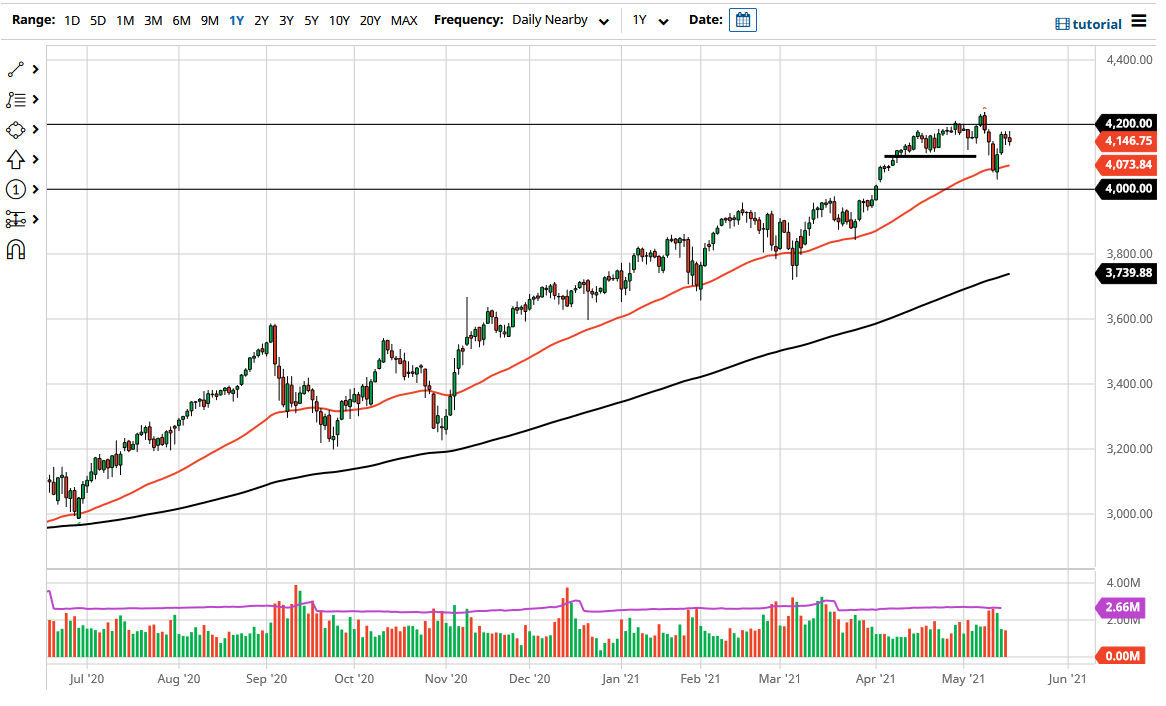

The S&P 500 initially tried to rally during the trading session on Tuesday but gave back the gains to show less-than-enthusiastic momentum. The market looks as if it could pull back towards the 4100 level, an area that previously had been support, so I think we also need to pay attention to not only that but the 50-day EMA underneath which is racing towards that area. If we do break down below there, then I think it is very likely that we would see buyers near the 4000 handle, not only due to the large figure, but also the fact that there is a big gap just above that region as well.

If we break down below the 4000 handle, then I would probably be a buyer of puts, but that is about as bearish as I would get at this juncture. Buying puts makes sense, because you can limit the downside as the S&P 500 is likely going to find one reason or another to turn around, if for no other reason than the massive amount of liquidity that is involved. At this point, I would anticipate that the 3800 level would probably be a target, especially as the 200-day EMA comes into the picture.

To the upside, the 4200 level is going to continue to be a bit of a barrier, but if we can break above there then I think that we will continue the overall uptrend. Given enough time, the market is likely to go looking towards the 4400 level, which is my longer-term target. I do think that we will get there, especially as the Federal Reserve will continue to see reasons to keep their liquidity flowing based upon recent comments. Furthermore, the US dollar continues to fall - and based upon the Federal Reserve they will probably contiinue to make it happen - so it is likely that the market will continue to see traders try to get away from the greenback in general. This is a market that I think continues to see plenty of upward momentum over the longer term, but we have a bit of noise in this general vicinity. I think I would have to be very small about my position sizing, but clearly buying is the only thing that can be done.