This week we will begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 18 years of Forex prices, which show that the following methodologies have all produced profitable results:

- Trading the two currencies that are trending the most strongly over the past 3 months.

- Assuming that trends are usually ready to reverse after 12 months.

- Trading against very strong counter-trend movements by currency pairs made during the previous week.

- Buying currencies with high interest rates and selling currencies with low interest rates.

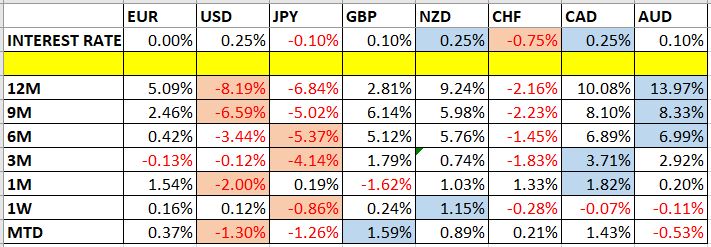

Let us look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast June 2021

For the month of June, we again forecast that the USD/CAD currency pair will fall in value, and the CAD/JPY currency cross will rise in value.

For the month of May, we made this same forecast. The performance so far has been nicely positive:

Weekly Forecast 30th May 2021

Last week, we forecasted that the EUR/NOK currency cross was likely to fall in value. Unfortunately, it rose very slightly, by 0.03%.

We make no weekly forecast this week, as there were no large counter-trend price movements in any important currency pairs or crosses.

The Forex market showed a slight decrease in its level of volatility last week, with 19% of the important currency pairs and crosses again moving by more than 1% in value. Volatility is likely to remain at a similar level over the coming week.

Last week was dominated by relative strength in the New Zealand dollar, and relative weakness in the Japanese yen.

You can trade our forecasts in a real or demo Forex brokerage account.

Previous Monthly Forecasts

You can view the results of our previous monthly forecasts here.

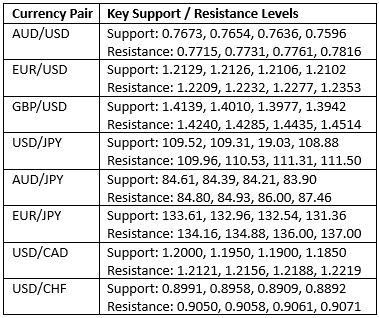

Key Support/Resistance Levels for Popular Pairs

We teach that trades should be entered and exited at or very close to key support and resistance levels. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.