After a recent upward correction, the USD/JPY's gains stopped at the 109.70 resistance level and returned to settle around 109.15 as of this writing. The pair is waiting for incentives to move strongly in one of the two directions, and the currency pair may remain in a limited range for a time. The announcement of US jobs numbers on Friday will determine the path of the dollar against the rest of the other major currencies. In general, the US dollar is still supported in the Forex market by the improvement in the economic performance, especially the labor market, which has received more stimulus plans by the Biden administration, as well as the stability of the Federal Reserve’s policy, which also does its part to stimulate the US economy.

On the other hand, the Indian strain of the virus threatens investor optimism, because its outbreak may bring more gains to safe havens, and the Japanese yen is the most prominent of those sanctuaries. On Thursday, injuries in India hit another grim record as demand for medical oxygen jumped seven-fold and the government denied reports that it was slow in distributing life-saving supplies from abroad.

The number of new cases has exceeded 400,000 for the second time and pushed the total number of cases in India to over 21 million. The Indian minister of health said that his country has enough oxygen but faces restrictions in its transportation. Most of the liquid oxygen supply is produced in eastern India while demand has risen in the northern and western parts.

The US administration is advancing strongly in vaccinations in order to accelerate the return of normal life. While schools are slowly starting to reopen, the amount of students who are choosing to return has remained far behind.

The results of a survey, conducted by the Department of Education in March and released today, Thursday, found that 54% of public schools without high school offer a full-time education in the classroom to any student who wants it. It represents a steady advance since January, when the figure was 46%. Schools were supposedly a priority for Biden, though his administration has been particularly sluggish in reopening schools, and even recommending that many schools remain closed, against the recommendations of health officials.

The growth of private sector jobs in the United States of America accelerated during the month of April, but it is still lower than estimates. In this regard, the ADP survey found that private sector employment jumped by 742,000 jobs in April after it rose by 565,000 jobs, adjusted for the increase in March. However, economists expected private sector employment to rise by 800,000 jobs compared to the 517,000 jump that was originally reported for the previous month.

“The labor market continues its upward trend of acceleration and growth, with the strongest reading since September 2020,” said Nella Richardson, chief economist at ADP.

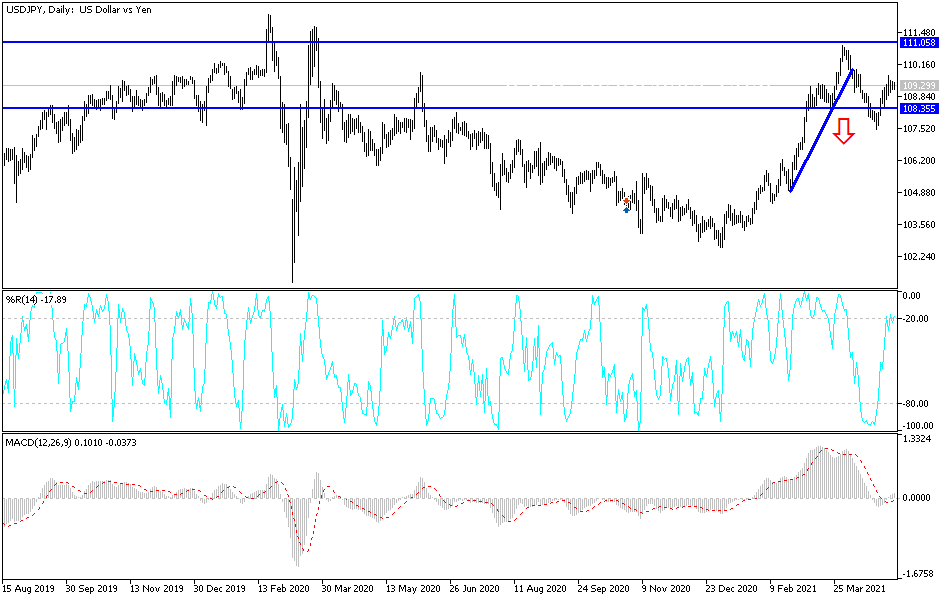

Technical analysis of the pair:

The psychological resistance level of 110.00 is crucial for the bulls' control over the performance of the USD/JPY, which would strengthen the formation of the clear ascending channel on the daily chart. On the other hand, the current optimistic outlook may end with the bears moving towards the support level of 108.35. All in all, I still prefer to buy the currency pair at every downside.

Today's currency pair will be affected by market risk appetite, as well as the US weekly jobless claims announcement.