GBP/USD

The British pound initially fell during the course of the week, but has turned around to show signs of resilience. What the weekly chart does not show you is just how resilient it was on Friday to find itself close to the 1.42 handle. At this point, it looks as if we can break down rather soon, and a move above the 1.4233 level would have me looking for a bigger move towards the 1.45 handle. At this point, it looks like pullbacks in the British pound continue to be buying opportunities based upon value and the fact that the US dollar is shrinking in general.

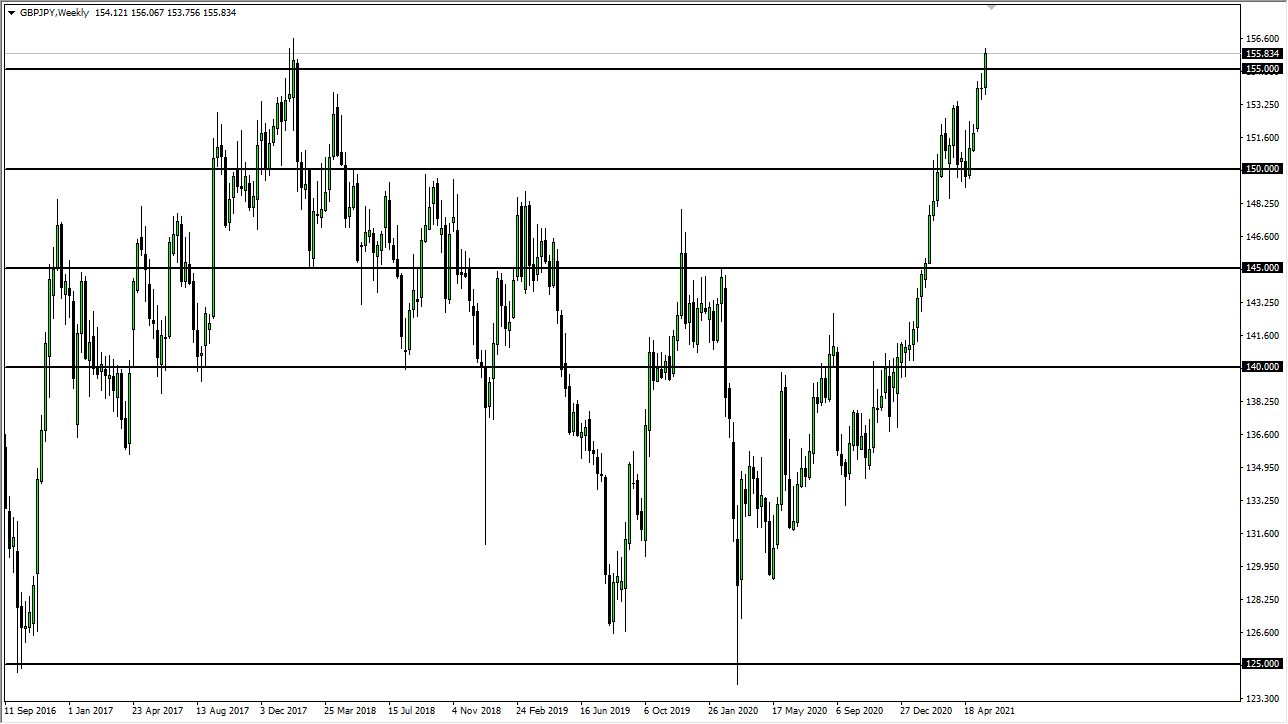

GBP/JPY

The British pound also had a big week against the Japanese yen, but unlike against the US dollar, it actually broke out. With that being the case, we are above the ¥155 level, and I like buying dips here. I think we will go looking towards the ¥157.50 level, and then eventually the ¥160 level. Even if we break down below the ¥155 level, there is so much support underneath at the ¥153.50 level that I would only consider that to be “a bargain” that I would be willing to take advantage of. Keep in mind that this pair is highly sensitive to risk appetite.

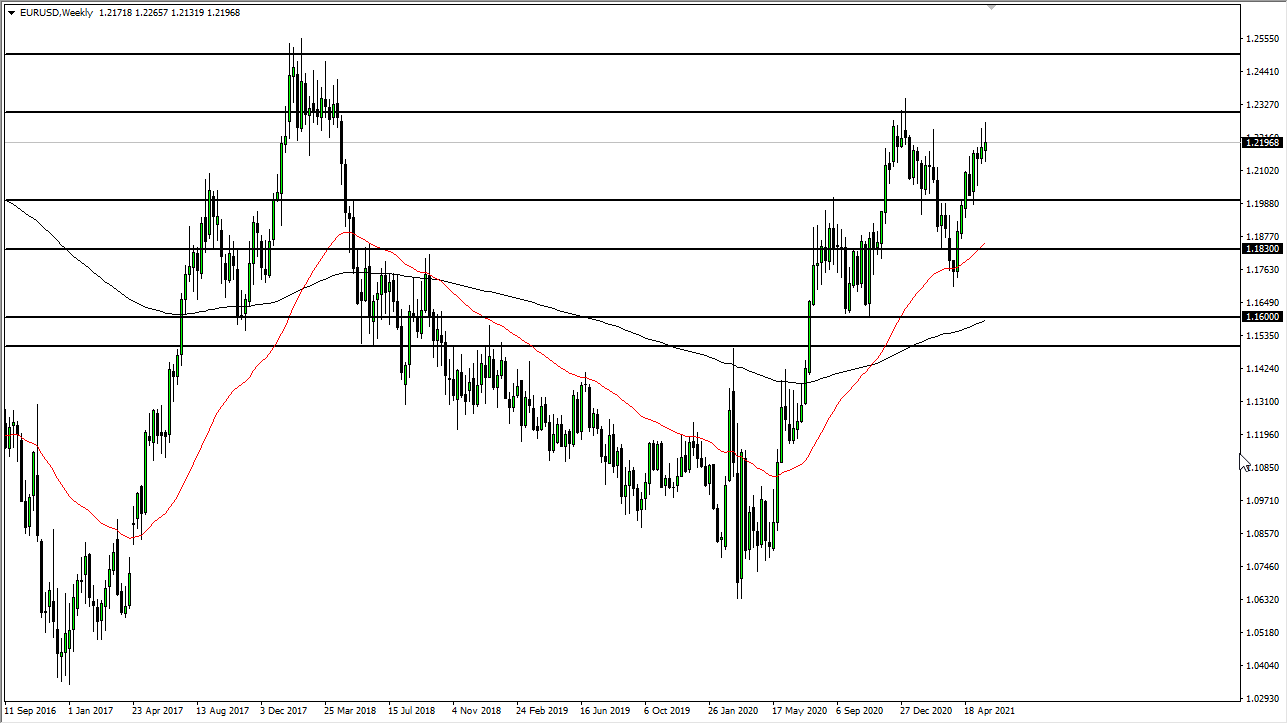

EUR/USD

The euro fluctuated during the week, but the most interesting thing is that we continue to struggle above the 1.22 handle. By doing so, it tells me that there is a massive amount of resistance above at the 1.23 level, as you can envision the “gap” that sits above this candlestick. At this point, I think we will continue to see buyers on dips, but I certainly think that the dip is coming. Look at that dip to kick off the week, but by the time we get the jobs report on Friday I anticipate that the market will probably show some type of recovery.

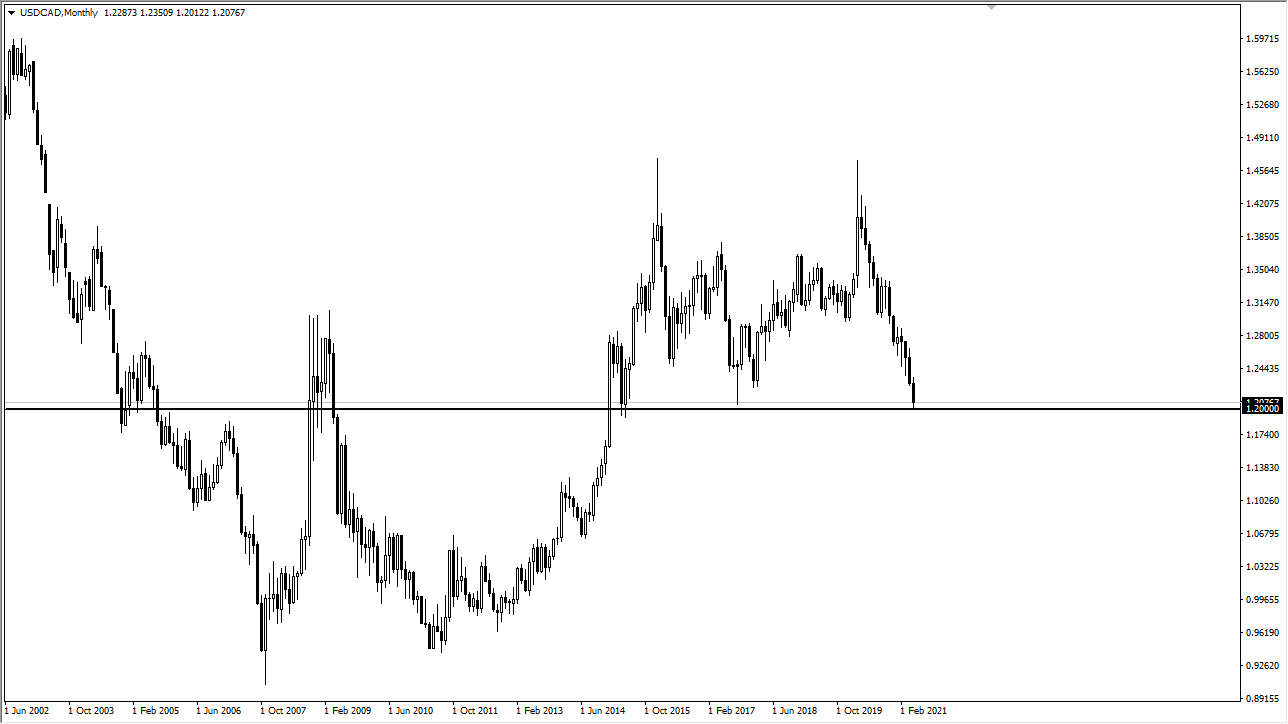

USD/CAD

I cannot stress enough how important the 1.20 level is for this pair. If the US dollar cannot bounce after this massive move to the downside, it is very likely to give up quite a bit from here, perhaps reaching as low as 1.10. This is a major inflection point on the longer-term charts, so pay close attention to this area because it could lead to a massive trade. As far as buying is concerned, I would not be interested in doing so.