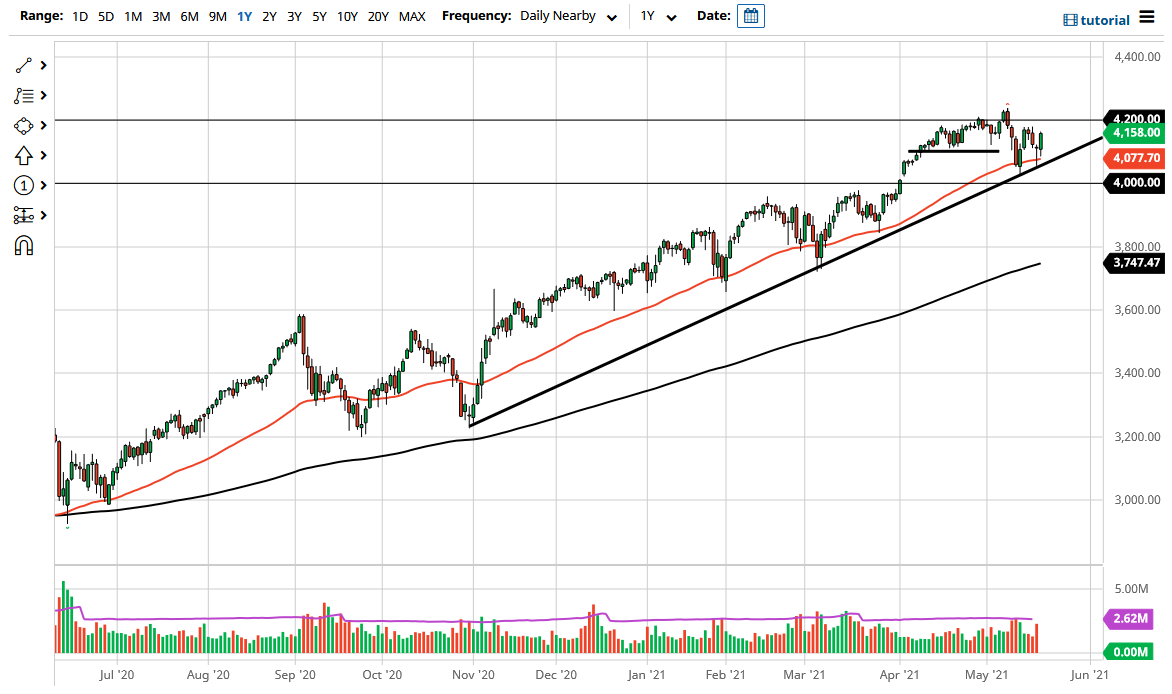

The S&P 500 has pulled back a bit during the course of the trading session on Thursday to find significant support just above the 50 day EMA. This is the second day in a row that we have seen buyers jump in to pick this market up, but perhaps more importantly the market has closed that the very top of the range which of course is a strong sign that we will more than likely see continuation. With that being the case, the market is likely to be a scenario where buyers continue to jump in and pick up dips as this market has been so strong. To the upside, the 4200 level is an area that is a large, round, psychologically significant figure that a lot of people would be looking at.

If we can break above that level, then it is likely that the market will continue the overall uptrend as we could go looking towards the 4400 level. Based upon the recent action, I do think that we eventually get there, but there has been a lot of concerns when it comes to the overall health of the market, and therefore I think that we will continue to see a lot of volatility but based upon the move that we had during the trading session on Thursday, it looks as if the overall trend should continue to the upside.

Furthermore, the liquidity measures out of the central banks will of course continue to boost asset prices as well. The 50 day EMA and the uptrend line both have served traders quite well, but I think what we are seeing is a continued building of inertia to finally make the breakout. If we were to make a fresh, new high, then the market continues to attract more money into the market.

If we did break down below the uptrend line, I believe that the 4000 level and the gap both could offer support as it is a large, round, psychologically significant figure, as well as structural support. With this being the case, we could simply go back and forth to form some type of consolidation. However, if we were to break down below there, then I think the market goes looking towards the 200 day EMA. Nonetheless, this is a market that I think continues to see upward momentum more than anything else over the longer term.