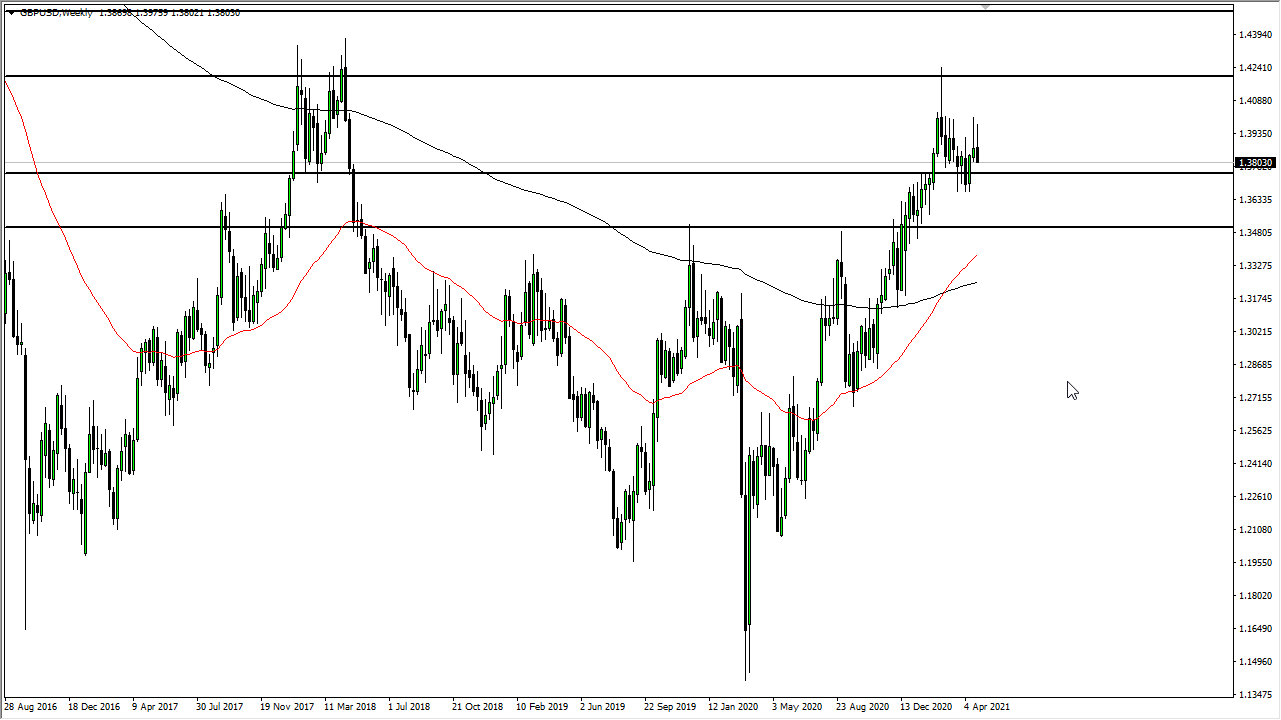

GBP/USD

The British pound initially rallied during the course of the week but gave back the gains yet again to form a shooting star for the second week in a row. I suspect that we will probably pull back this week, reaching down towards the support level near 1.3670 underneath. Furthermore, even if we break down below there, I think the 1.35 level is massive support as well. I think that in the short term, we will have a pullback, but long term, the US dollar will continue to struggle. The British pound is essentially forming a bullish flag if you squint.

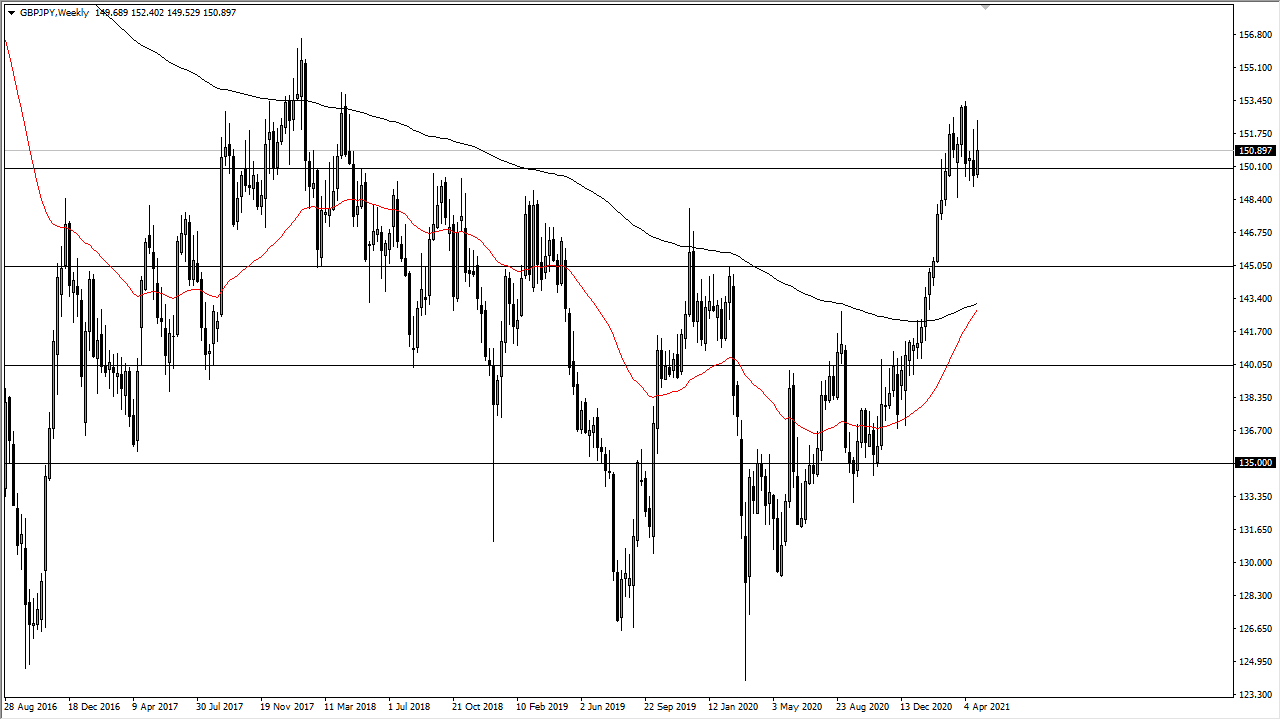

GBP/JPY

The British pound also rallied against the Japanese yen and closed higher than the previous week. We continue to see a lot of noise above, though, so I think what we are looking at here is the likelihood of more of a sideways grind than anything else this week, but I still favor the upside as we had seen such a massive shot higher. If we break down below the ¥148.50 level, then we may have to “reset” down near the ¥145 level to continue the move higher. More likely than not, though, we will probably have a lot of sideways back and forth trading over the course of the next week.

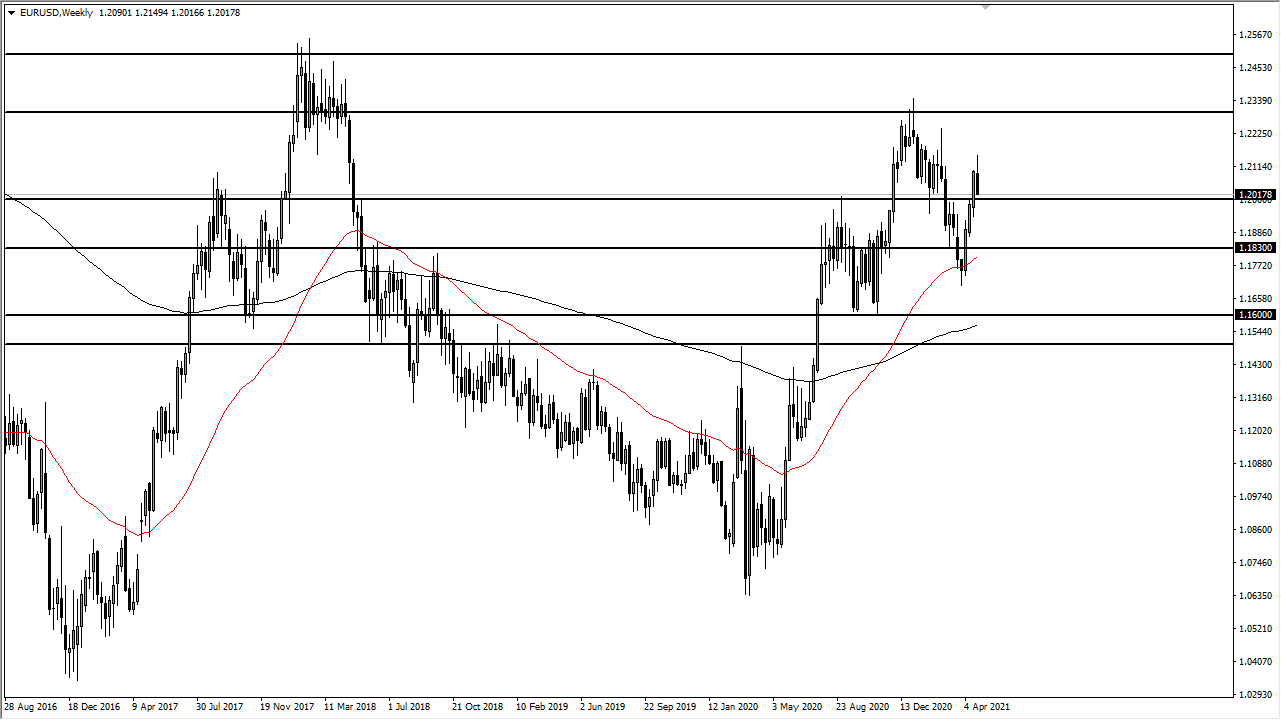

EUR/USD

The euro initially rallied during the week but also gave up its gains late to form a very negative-looking candlestick. Having said that, it is very likely that we should see some type of support near the 1.20 level, so I do think that eventually we will see buyers jump back into this market. Keep in mind that Friday was the end of the month, so that nasty Friday candlestick might be blamed partially on position squaring. In other words, people have been taking profits so that they can report to clients gains at the end of the month. I do not necessarily think that it is going to be easy to go higher, just that the market still has that proclivity.

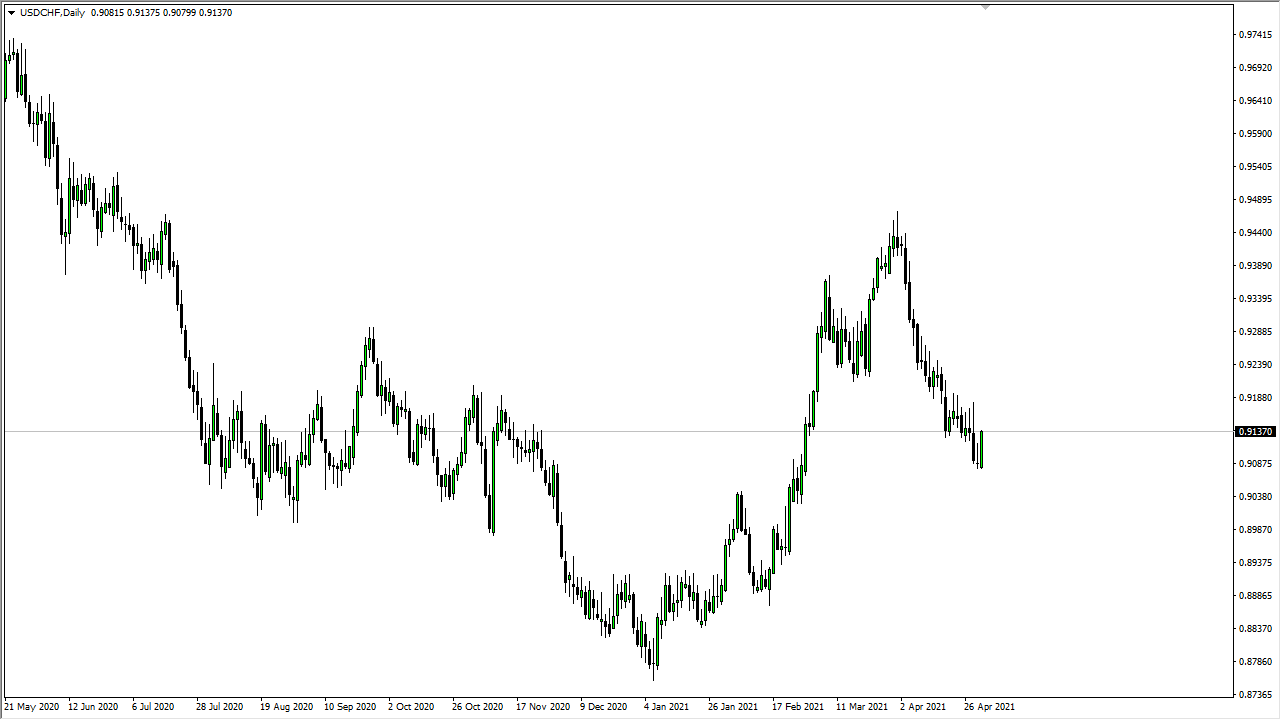

USD/CHF

The US dollar shot straight up in the air against the Swiss franc during the latter part of the week, but it is worth noting that just above current levels there are quite a few sellers, so I think it is only a matter of time before we see some type of selling pressure enter the fray. I suspect that we may have a little bit of positivity initially, followed by fresh selling. However, if we were to break above the 0.92 handle, that could send the US dollar much higher.