Bearish View

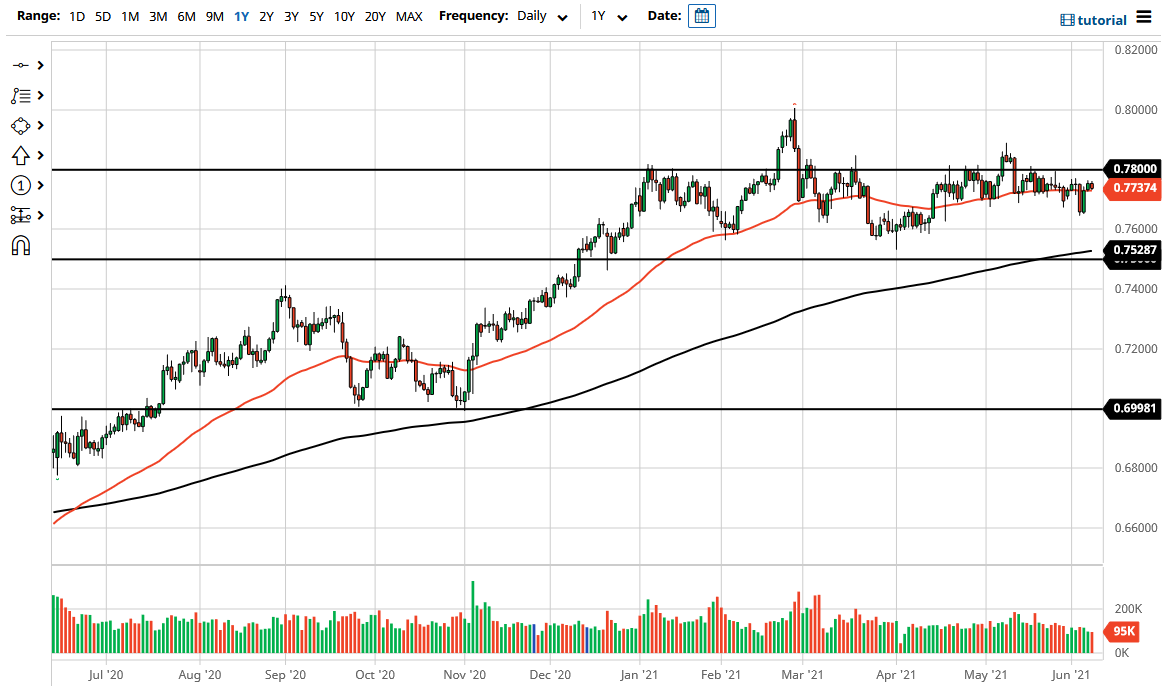

- Sell the EUR/USD and add a take-profit at 0.7650.

- Add a stop-loss at 0.7750.

- Timeline: 1-2 days.

Bullish View

- Set a buy-stop at 0.7750 and a take-profit at 0.7800.

- Add a stop-loss at 0.7700.

The AUD/USD pair was little changed after the latest Australian consumer sentiment data and the relatively strong China inflation numbers. It is trading at 0.7735, which is a few points below yesterday’s high of 0.7765.

China's Inflation Rising

Australia and China have a relatively strong relationship. China buys most of Australia’s goods like iron ore and coal. It is also the biggest consumer of Australia’s services like education and hospitality. Therefore, traders often view the Australian dollar as a close proxy of the Chinese economy.

Earlier on Wednesday, data from China showed that factory inflation surged by 9% in May from the previous 6.8%. This was the highest it has been since 2008 and is mostly because of the rising commodity prices.

In the past few months, top commodities like copper and iron ore have jumped to an all-time high while others like lumber and crude oil have more than doubled. In recent weeks, though, Chinese officials have made policies to stem this rise by targeting speculators. The PPI number is important because it tends to flow to consumers as companies hike prices.

Meanwhile, the Consumer Price Index rose from -0.3% in April to -0.2% in May. This increase was relatively smaller than the median estimate of -0.1%. Further, the CPI rose by 1.3% on a year-on-year basis.

The AUD/USD pair also reacted to the relatively weak June consumer sentiment in Australia. According to Westpac, the sentiment declined to -5.2% in June from the previous -4.8%. This is a relatively important figure since weak consumer sentiment leads to weak spending.

Looking ahead, the AUD/USD pair will react to the latest US inflation that will come out on Thursday. Analysts see the headline CPI rising from 4.2% in April to 4.7% in May. Excluding food and energy, they see the prices rising from 2.3% to 3.2%.

AUD/USD Technical Analysis

The four-hour chart shows that the AUD/USD pair has pulled back from yesterday’s high of 0.7765 to the current level of 0.7736. The pair has moved slightly below the upper side of the descending channel. It is also at the same level as the 25-day and 15-day exponential moving averages (EMA) and slightly above the standard pivot point. Therefore, the pair will likely keep falling as bears target the next key support at 0.7700.