In its best daily performance of the year, the USD/JPY moved to the 109.70 resistance level yesterday, where it stabilized near at the beginning of trading on Thursday. The dollar’s strong gains against other major currencies were a natural response to the announcement of the largest monthly jump in US inflation in more than a decade.

The strength of US inflation has prompted investors to question how long the Fed can afford to maintain the current ultra-low interest rate policy. The headline CPI reading in the US was at 4.2% year-on-year for April, which is stronger than the 3.6% increase that analysts had expected. This leads to a sharp increase over the March results of 2.6% and confirms that the US economy is heading into a period of rampant inflation.

All in all, investors are becoming increasingly concerned about mounting inflationary pressures not only in the US but around the world. While the Forex markets have proven to be relatively optimistic with rising inflation expectations, the sell-off to global stock markets, particularly technology stocks, indicates that the problem is not without consequences for investors. The month-on-month inflation reading stood at 0.8% for the month of April, which predates the consensus forecast of 0.2% and before 0.6% the previous month.

When looking at the data, it must be emphasized that the current readings are compared to the deep recession in inflation on an annual basis, as last April witnessed a sharp decline due to the global economic slowdown caused by the virus. The Fed has indicated that it tends to look through the "hype" caused by a series of hot inflation readings in excess of 2.0% over the coming months, expecting the ratios to be fleeting. However, you will likely see a strong core CPI reading of 3.0% for April - much stronger than expectations of a 2.3% reading - as some in the markets question the sustainability of the Fed's position. After all, core CPI excludes variables such as fuels that may be more susceptible to global dynamics.

Therefore, it can be said that the Fed has a greater impact on core inflation by virtue of its ability to control quantitative easing and interest rates. The market is likely to support the US dollar if they think the Fed will have to change its stance and start introducing the time when they intend to reduce quantitative easing and advance the time for the first rate hike. At the same time, the Fed says that US employment is really important when looking at monetary policy, and given the terrible job market reading last Friday, investors were tempted to take the Fed’s word that raising interest rates is still a long way off.

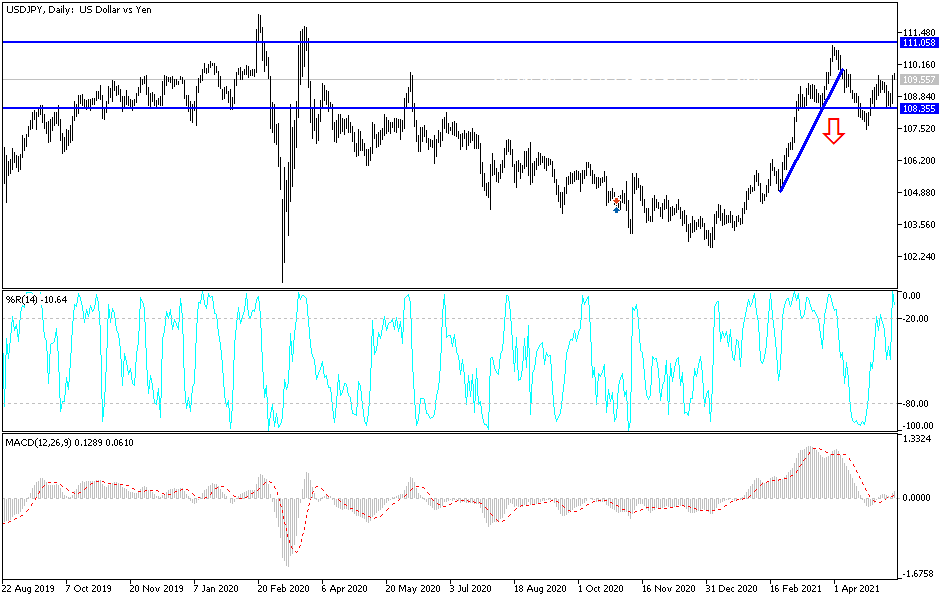

Technical analysis of the pair:

The trend has shifted expectedly to the upside, and the bulls will gain control over the performance of the USD/JPY if the psychological resistance level 110.00 is breached, which may increase buying that will push the currency pair towards higher peaks. The closest resistance levels for the currency pair are currently 109.85, 110.45 and 111.20. On the downside, the psychological support of 108.00 will remain the most important target for bears to control performance for a longer period.

The currency pair will be affected today by the extent of investor risk appetite, as well as the announcement of the number of US jobless claims weekly and the Producer Price Index reading, which complements the US inflation figures.