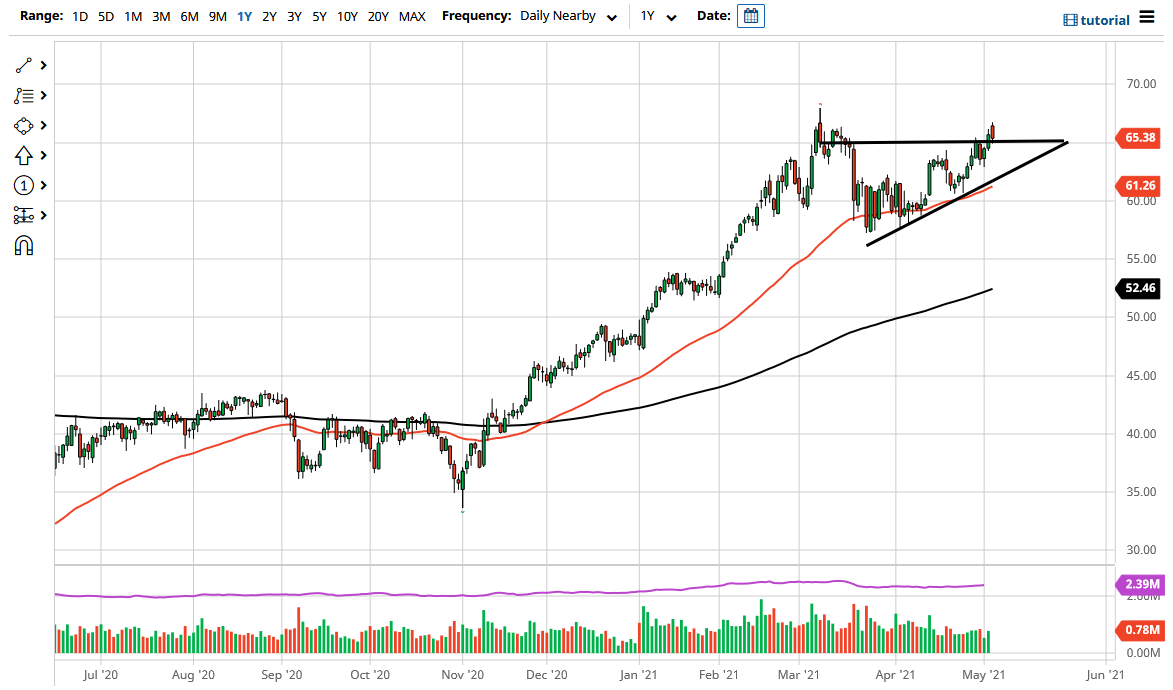

The West Texas Intermediate Crude Oil market gapped higher to kick off the trading session on Wednesday and then shot towards the $67.50 level. We could not break above there, though, so it is not a huge surprise that we pulled back. We pulled back towards the top of the triangle that we have just broken out of, and now it looks as if we are trying to find buyers in that area. Keep in mind that the market has been bullish for quite some time, so it could have been a little bit of profit-taking.

When I look at this chart, the most obvious support level is underneath at the bottom of the ascending triangle, which features the trendline and the 50-day EMA. I also see a lot of support areas between here and there, so I think it is only a matter of time before the buyers get involved and start buying again. In fact, it is not until we break down below the 50-day EMA that I become concerned about the market, because I know that the jobs number will have a lot of influence on what traders do next.

The bigger the jobs number, the better that this market will probably move to the upside, as the idea of more workers would suggest that the economy in the United States will demand more crude oil. That is the idea that most traders are working with, as OPEC + and British Petroleum both have suggested that there should be a an increase of 6 million barrels per day as far as demand is concerned globally. As long as that is going to be the case, then I think what we are looking at is a market that will eventually find plenty of buyers, and if the US dollar gets hammered that will only accelerate this pace. Based upon the ascending triangle, the “measured move” suggests that we could go towards the $72.25 level if we fulfill the expansion. That does not mean that we will go straight up in the air, but it does mean that you should be looking for value opportunities every time the market dips, as it could present you with “cheap oil.” Regardless, I think that we are looking at a bullish market and I am not willing to go against it.