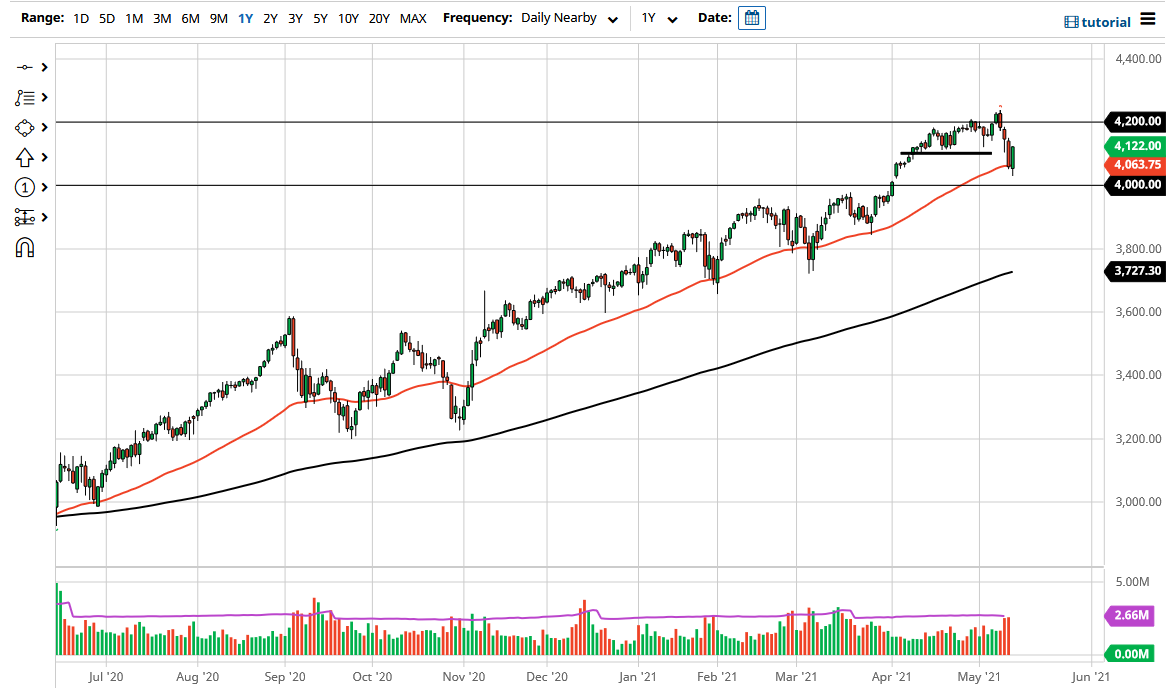

The S&P 500 has pulled back a little bit to kick off the trading session on Thursday but has turned around to see buyers take over again. The 50 day EMA offering support is nothing new to this market, and if you remember during the video yesterday, I had stated that this market does tend to break below the 50 day EMA before turning right back around. With that in mind, it is obvious that we are simply repeating the same pattern that we had been in for a while, and it is likely that will continue to be the case going forward.

What I find interesting is that we broke above the 4100 level, and as a result it is likely that the market will then go looking towards the 4200 level. The 4200 level is a major resistance barrier that we had pulled back from, and I think the market got cheap enough to attract a certain amount of money. With that being the case, the market is likely to see further momentum, and I think we will not only see the 4200 level overtaken, but I think it should send this market to the upside.

To the downside, the 4000 level continues offer support, right along with that massive gap that sits just above it. Ultimately, this is a market that I think can only be bought on dips and therefore I have no interest in trying to short it. Furthermore, the liquidity measures that the Federal Reserve are almost certainly going to continue to pump into the market should push this index higher. After all, the same playbook has been in effect for quite some time, as the inflation scare during the day on Wednesday was but a blip on the radar, and the Federal Reserve is not going to tighten monetary policy anytime soon, so with that in mind I think it continues to be a scenario where you buy the dips and add as we go higher. 4500 is my longer-term target and I do think it is only a matter of time before we get there, but that is probably an argument for sometime this summer and not the next few weeks. Granted, the volatility will continue to be an issue, but we are very much in an uptrend despite what the last couple of days had looked like.