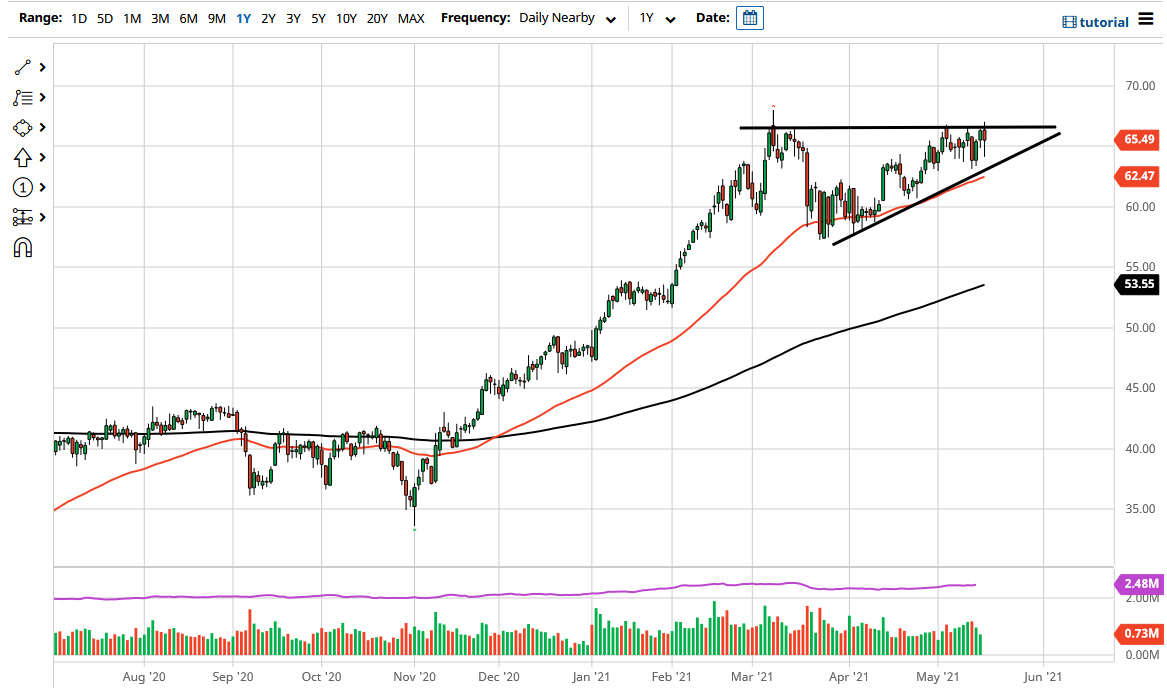

The West Texas Intermediate Crude Oil market initially fell rather hard during the trading session but turned right back around to show signs of strength as the $64 level offered significant support. That being said, the market is likely to continue to try to press to the upside and take off. If we can break above the top of the recent highs, then we could go looking towards the $70 level. The $68 level was that spike higher, so therefore I think it is only a matter of time before we go higher than that, perhaps even as high as the $75 level.

It is worth noting that the 50-day EMA is climbing the uptrend line in the ascending triangle, so I think at the end of the day it is likely that we will see that offer dynamic support. Regardless, I do not have any interest in shorting this market, but if we did break down below the 50-day EMA it is likely that we could go looking towards the $57.50 level. In general, I do believe that it is only a matter of time before market would find buyers, but a break down below the 50-day EMA certainly could send this market lower in the short term.

It is very likely that we will continue to see buyers on these dips, so it is difficult to get short of this market. This is especially true as we ended up forming a bit of a hammer, which has a bullish tone to it as well. Nonetheless, most people are trading this market based upon the idea of further demand coming into the picture, especially as economies around the world start to reopen, and therefore demand more crude oil. Beyond that, the market has also shown itself to be very resilient, so I think that we will continue to find one reason or another to go higher, especially if the US dollar crumbles, as the simple inflation equation could come into play and send this market higher. Commodities are all following the same trajectory, and that is to the upside. I have no interest whatsoever in trying to short this market until we break below that 50-day EMA, something that does not look very likely to happen.