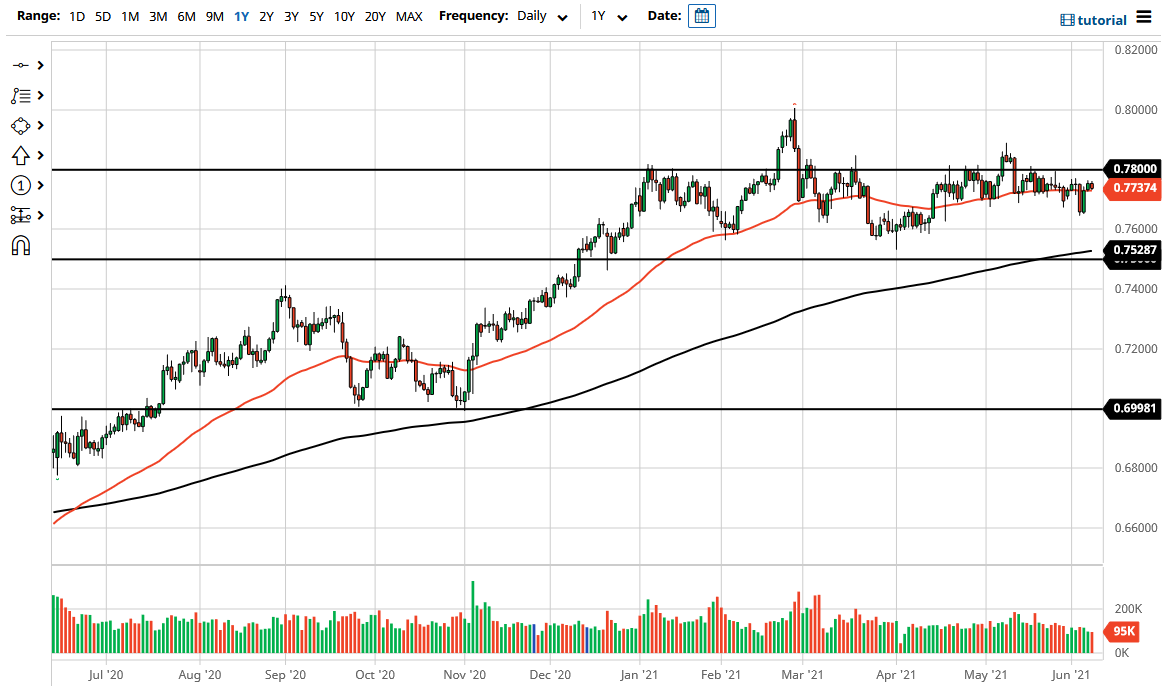

The Australian dollar fluctuated during the trading session on Tuesday as we sit just above the 50-day EMA. Ultimately, this is a market that seems to be doing almost nothing, so I have not been trading it. However, if you are a short-term scalper, this might be an opportunity to take advantage of a well-defined range. Beyond that, I find it very difficult to trade the Australian dollar for anything more than a discount.

When you look at the 50-day EMA, it is essentially sideways, and it suggests that we are very range-bound and very flat. There is nothing out there to move the Aussie right now because we have a couple of different things going on at the same time. The first thing is the fact that the commodity boom is going on around the world, and that does help the Australian dollar. However, at the same time, we also have the Australians and the Chinese arguing about trade terms weighing upon the Aussie. The Chinese recently have abandoned using Australian coal, but you should also keep in mind that at the same time, the Chinese demand for coal continues to be insatiable, and they are in fact running into a lack of supply. If that is going to be the case, it may only be a matter of time before the Australians get open access to the market again.

At this point, the market is likely to continue seeing a lot of back and forth and choppy behavior with the 0.78 level above offering significant resistance, just as the 0.76 level underneath offers support. The area above will continue to cause significant resistance, extending all the way to at least the 0.80 level, if not the 0.81 level. We are working against massive selling pressure above, but if this market can ever break above the 0.81 handle, then it is likely that we would go looking towards the 0.90 level. To the downside, if we manage to break down below the 0.75 handle, the market would almost certainly drop another 500 pips to reach down towards the 0.70 level. In the meantime, we will simply bounce around in this relatively tight range, with almost nothing to do, unless you have the ability to scalp short-term charts.