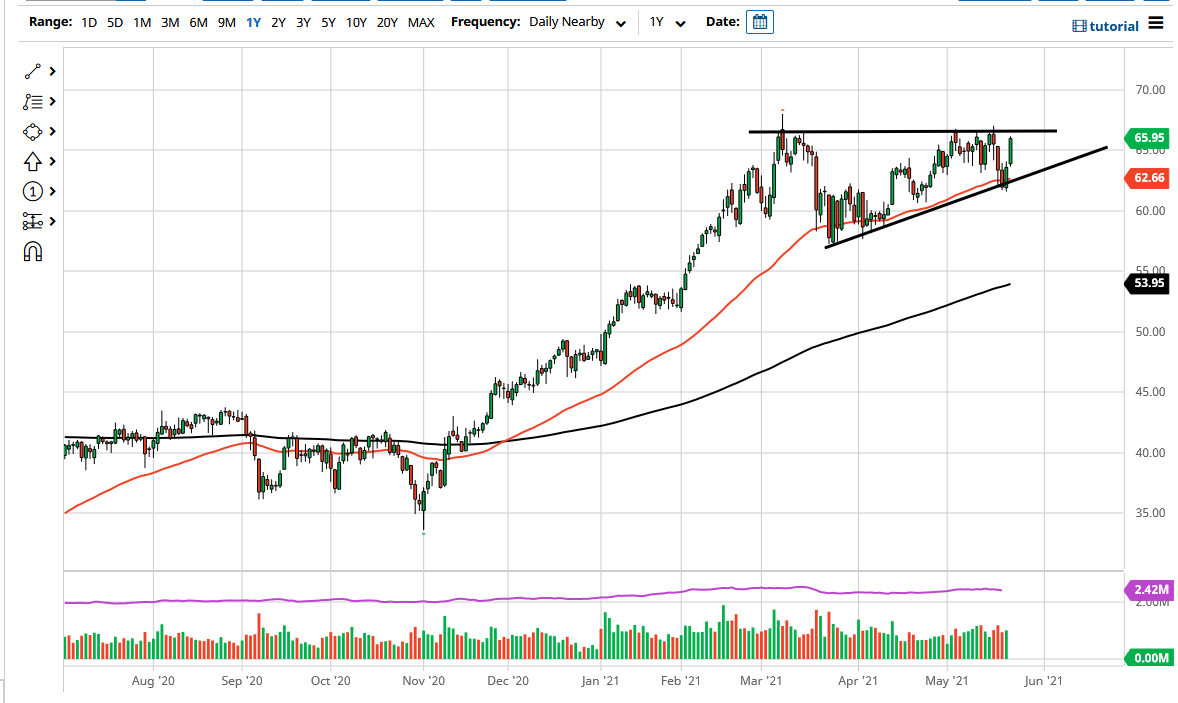

With the Iranians in the midst of conversations about being able to sell to the open market, it is worth noting that the nuclear deal has hit a few snags during the trading session, suggesting that perhaps that supply of crude oil will not hit the market anytime soon. That is today’s excuse at the very least, so it is worth noting that we continue to see buyers on dips and that is what people are focusing on in the heat of the moment. However, you can clearly see a well-defined ascending triangle, so that something worth paying attention to as well.

Speaking of the ascending triangle, the bottom of it features an uptrend line and the 50-day EMA walking right along it. That tells me there should be plenty of support in that general vicinity, so I like the idea of picking up bits and pieces in that area. On the other hand, the measured move from the entire triangle suggests that we could go as high as $75 once we finally do get that significant break out. It does make sense, because people are banking on the reopening trade more than anything else, and the massive amount of supply that will be needed by economies waking up. When you look at the problems that the supply chain had, we have worked through the massive glut after the pandemic, and the fundamentals are starting to line up a bit more positive over the last several months.

Another thing to pay attention to is that the US dollar has been getting hammered as well, so that provides a little bit of bullish pressure for a longer-term move. At this point, I do think that it is only a matter of time before we break out, so on a daily close above that $67.50 level I would not only be a buyer, but I would be a holder.

To the downside, the 50-day EMA being broken could open up the market to the possibility of the $60 level, which is a large, round, psychologically significant figure, but it is also worth noting that the support is likely to extend all the way down to the $57.50 level. With that, the market is likely to see a significant “flush lower” if we do break down below it.