The USD/JPY's hemorrhage of losses continues, reaching the 108.35 support level before settling around 108.70 as of this writing, ahead of the US inflation figures. The data may give the currency pair the momentum to move towards stronger support levels or find an opportunity to recoup its recent losses. Before the inflation figures are released, global markets are suffering from a major selling wave as investors fear the possibility of higher inflation rates, driven by global supply restrictions and rising wages in the United States. The fear now is that rising inflation will force global central banks to withdraw their generous supplies of liquidity into the global economy, triggering a stock appreciation boom and pushing safe-haven currencies to rise.

“Tech stocks pushed the US markets lower at the close, while major Asian stock indices, including Japan’s Nikkei index, fell (down more than 3%),” says Han Joo-ho, an economist at Lloyds Bank. Concerns about rising inflation were cited as a factor weighing down risk sentiment ahead of today's release of US CPI numbers, with more inflationary pressures in the pipeline as a result of the recent rise in the prices of some basic commodities.

Meanwhile, the Forex markets are relatively unaffected by equity market actions, although analysts say the inflation story will definitely have an impact on these markets in the future. "A stronger CPI reading than expected today could provide some much-needed support for the US dollar although the hurdle is much higher now after the softer non-farm payrolls report," says Lee Hardman, an analyst at MUFG Bank.

Before the release of today's report, the dollar was under pressure against the rest of the major currencies, largely due to weak US jobs data released last Friday. The US was disappointed by the addition of far fewer jobs than expected, prompting investors to bet that the Fed will be forced to stick to its current policy with more generous quantitative easing and lower interest rates.

Standard central banking theory suggests that the central bank raises interest rates and exits quantitative easing when inflation is extremely high, as this reduces the flow of money through the economy and cools activity. Higher interest rates, in turn, tend to be supportive of the currency issued by the central bank.

But the Fed said it would only focus on controlling inflation when the US labor market returns to a full recovery, indicating that a series of bumper job reports were required before they changed their stance on policy. The bet in this week's inflation report is that the Fed will consider wage increases sharply as long as the labor market struggles.

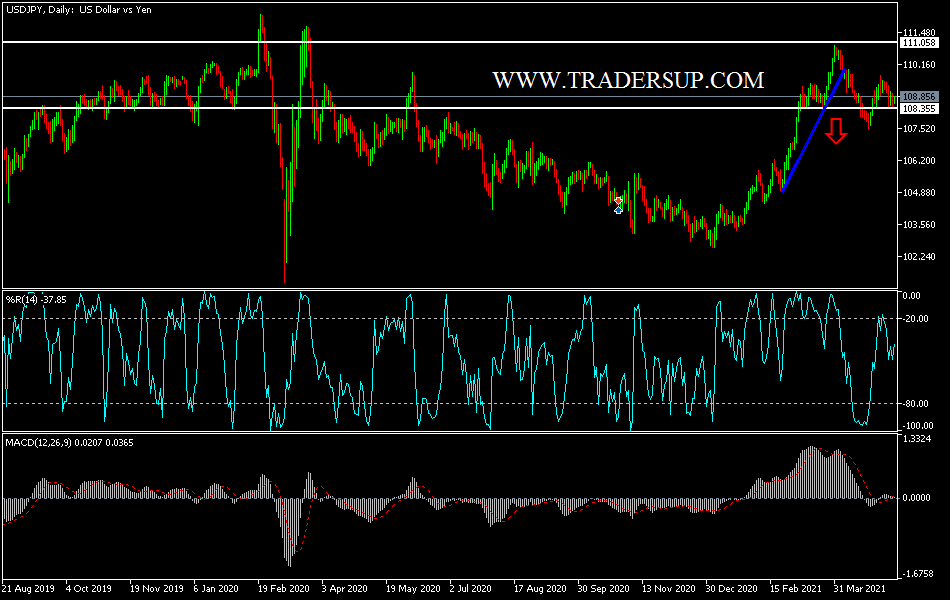

Technical analysis of the pair:

On the daily chart below, it appears clear that the downward trend of the USD/JPY will continue. The bears will dominate in a decisive way upon a breach of the 108.00 psychological support, which would increase selling and push the currency pair towards stronger descending levels. The most important support levels are 108.25, 107.65 and 106.90, the second and third of which are the best for buying. I am ready for an upward rebound, which can happen at any time. On the upside, there will be no real reversal of the general trend without testing the psychological resistance of 110.00.

The currency pair will be greatly affected by the release of US inflation numbers and investor risk appetite.