The bulls dominated the performance of the USD/JPY to some extent, with gains that pushed the pair to the 109.34 resistance level, where it closed the week’s trading. This increased speculation of a new opportunity to move towards the 110.00 psychological resistance, which would confirm a bullish move higher. The US dollar gained strong momentum from the sharp acceleration of the world's largest economy during the first quarter of 2021, which bodes well for both the US growth forecast as well as the widely expected global recovery in 2021. US GDP growth has increased from a quarterly pace. It went from 4.3% at the end of 2020 to 6.4% in the first months of 2021, which was just below the 6.8% predicted by economists.

American consumers are leading the increase in growth, supported by unprecedented financial support packages for families, in addition to moves by the US states to ease restrictions related to the virus. Personal consumption expenditures and federal government spending were the most important contributors to this growth. Also driving the recovery were fixed non-residential investment and fixed residential investment. “Assuming that the COVID variables are still contained, the second quarter is expected to witness further acceleration in growth as the reopening continues,” says Kathryn Judge, economist at CIBC Capital Markets.

Within personal consumption expenditures, durable goods saw the largest increases in production, led by cars and spare parts, although non-durable goods such as food and beverages saw strong increases in demand alongside service providers in the food and accommodation trade. At the same time, increases in government spending "primarily reflect an increase in payments to banks for processing and managing Paycheck Protection Program loan applications" and public procurement of coronavirus vaccines.

The subtraction from the US recovery in the first quarter was reduced exports. The decline in exports is a symptom of weak global demand as many major European economies and the rest of the world returned to lockdowns or restrictions on activity in the face of soaring infections and lackluster progress in vaccinations.

But even with declining global demand for US goods and services, an increase in corrosive imports of GDP into America will act as a catalyst for those exhausted economies elsewhere, which are widely expected to recover with increased enthusiasm as the year passes and with the potential to be beneficial implications for US exports.

The economic recovery in the US has started since January with another notable $1.9 trillion fiscal stimulus package, dubbed the "American bailout", all of which are made possible, as well as being supported in its effectiveness,s by the monetary policy of the US Federal Reserve. Fed officials made clear in their April monetary policy update that they would not be inclined to end the bank’s $120 billion monthly quantitative easing program or raise the interest rate range from virtually zero by “temporary” increases in inflation over the coming neighborhoods.

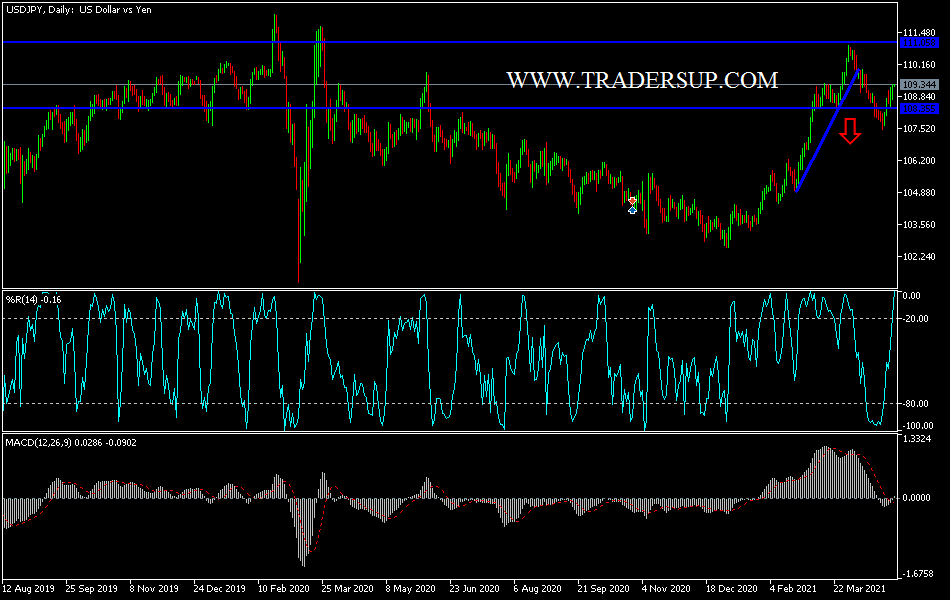

Technical analysis of the pair:

The bullish performance of the USD/JPY will be strengthened if the pair breaks through the psychological resistance of 110.00, which would lead to a move towards higher resistance levels, the closest of which are 109.85, 110.35 and 111.20. These levels are important to confirm a return to a bullish trend. On the other hand, a movement towards the support level of 108.40 will eliminate bullish expectations and strengthen the bears.

The currency pair will be affected by the extent of investor risk appetite, as well as the announcement of US economic data, as the ISM Manufacturing PMI reading and the rate of construction spending will be announced, and then new statements by US Federal Reserve Chairman Jerome Powell.