What I find interesting is that most of this is probably based upon the idea of the Iranians starting to be able to sell into the general markets, which of course would drive down prices in the theory of more supply.

Whether or not the Iranians are allowed to sell again is a completely different question, but at this point time it looks like there is at least a certain amount of momentum heading in that direction. If that is the case, we could see a little bit of selling as supply comes back into the market. Nonetheless, there should be demand picking up around the world as we reopen, so I think it is probably more likely than not that we find time type of bounce. That being said, the way we ended up closing for the trading session on Thursday is a little disheartening for the buyers, so in order to get long you would probably need to see a significant bullish candle. Or at the very least some type of stability.

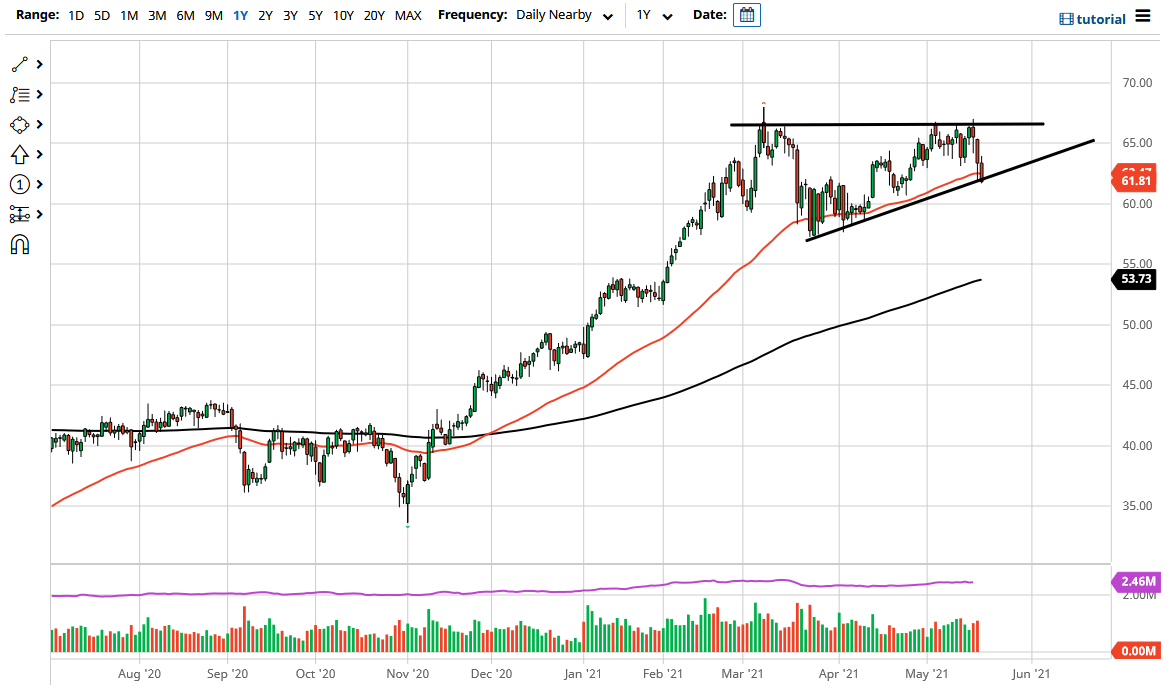

If we do break down, the $60 level would be the next target for support, and then of course the $57.50 level which is the bottom of the triangle. Whether or not we can break out to the upside remains to be seen but the reality is that the trend is very much to the upside still so one has to think that until proven otherwise, the trend remains intact.

That being said, there are some people claiming that this has started to form a bit of a “double top”, so is the possibility this incident be in the end of the rally. I do not necessarily think it is yet, but if we were to drop down below the 200 day EMA then it would be completely confirm, or for that matter if we break down below the $57 level, I will consider it confirmed. One thing is for sure, risk appetite has taken a significant hit over the last couple of days, so it is worth paying attention to. Regardless, I would be cautious about position size initially.