The West Texas Intermediate Crude Oil market rallied again during the trading session on Friday to show signs of continuation. The market is trying to break out and go much higher, but I think it will take some type of catalyst to make that happen. At this point in time, it appears that the market is likely to see a significant amount of demand coming down the road as we reopen around the world. With that being the case, the market could very well break out, and that would be the main reason that people are looking at this market through a bullish prism.

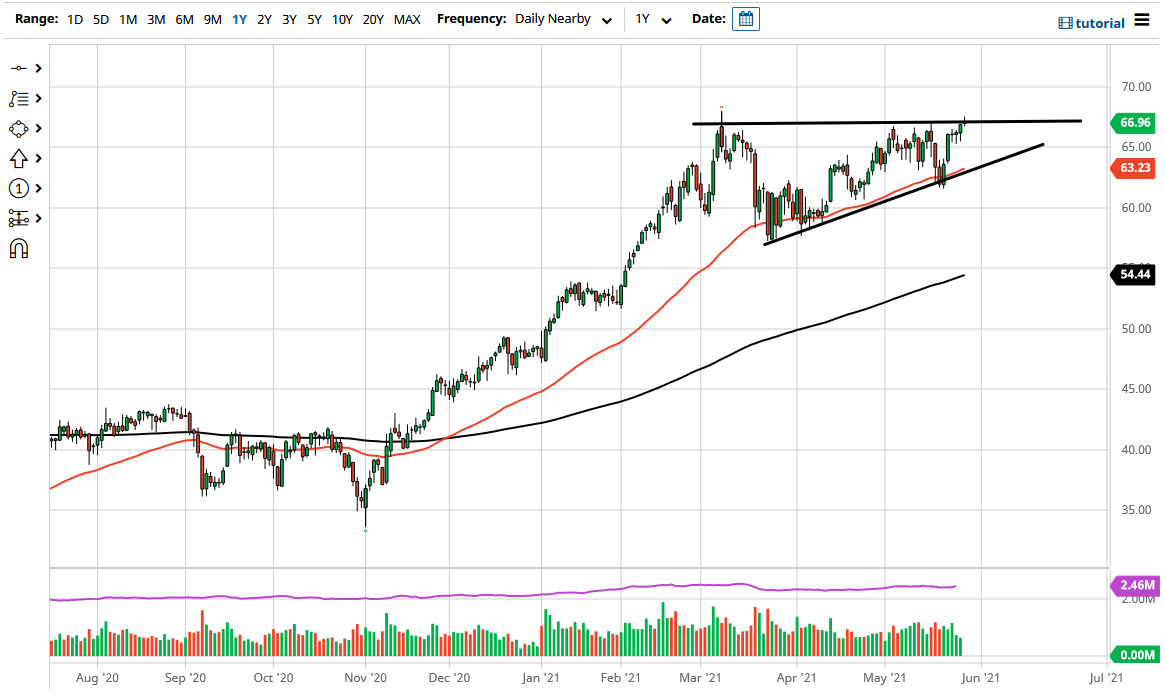

If we can break above the $67.50 level, then it is likely that we could go looking towards the $70 level, perhaps towards the $72.50 level. To the downside, the market has support at the $65 level, and the 50-day EMA is trying to walk right along the uptrend line. The ascending triangle is something that you should pay close attention to, and it does make sense that we will continue to go higher. “Market memory” comes into the picture at a break above the $67.50 level, and it is likely that we would see a move of about $10 at that point.

If we break down below the uptrend line, then the market could drop towards the $60 level, possibly even lower than that. That would obviously be a sign of weakness or at least hesitation. Pay attention to the US dollar, because it does have a significant amount of influence on the market as well. After all, the crude oil market is priced in the US dollar, so if the US dollar falls, then it is likely that we will need more of those US dollars to buy a barrel of oil. Furthermore, you should also look at this through the prism of the US dollar being a safety asset, so if we are looking at a runaway from safety, then we are running into the idea of global growth. That is a full-circle argument, and it brings money back into the crude oil market. Furthermore, it is probably worth noting that we are now beyond working through the glut of crude oil that had built up during the pandemic.