After two weeks of correcting upwards, the USD/JPY's gains were capped by a move towards the 109.70 resistance, the highest in a month. Most of its gains collapsed at the end of last week’s trading, reaching the support level of 108.33 amid a sharp and unexpected collapse of US jobs for the month of April, with results that were not within the expectations of the markets and economists. The pair started trading this week with stability around the 108.60 level. Today, the USD/JPY will continue to interact with the reaction of investors and markets to the new US jobs numbers, which represent a strong setback to optimistic expectations for the future of the US economy and the policy of the US Federal Reserve. The jobs figures also shed a harsh light on the Biden administration, which is paying some people to stay home with constant stimulus checks.

On the economic side, the data showed a much smaller-than-expected increase in US employment in the non-farm sector during the month of April. Weaker than expected data reinforced the view that the Fed will leave super-accommodative monetary policy unchanged for the foreseeable future. Data from the US Labor Department showed that non-farm payrolls in the United States increased much less than expected in April, rising by 266,000 jobs, after an increase of 770,000 jobs revised downward in March.

Economists had expected an increase in US employment of 978,000 jobs compared to the jump of 916,000 jobs originally reported for the previous month. The report also showed that the US unemployment rate rose to 6.1% in April from 6% in March. Economists had expected the unemployment rate to drop to 5.8%.

The US Commerce Department released a report on Friday showing that wholesale inventories in the US jumped slightly less than expected in March. The report said wholesale inventories rose 1.3% in March after rising an upwardly revised 1% in February. Economists had expected wholesale inventories to rise 1.4% compared to the 0.6% increase originally recorded for the previous month.

In Japan, the minutes of the recent Bank of Japan meeting revealed that the country is still fighting the negative effects of the COVID-19 virus. The labor market showed a change of -1 from the previous reading while the recovery in the private market consumption appears to be slowing down. This explains the rise of the USD/JPY during the past week, before declining last Friday.

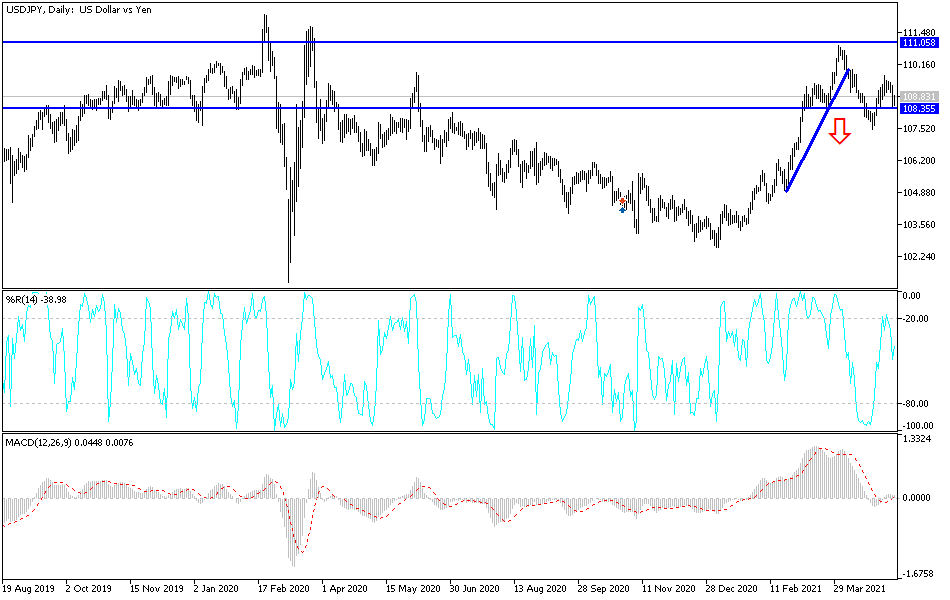

Technical analysis of the pair:

In the near term, according to the performance on the hourly chart, it appears that the USD/JPY has recently made a bearish breakout of the triangle formation, which indicates a shift in market sentiment to the downside following the release of the US jobs numbers. Therefore, the bears will look to ride the current downside momentum towards the support 108.36 or less to the support 108.09. On the other hand, the bulls will target a quick rally at around 108.97 or higher at 109.24.

In the long term, according to the performance on the daily chart, it still appears that the USD/JPY is trading within the formation of an upward channel. This indicates significant long-term bullish momentum in market sentiment. It is still holding several levels above the 100-day and 200-day simple moving average lines. Accordingly, the bulls will look to ride the current rising wave towards the 109.79 resistance or higher to the 110.83 resistance. On the other hand, the bears will target potential pullbacks around 107.57 or lower at 106.46.

The USD/JPY does not expect important data from the United States of America or Japan, so it will be affected by the extent of investor risk appetite.