of.