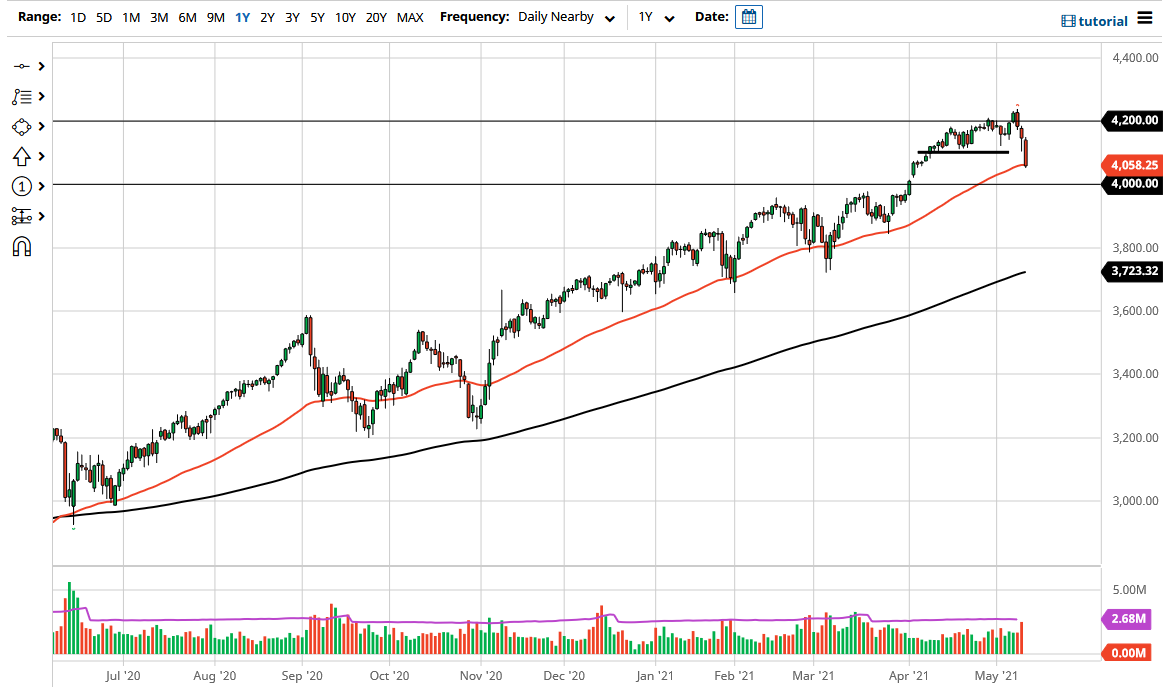

The S&P 500 has sold off quite drastically during the trading session on Wednesday to reach down towards the 50-day EMA. At this point, the market is closing at the very bottom of the range, which typically means that we are going to see a bit of continuation. Breaking down below the bottom of the candlestick more than likely goes looking towards the 4000 level underneath which is a large, round, psychologically important figure. Furthermore, we also have the large gap that sits in that general vicinity that comes into play, so I think there are plenty of reasons to anticipate that there could be a nice buying opportunity.

I am waiting for some type of daily candlestick to start buying, something that I do think will happen sooner rather than later. A lot of the selloff was probably due to traders freaking out about the idea of inflation, but not all markets were seeing it as dangerous. The size of the candlestick does suggest a little bit of panic, and we did see a spike in volume, so at this point I think we are getting relatively close to the capitulation low. I anticipate that the next couple of days could be very rocky, but at this point it is only a matter of time before the buyers come back in to pick this market up.

If we were to break down below the 4000 handle, I would be a buyer of puts more than anything else. I have no interest in shorting this market, because there is enough manipulation coming out of the central banks that they keep the stock markets afloat. This is especially true with the Federal Reserve, which is more than likely going to let inflation run much hotter than usual, so it is probably only a matter of time before they step in and drive yields back down. If and when they do, growth stocks will start to look quite a bit better. Right now, a lot of the “favorite stocks” out there have been hammered, and that drives down the S&P 500 as it is so heavily weighted by just a handful of stocks and therefore is vulnerable to these types of moves. Longer term, though, this is a market that has been in an uptrend and will continue to be.