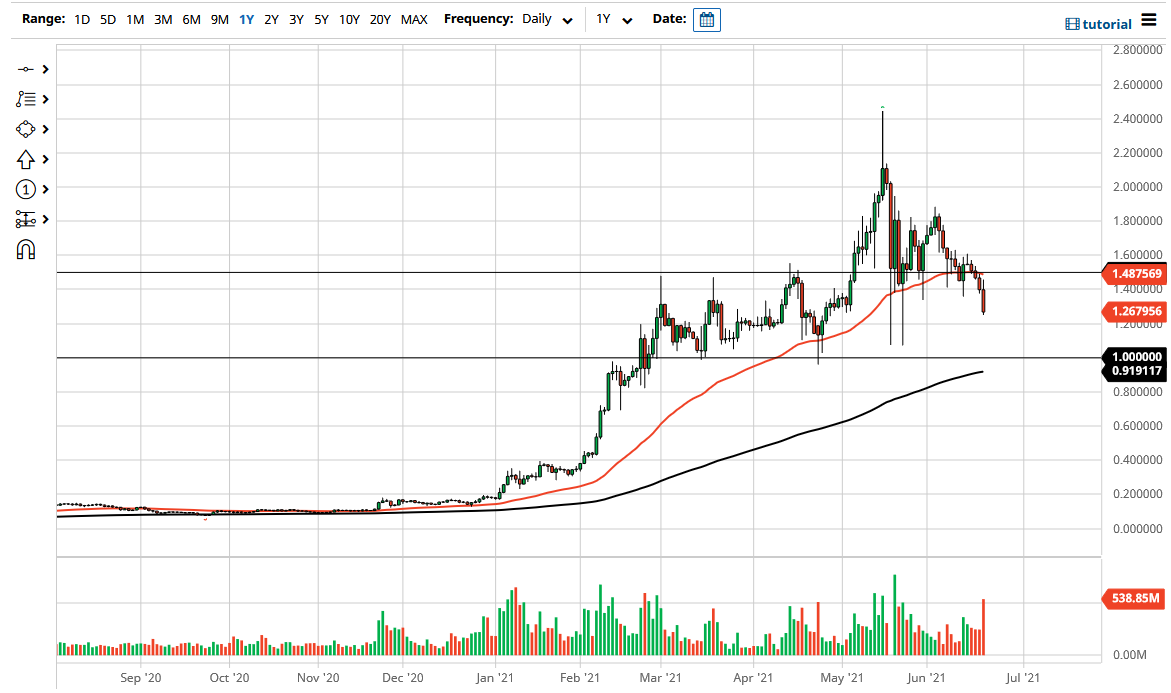

The Cardano market initially tried to rally during the trading session on Monday, but you can see that the 50-day EMA at the $1.50 level has offered significant resistance. This is an area that has previously been important more than once, as it had been significant support over the last couple of months, as well as resistance previously. By breaking through the $1.50 level, Cardano has shown a real proclivity to continue falling, especially now that we are finally closing underneath the $1.40 level, an area that had been somewhat important in the last 30 days.

As we are closing towards the bottom of the candlestick, it suggests that we are going to go looking towards the $1.20 level, and then eventually the $1.00 level where I believe there should be a significant amount of support. For what it is worth, the 200-day EMA is sitting just below the $1.00 level, so I think it all ties together quite nicely for a support opportunity. At this point, I do not see much to change the overall attitude in the market, and that is especially true as Bitcoin continues to struggle overall.

While I do like the idea of Cardano, I recognize that the overall crypto market is being held hostage to the Bitcoin price movement, so I believe that there should be a significant amount of value near the $1.00 level underneath, and I plan on scaling into a position somewhere in that area. However, if we were to break down below the 200-day EMA, it is very possible that we may go looking towards the $0.80 level. If that were to happen, it could be a straight shot down to the $0.20 level. While that would be rather catastrophic, it could be a nice opportunity to pick up Cardano “on the cheap.” In fact, I would be willing to pile into it to build up a longer-term move.

To the upside, I would need to see this market clear the $1.50 level on a daily close to get long at this point. I think overall we are looking at the choppiness in this area as an opportunity given enough time, but I am not willing to jump in right now because I think we will get a bit of follow-through based upon the close.