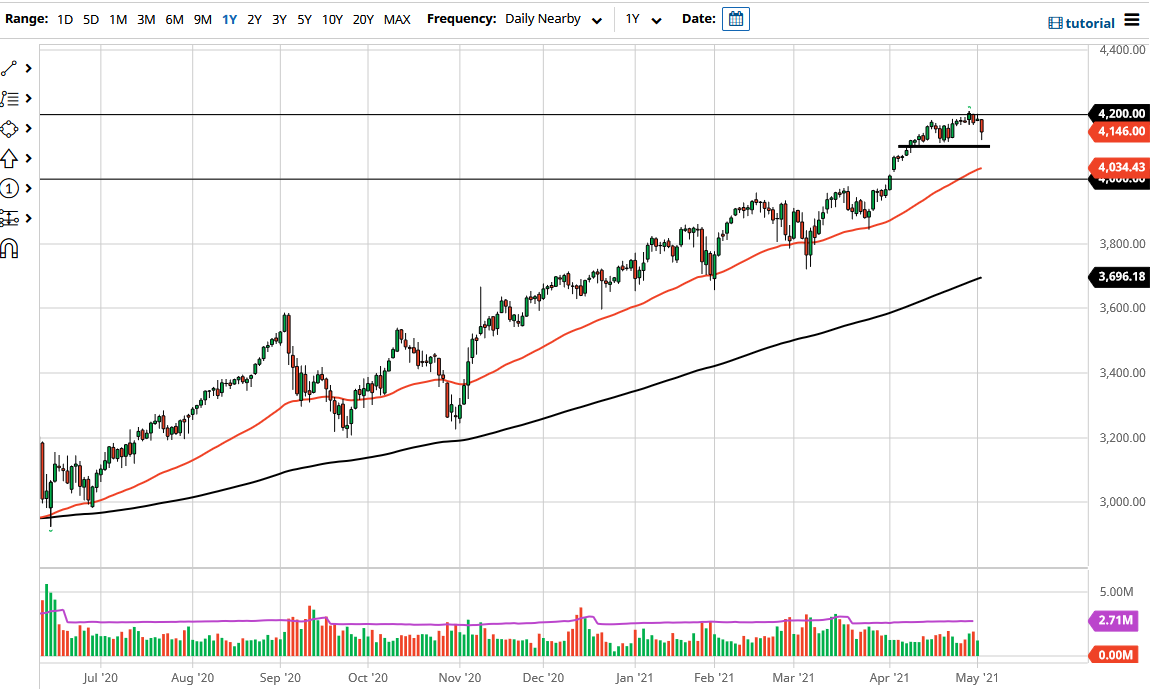

The S&P 500 pulled back rather significantly during the trading session on Tuesday to reach down towards the 4125 handle. This is an area where we have seen buyers previously, so it does make sense that we have bounced from that level late in the day. The market has been in an uptrend for some time, and if you have been listening to me over the last couple weeks, I have suggested that we could perhaps continue to see buyers on a dip closer to the 4100 level. The fact that we did see a little bit of a recovery late in the day does suggest that perhaps there is a lot of resiliency in this market, and the fact that we are in the midst of earnings season probably has a lot to do with what is going on as well.

To the upside, the 4200 level would be a large, round, psychologically significant number that people are paying close attention to, and we have seen a significant amount of resistance in that general vicinity. If we can break above there, then the market is likely to continue going much higher. The 4200 level needs to be broken on a daily close for me to get overly aggressive, but in the short term it is likely to be very noisy. That being said, I think it is only a matter of time before we break out, and we are simply just building up a little bit of momentum in order to finally make that move higher.

Even if we did break down below the 4100 level, the market could go looking towards the 50-day EMA, the gap sitting just at that level, or perhaps even the 4000 handle. There are plenty of reasons to think that the market is going to continue to see support in that area, as all of those factors could come into play. Ultimately, this is a market that I would not short, and even if we broke down below the 4000 level, buying puts is about as bearish as I get when it comes to the S&P 500, because at least that way you can limit your downside. As long as central banks around the world continue to flood the markets, markets go higher.