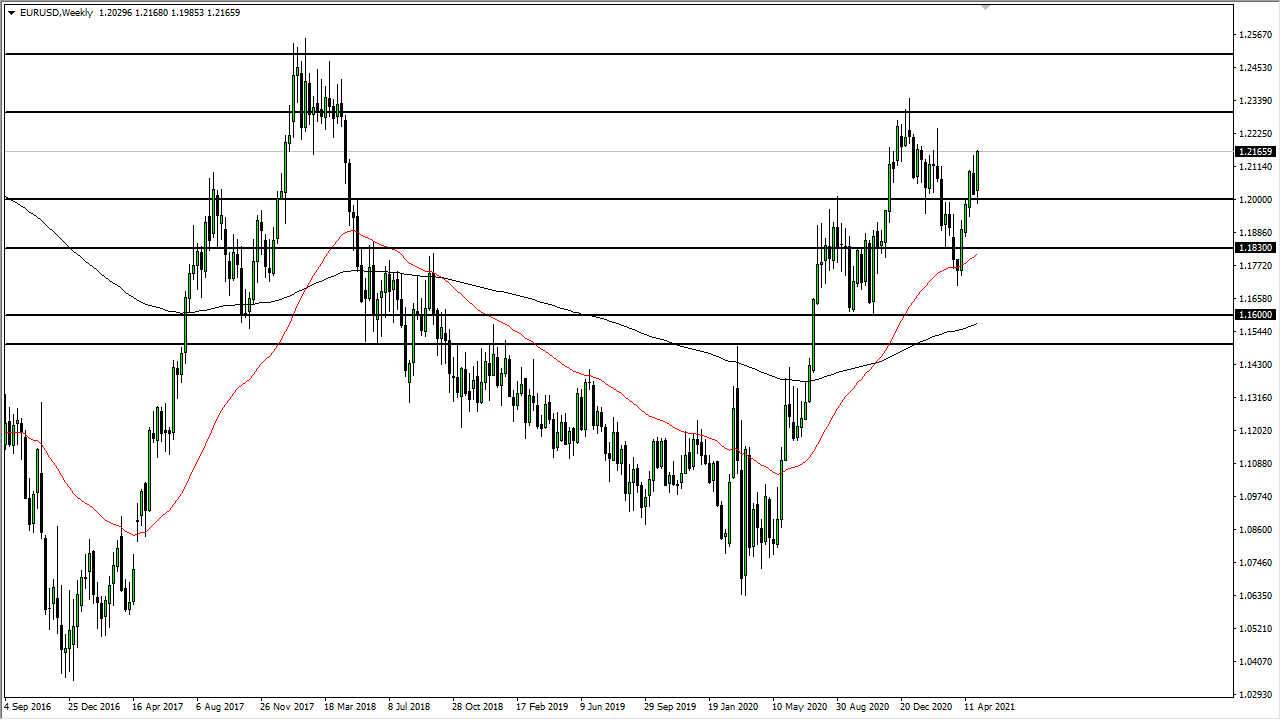

EUR/USD

The euro rallied during the course of the week, breaking above the 1.2150 handle. Ultimately, the market is closing at the very top of the candlestick, so it does make sense that the market should continue to go higher. If we get a short-term pullback, it is very likely that we will have plenty of buyers jumping into the market to take advantage of value as it occurs. At this point, it looks as if the 1.20 handle is going to be major support and therefore the “floor in the market.”

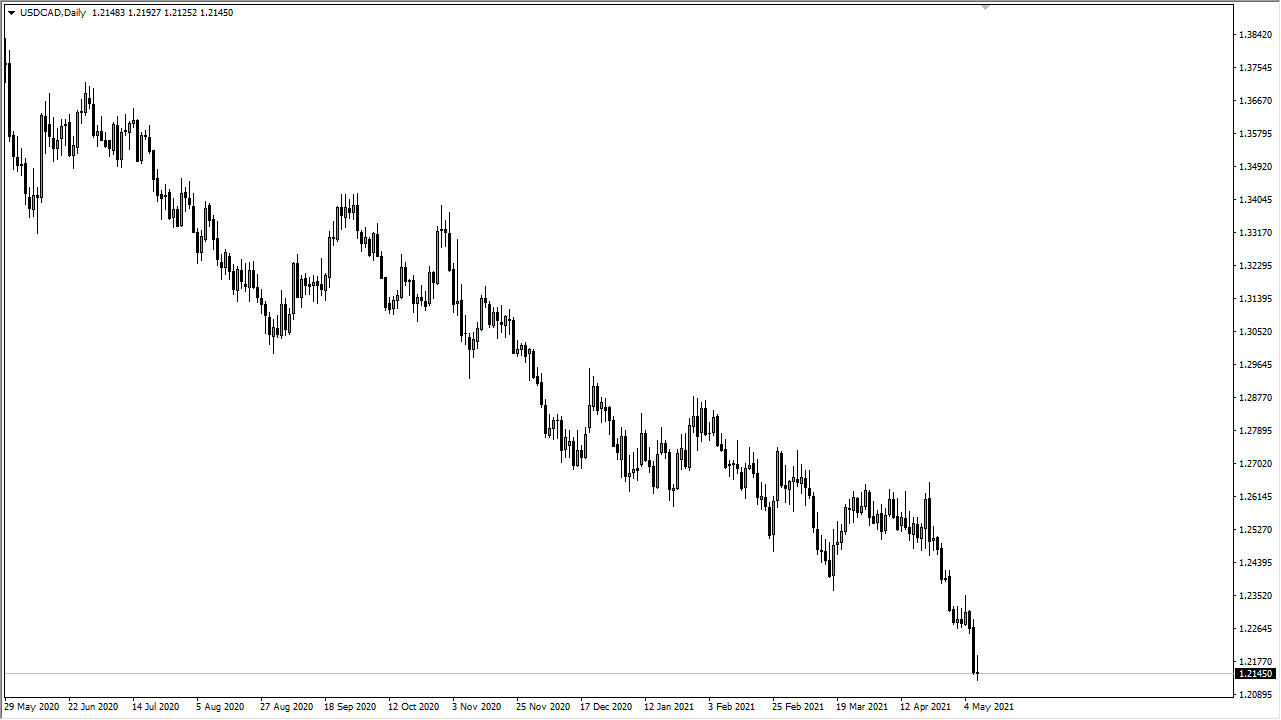

USD/CAD

The US dollar has gone back and forth against the Canadian dollar during the week, as we are well below the 1.22 handle. At this point, crude oil markets continue to strengthen, which should continue to strengthen the Canadian dollar. The Bank of Canada has recently announced that it was going to cut back on bond purchases, so that should continue to strengthen the Loonie going forward as well. Furthermore, the US dollar has taken it on the chin against multiple other currencies, so it makes that we will continue the downtrend here.

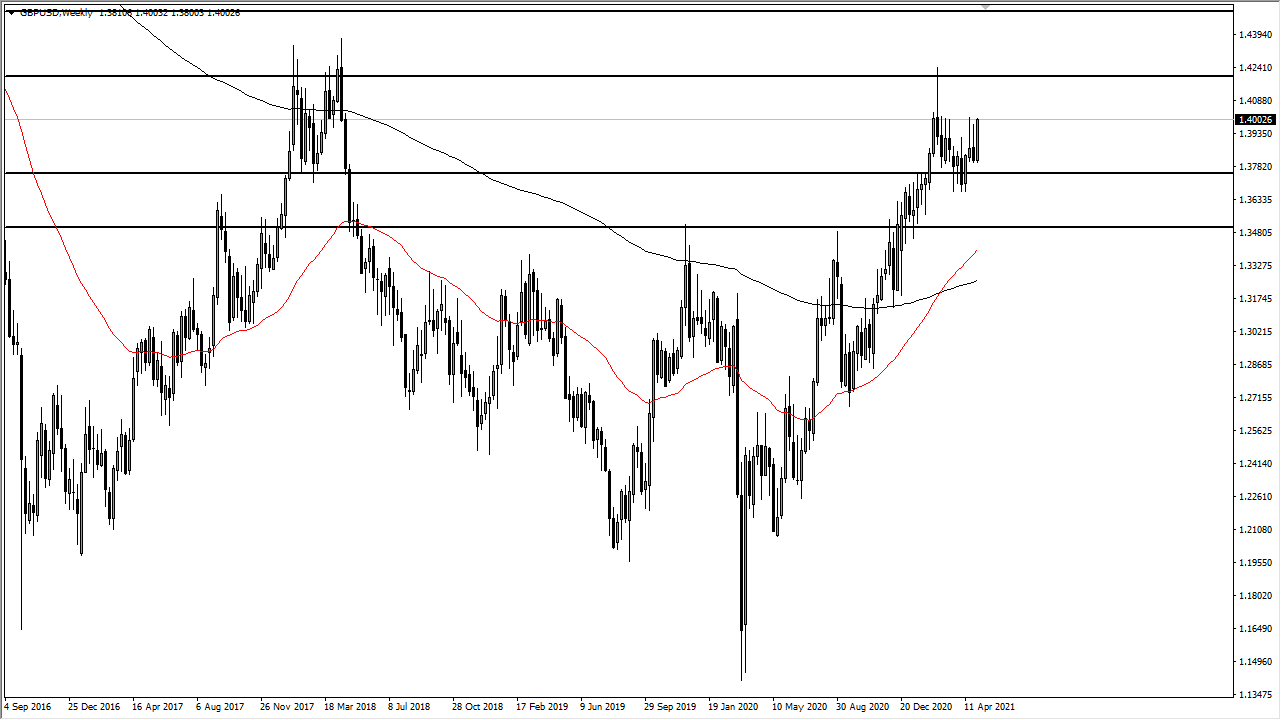

GBP/USD

The British pound has had a very strong week, breaking all the way towards the 1.40 level but is stalling there at the end of the day on Friday. If we can break out above the candlestick from two weeks ago, I think at that point the British pound would probably continue to go higher. It is obvious that we want to go higher, and we are obviously in a very strong uptrend. With that being the case, I think that this pair continues to see buyers on dips, and I have no interest in trying to short what is an obvious strong uptrend. The fact that we have been sideways for the last couple of months is not a huge surprise after getting this massive move to the upside.

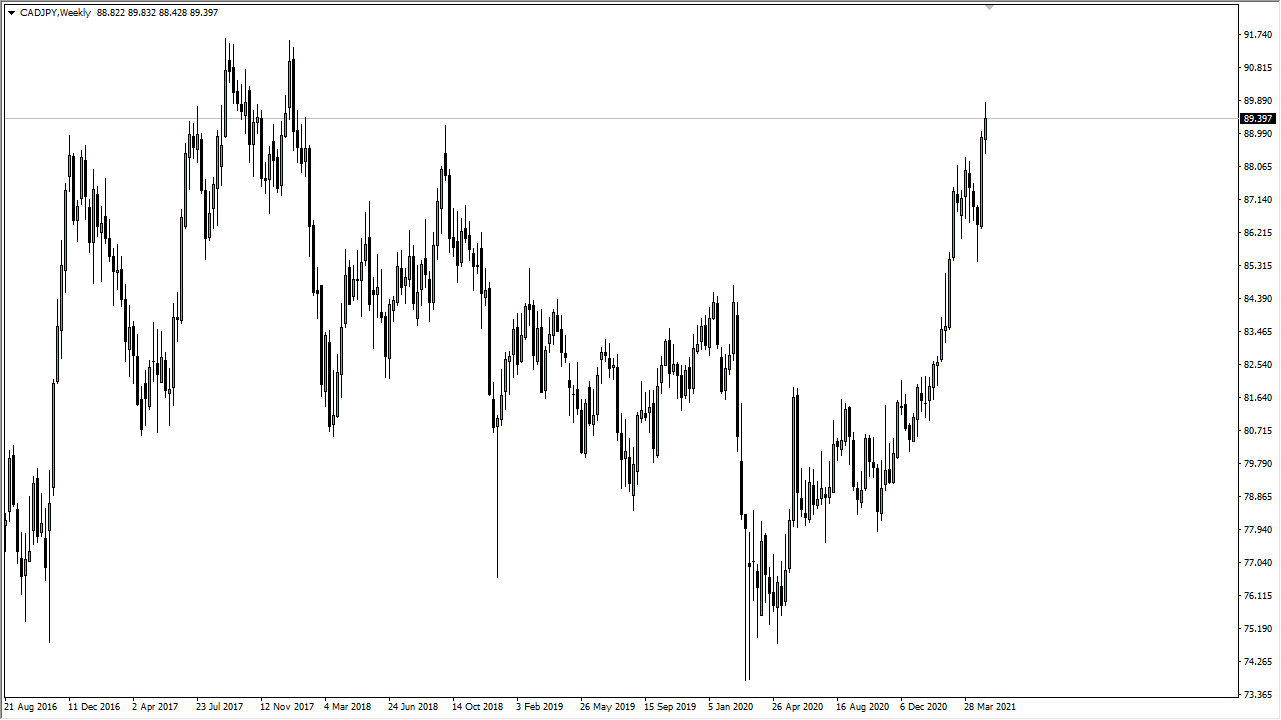

CAD/JPY

The Canadian dollar rallied again during the course of the week, continuing the overall massive bullish pressure that had been seen during the previous week. Because of this, it looks like we are going to continue to see upward pressure, perhaps to the ¥91 level. In the short term, though, do not be surprised if we see a little bit of a pullback in order to build up enough momentum, but clearly the bullish pressure remains in this market, especially if the crude oil markets continue to rally.