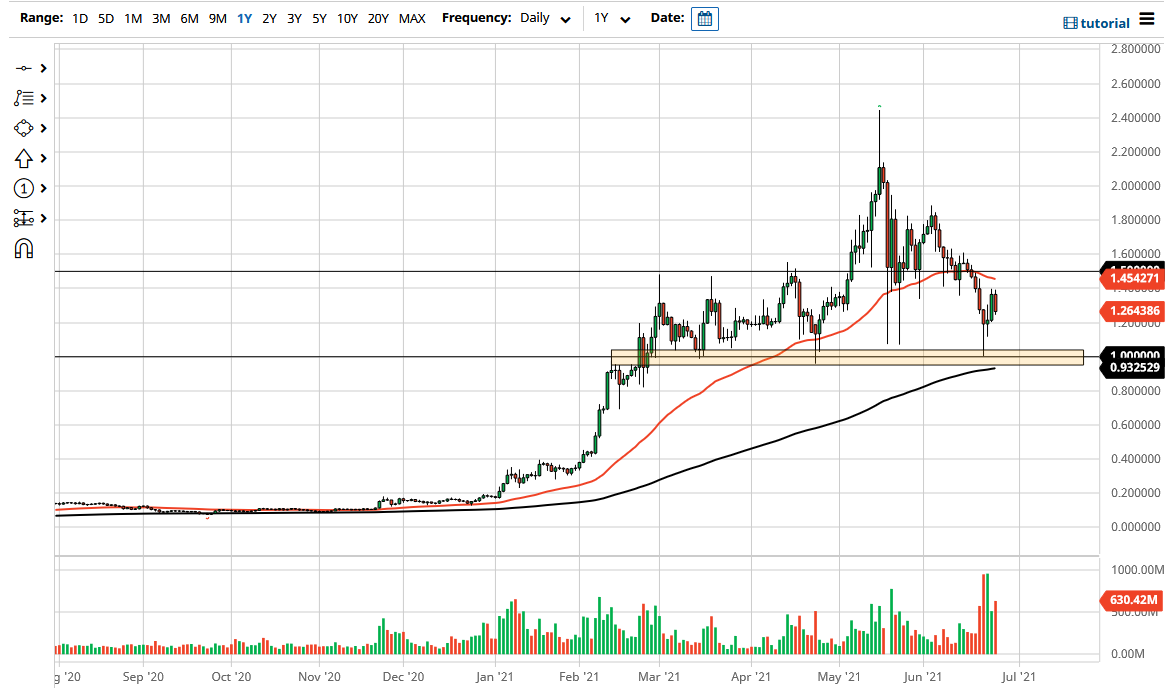

Cardano fell a bit during the trading session on Friday as we initially tried to break above the $1.40 level before turning around and showing signs of exhaustion. At this point, the market has dropped about $0.20, and as a result, it looks like we are hell-bent on trying to test the $1.00 level again, which is where the 200-day EMA currently sits, and is a place where we had formed a massive hammer. There seems to be a “zone of support” from the $1.20 level down to the $1.00 level underneath, and I think as long as we can stay above there, the market is likely to continue to see buyers try to defend Cardano.

However, as with all things crypto, you need to keep an eye on the Bitcoin market, as it will give you direction on the other coins, Cardano included. Because of this, if we continue to see bearish pressure in the Bitcoin market, that could then break down the Cardano market as well. If the $1.00 level gets broken to the downside, is very likely that the market will go looking towards the $0.75 level, followed by the $0.50 level. With that being the case, the market is likely to continue to see a significant sell-off and probably with significant momentum, because it would more than likely have something to do with crypto markets themselves crashing. After all, if Bitcoin breaks down below the $30,000 level, one will have to think there is a significant “flush lower” just waiting to happen. There is no way that Cardano could avoid that type of carnage, so it is the most important thing to pay attention to.

However, if Cardano does break above the $1.50 level, then it will immediately face a challenge in the form of the $1.60 level, which opens up the possibility for a move to the $1.80 level. Cardano is a coin that I like a lot, but crypto tends to move in one overall direction, and Bitcoin is the leader of the band. Without Bitcoin, Cardano stands no chance of rallying for any significant amount of time. The crypto markets are not mature enough to stand on their own, with one coin moving in one direction while Bitcoin moves in the other.