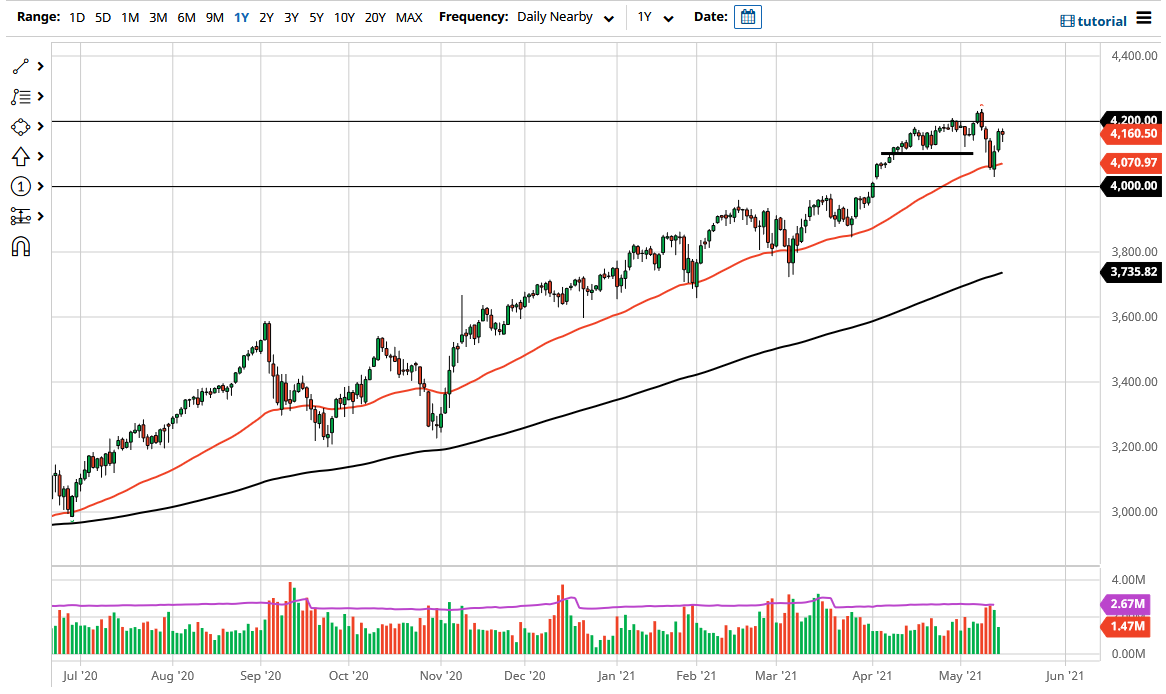

The S&P 500 initially fell during the trading session on Monday but has recovered most of the losses to form a bit of a hammer. With that being the case, it is very likely that we will continue to reach towards the 4200 level above which is a large, round, psychologically significant figure and the most recent high. That being the case, I think what we are looking at here is a scenario where the buyers continue to come back into the market to pick up value. After all, the 4100 level has proven itself to be short-term support again.

Underneath, we have dropped to the 50-day EMA only to find buyers again, so that is a good sign as well. By bouncing from the 50-day EMA, it suggests that the uptrend is very much intact, and that we will continue to see people get involved in general. With this being the case, I believe that the 4000 level underneath also offers a significant amount of support as there is a major gap there, and that in and of itself will capture a lot of attention.

Remember that the Federal Reserve is still very loose with its monetary policy, and despite the fact that some people out there are worried about tightening, the reality is that the central bank will do nothing to bring down the value of the stock market for any length of time. This is a matter of “watch what they do, not what they say.” Every time the central bank has seen the stock markets melt down, they get involved and do something to patch over the credit markets, which is the real problem.

The S&P 500 continues to attract a lot of attention and, if the US dollar continues to be torched, it is very likely that the stock market will rally, as it is the correlation for most moves. Even if we did break below the 4000 handle, I think at that point the most bearish you can get in this market is to buy puts, as we would likely see a lot of support at the 200-day EMA. I certainly would not be a seller of this market under any circumstance that I can foresee based upon the last 13 years.