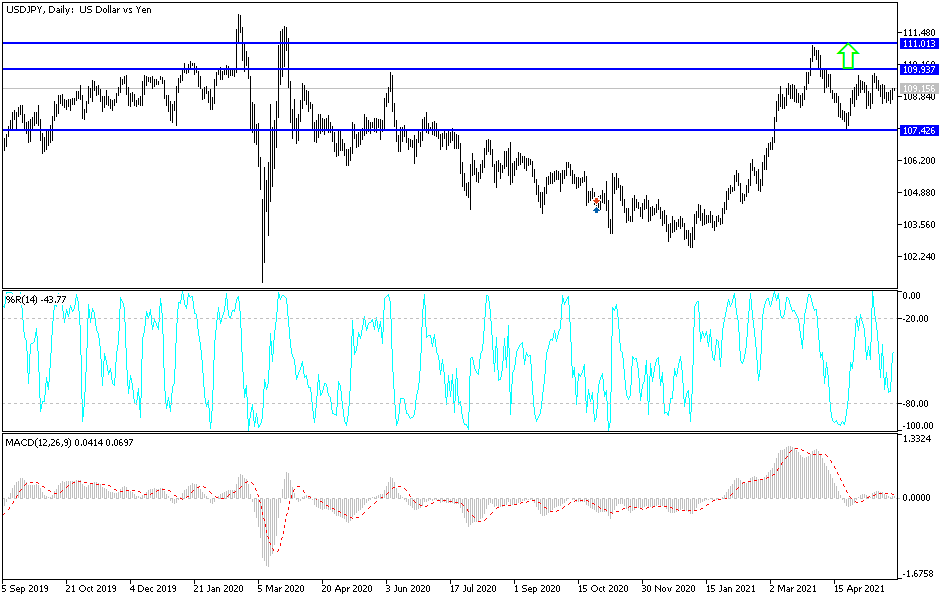

For the third day in a row, the price of the US dollar against the Japanese yen moves in an upward correction range that moved towards the resistance level 109.20. USD/JPY is currently stable and may remain moving in a narrow range until the results of the important US economic data, which are announcing the GDP growth rate, weekly jobless claims, durable goods orders and pending US home sales.

Economists expect a major recovery in 2021 and results from the start of the year will give Wall Street a clearer picture going forward.

The growing economy has also raised concerns about inflation, although analysts expect most of the increase will be related to economic growth and be digestible. Concern centers around stronger inflation, forcing governments and global central banks to backtrack on economic stimulus and change the course of interest rates. In this regard, US Federal Reserve officials said that they do not see any need to change course yet.

The Japanese government is expected to extend a "state of emergency" in some regions including Tokyo after May 31, in an effort to curb COVID-19 cases. Public concern increased with the start of the Olympic Games, which are scheduled to begin in Tokyo on July 23. Surveys show that the majority of the population wants the Games to be canceled or postponed.

US President Joe Biden is asking US intelligence agencies to "double" efforts to investigate the origins of the COVID-19 pandemic. In this regard, he stated that there is insufficient evidence to conclude "whether it was a result of human contact with an injured animal or from a laboratory accident." Therefore, Biden directed the US national laboratories to assist in the investigation and called on China to cooperate with international investigations into the origin of the epidemic. Given the Chinese government's refusal to fully cooperate with international investigations, a conclusive outcome may not be known at all, he noted.

The United States of America leads the world with 33.1 million confirmed cases of coronavirus and 591,000 confirmed deaths.

Technical analysis of the pair: the recent upward correction attempts for the currency pair the US dollar against the Japanese yen, USD / JPY, will not succeed without the bulls breaking the psychological resistance level of 110.00. 107.90, respectively. I still prefer to buy the currency pair from every downside. Forex traders will focus today and tomorrow on the results of the US economic data. Improving results may compensate for the US dollar’s setback in recent releases.