Sell-offs in the USD/JPY pushed the pair towards the 109.07 support level at the beginning of trading this week before settling around 109.25 at the beginning of Tuesday's trading. The US dollar is still losing ground against the rest of the major currencies, as disappointing US retail sales data indicate that the Fed will maintain its very loose monetary policy. During the past week, comments from several US Federal Reserve officials were stating that the bank is unlikely to raise US interest rates, as it is very likely that the rise in inflation was temporary, which also contributed to the weakening of the US currency.

For his part, Fed Governor Christopher Waller said that the factors that impose upward pressure on inflation are temporary and may continue to rise until 2022. He added that the Fed will not overreact to the temporary excesses of inflation. Federal policymakers Lyle Brainard and Richard Clarida made similar statements in the same week.

On the economic side, according to a report by the Commerce Department, US retail sales were almost unchanged in April after rising by an upwardly revised 10.7% in March that may have also eased recent concerns about inflation. Economists had expected US retail sales to jump by 1%, compared to the 9.8% originally reported in the previous month.

A separate report from the Federal Reserve showed that industrial production in the US increased less than expected in April, rising 0.7% after rising by an upwardly revised 2.4% in March. Economists had expected industrial production to increase 1% compared to the 1.4% jump originally recorded for the previous month. Meanwhile, the University of Michigan released a report showing that the US Consumer Confidence Index fell to a reading of 82.8 in May from a reading of 88.3 in April. The decline surprised economists, who expected the index to rise to a reading of 90.4.

With the decline in COVID-19 cases after more than 580,000 deaths and with more than a third of the US population fully vaccinated, millions of Americans are deciding whether to continue wearing face masks, in keeping with evolving scientific data.

For its part, the CDC said last week that fully vaccinated people - those who have passed two weeks after taking their final dose of COVID-19 vaccine - can stop wearing masks outdoors in crowds and in most indoor places and forgo social distancing. The agency also said that people who are either partially vaccinated or unvaccinated should continue to wear masks.

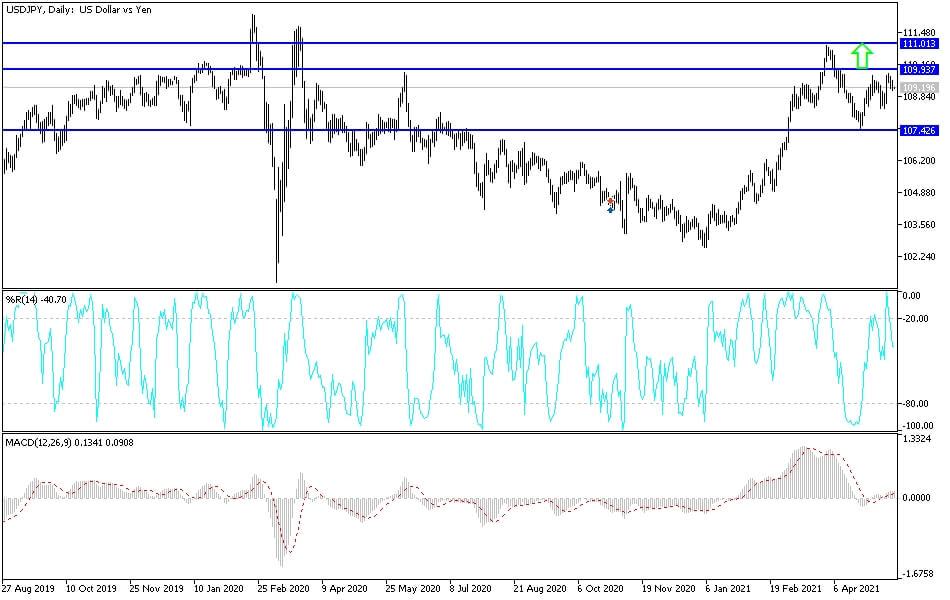

Technical analysis of the pair:

The success of the bears in pushing the USD/JPY below the support level of 109.00 will increase selling and thus the rush towards stronger support levels, the closest of which are currently 108.75, 108.10 and 107.45. On the upside, the pessimistic outlook will not change now without breaching the psychological resistance of 110.00. I still prefer to buy the currency pair from every downside level.

The yen will be affected by the announcement of Japan's GDP growth rate. The USD will be affected by the rate of building permits and housing starts.