The West Texas Intermediate Crude Oil market gapped a little bit lower to kick off the trading session on Thursday to show signs of negativity. That being said, I think the big driver of the negativity was probably due to the EIA numbers coming out showing a lack of demand for gasoline. Ultimately, this is a market that I think will show more bullish proclivity to the upside. This is all based upon the “reflation trade”, and the “reopening trade” that traders are focusing on.

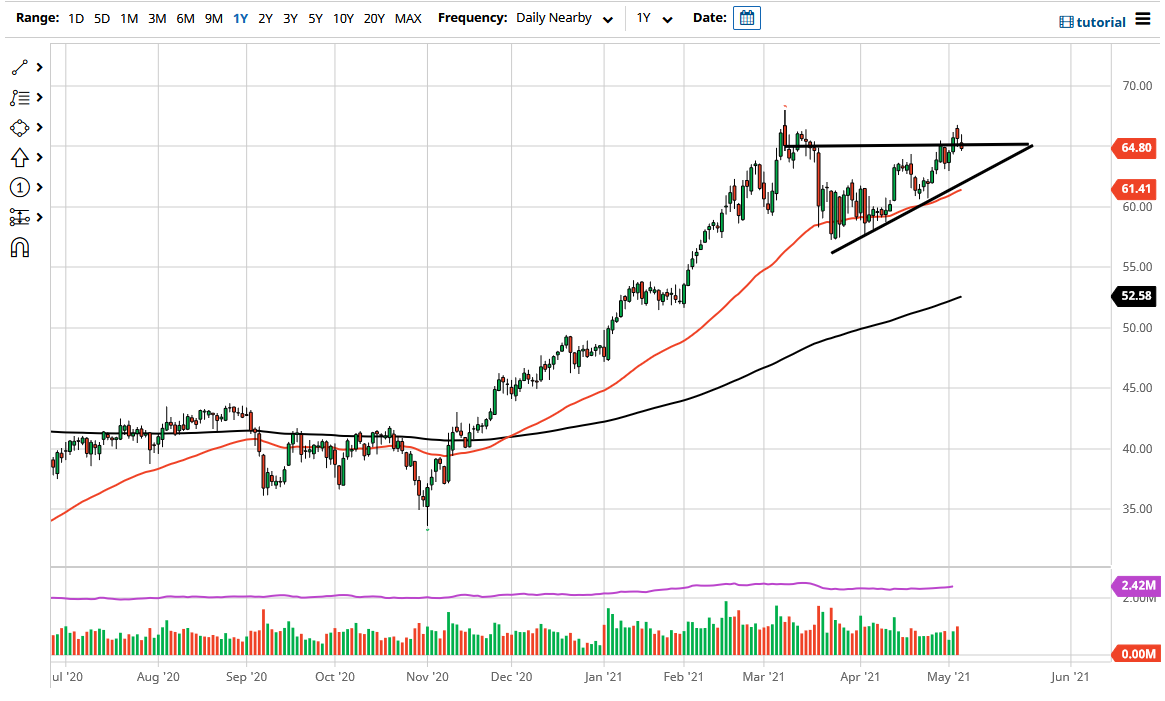

With the jobs number coming out on Friday, I think it is only a matter of time before we would see you choppiness, but any type of support underneath will be a buying signal from what I can see. The ascending triangle that you can see on the chart is obvious and a lot of traders out there will be paying close attention to it, so I think at this point in time it is likely that we go looking towards the $67.50 level. After that, the market is likely to go looking towards the $70 level which of course is a large, round, psychologically significant figure.

To the downside, I think it is somewhat limited, as I think there are plenty of areas that buyers will start to look towards. The first one of course would be the $62.50 level as it was a short-term bounce that happen, followed by the 50 day EMA and the uptrend line from the ascending triangle. All of that should provide plenty of support for the market going forward, and any selloff during the trading session on Friday should probably offer a buying opportunity given enough time. You will probably have to look at short-term charts to find that trade, as we have been in an uptrend for quite some time so if we get any type of break down after the jobs figure, value hunters will eventually come looking for an opportunity in the markets.

That being said, if we break down below the 50 day EMA, we could go looking towards the $60 level, perhaps even the $57.50 level. That being said, I think it is very unlikely that this happens anytime soon based upon the strong action that we have seen lately. In fact, I do not really have a scenario in which I am looking to short this market.