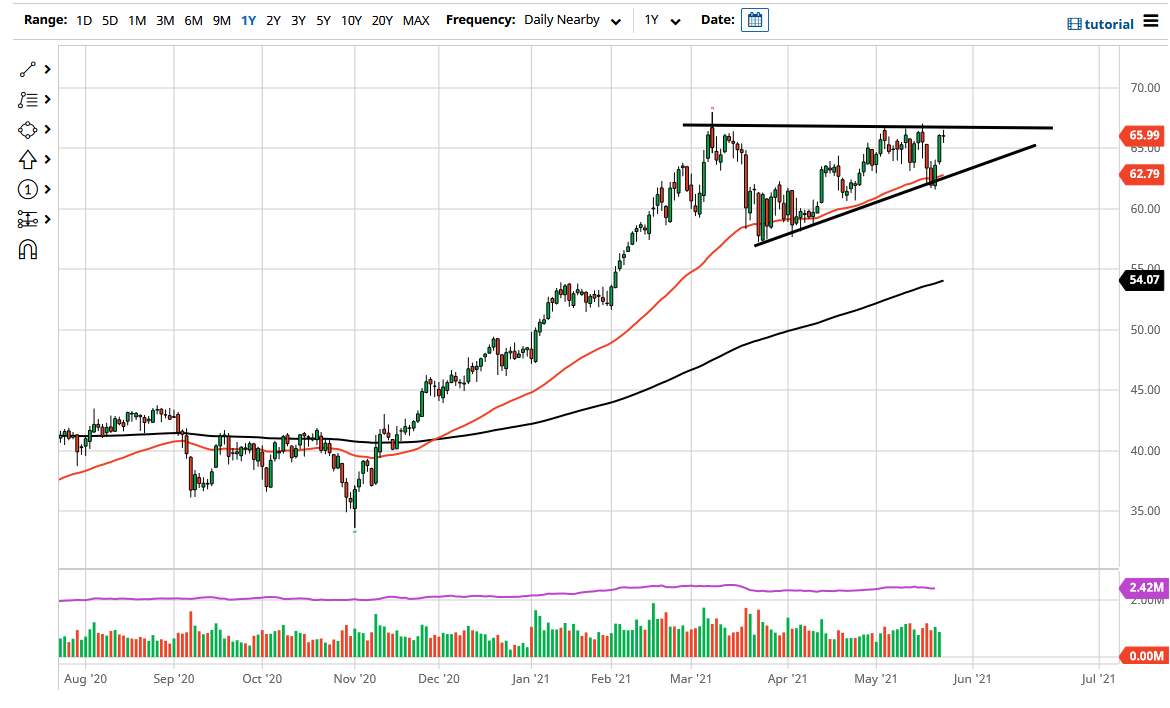

The West Texas Intermediate Crude Oil market fluctuated during the trading session on Tuesday, as we are at the top of a massive ascending triangle. It should not be a huge surprise that we could not break out to the upside, because we are in the midst of the Iranian nuclear deal talks. There are a lot of questions as to whether or not Iran will comply, but if they do, then a flood of fresh Iranian crude could jump into the marketplace, causing a little bit more supply than the market currently enjoys.

With that being the case, it does make a little bit of a bearish argument. However, history has shown us that the Iranians coming to the table does not necessarily mean that they are going to give in and do whatever it is the Western powers want them to do. They have talked about having the International Atomic Energy Agency allowed access to their nuclear facilities for another month, which is seen as a positive development; but at the same time, there seems to be a multitude of minor snags along the way. Traders are starting to question whether or not the deal will actually get done.

As long as the Iranians are not adding their mix of crude oil into the marketplace, then it is more than likely going to be a bullish case scenario. Even if they do, I think that given enough time, the buyers will return based upon the reopening trade and the anticipated demand that will come with massive economies around the world reopening. With that, and perhaps a little bit of help from the US dollar falling, we could very well see the WTI Crude Oil market break above the top of the triangle and go as high as $75 based upon the measured move. Obviously, the $70 level would have a certain amount of psychology involved, so I do not necessarily think that we would simply slice through it. Nonetheless, pullbacks at this point look like they are being supported by not only the 50-day EMA, but also the uptrend line that sits at roughly the same spot. Because of this, the market still looks like it is going to be a “buy on the dips” type of scenario.