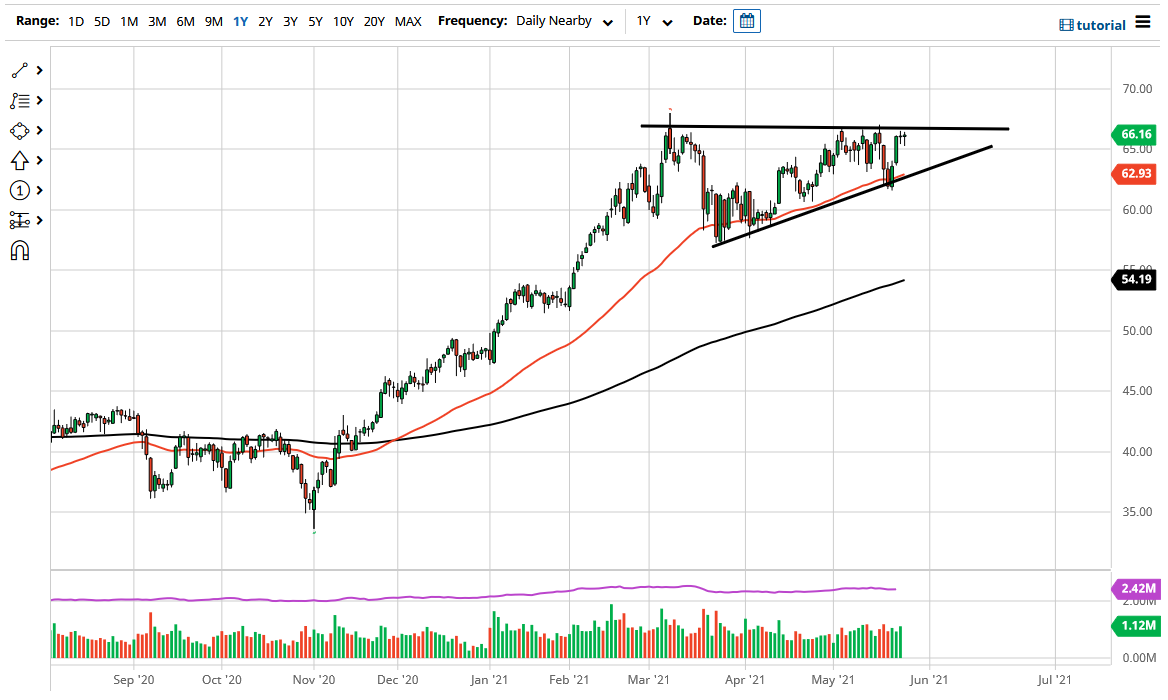

The West Texas Intermediate Crude Oil market fluctuated during the trading session on Wednesday, as we continue to press the top of a major ascending triangle. This ascending triangle has been worth paying attention to for some time, so if we can break above the $67.50 level, it is likely that this market will go much higher, perhaps reaching towards the $70 level. Beyond that, the market then goes looking towards the $72.50 level, which is a significant area of both support and resistance.

When I look at this chart, it does suggest that we are going to continue to see bullish pressure, despite the fact that there are a lot of questions out there about the reopening situation. Right now, the market is likely to continue to see traders banking on the idea of more demand coming around the corner. That being said, we will probably see this momentum keep up. If we do pull back from here, it is likely that the $65 level would be support, just as the 50-day EMA will be below there. Underneath the current action, we also have the uptrend line from the ascending triangle, so all of it kind of piles into one ball of support. If we break down below that uptrend line, then it is possible that the market could go looking towards the $60 level.

I think a lot of what we are seeing is the market trying to price in the idea of perhaps the Iranians not been able to flood the market with domestic oil, as we continue to see the Iranian nuclear deal drag on. Beyond that, we still have to ask questions as to whether or not there is going to be a sudden push higher due to the fact that Europe is starting to open up as well. That should translate into more demand overall. We probably have the summertime cyclical trade coming into play as well. With this, the market is more than likely going to break out to the upside, but I need to see a daily close above that $67.50 level in order to blow through a significant amount of resistance that we have seen over the last month or so.