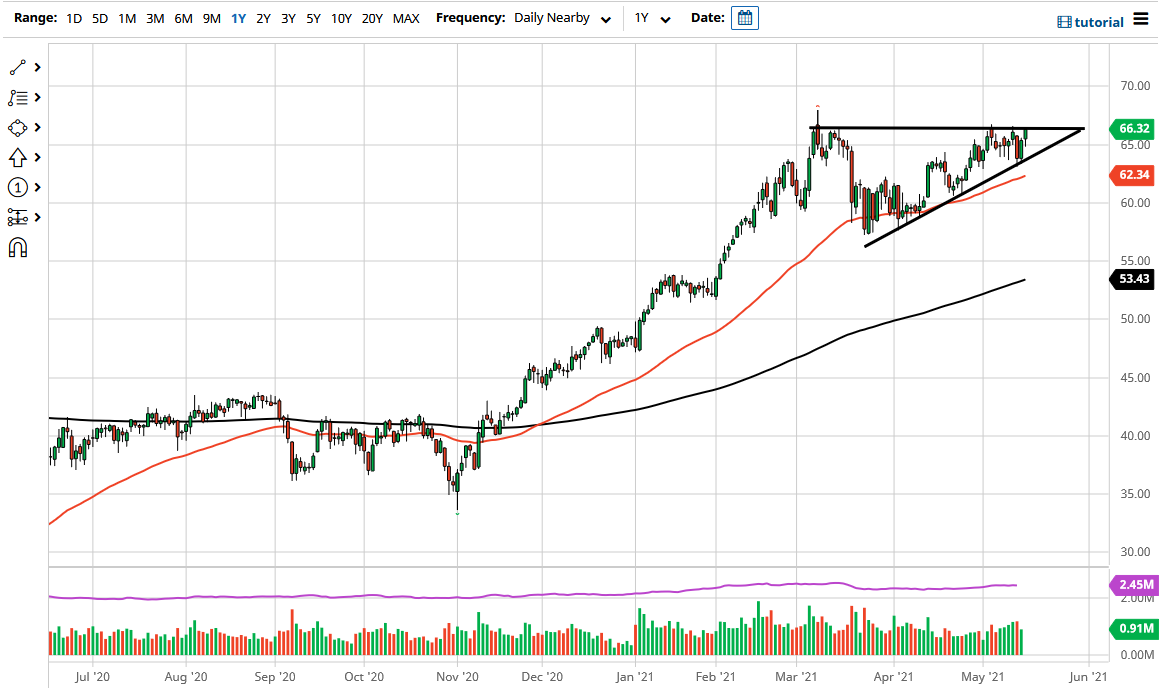

The West Texas Intermediate Crude Oil market rallied again after initially pulling back from the gap higher on Monday. This suggests that the market is likely to continue going higher, which should not be a huge surprise considering that we have such a massive ascending triangle and the overall uptrend anyway. With this being the case, the market looks as if the 50-day EMA is going to also offer a bit of a “floor in the market”, as it has several times in the past. Ultimately, this is a market that I think will eventually go looking towards the $70 level, but that is an area that would probably cause a little bit of resistance.

To the downside, I believe that the uptrend line of the ascending triangle continues to keep the market supported, and then possibly the $65 level as well. This is a market that should continue to see buyers on dips due to the idea that the market is going to continue to see plenty of demand out there as the world continues to open up due to the pandemic subsiding finally. I think that there will be plenty of value hunters and “dip buyers” getting involved.

The US dollar falling could also come into play, so I think that could also be a reason why oil will continue to rise. At this point, I have no interest in shorting crude oil, because there is such a huge push to the upside in general. However, if we were to break down below the 50-day EMA, then we might see more of a correction; but right now, it is obvious to me that there are plenty of value hunters out there.

Longer term, I believe that this market will go looking towards the $72.50 level, based upon the measured move of the ascending triangle. This is a market that should continue to move based upon the inflation expectations and the reopening theme that almost everybody is jumping on. With this being the case, I believe that if we can break above the highs of the trading session for Monday, it could be a signal that we are ready to continue going higher. If the US dollar falls, that will only push this even quicker.