While there are a lot of arguments to be made for the efficacy of Cardano longer-term, the reality is that the crypto markets tend to move in the same general direction as Bitcoin. Ultimately, this is a market that is being held hostage by Bitcoin, so with that being the case it is likely that we will continue to see an outsized influence from that marketplace. As Bitcoin fell during the trading session after initially trying to rally, Cardano and other crypto all moved in kind.

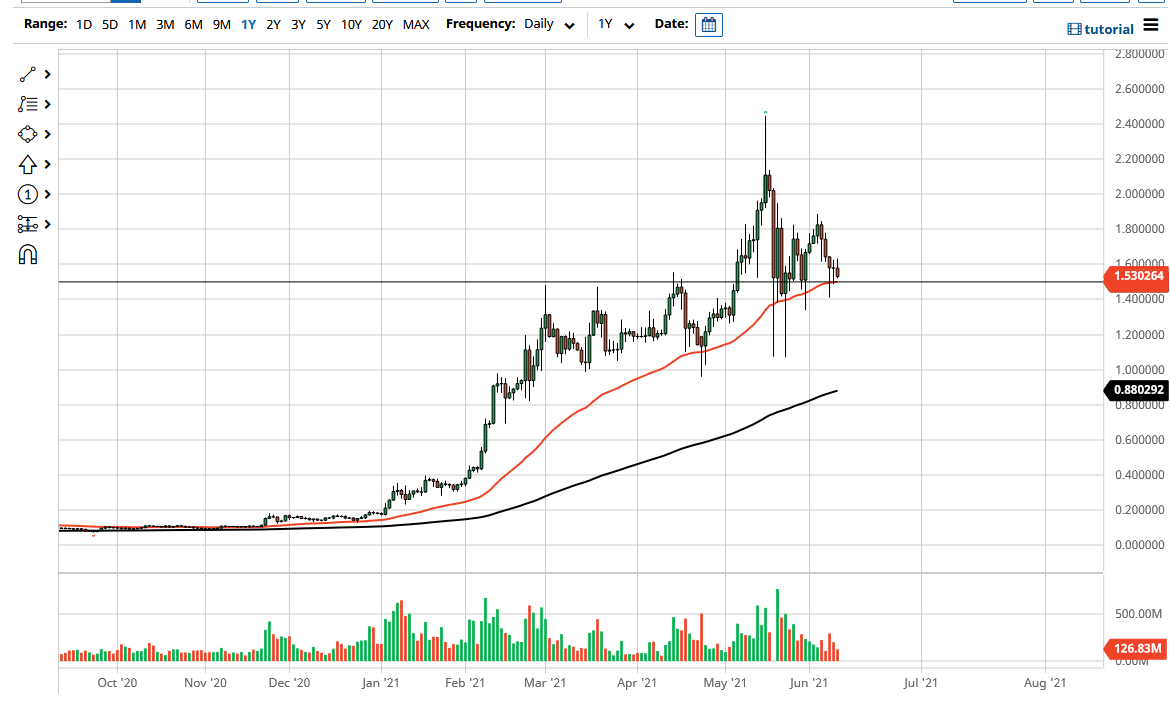

The 50 day EMA sits just below at the $1.50 level, which in and of itself of course is an important level due to the psychology of it and as you can see, has been both support and resistance multiple times in the past. Because of this, the market is likely to continue to see a certain amount of interest in this general vicinity. Whether or not we can break down might be a different question, but if Bitcoin does, you can almost count on Cardano doing the same thing. The $1.40 level should be supportive, but after that we could see a drop down to the $1.20 level after that.

What I do find interesting is that the 200 day EMA is starting to race towards the $1.00 level, and that could be where we end up. Obviously, we would need to see a bit of crypto selling in general, which of course Cardano is not immune to. You could make an argument for a little bit of a descending triangle, assuming that you do not use the works. However, if you do use the works in this area, then it is likely that we are in the midst of a symmetrical triangle, which tells me that the market is more than likely to make a bigger move sooner or later. In the meantime, I think that there is a lot of negativity in the crypto markets, and I do not know that this one is going to be any different.

Having said that, if we were to break above the highs from the Thursday session, it could open up a move to the $1.80 level, possibly even the $2.00 level to the upside. That is not my core position right now, but I do think that it is a real possibility that we need to pay close attention to.