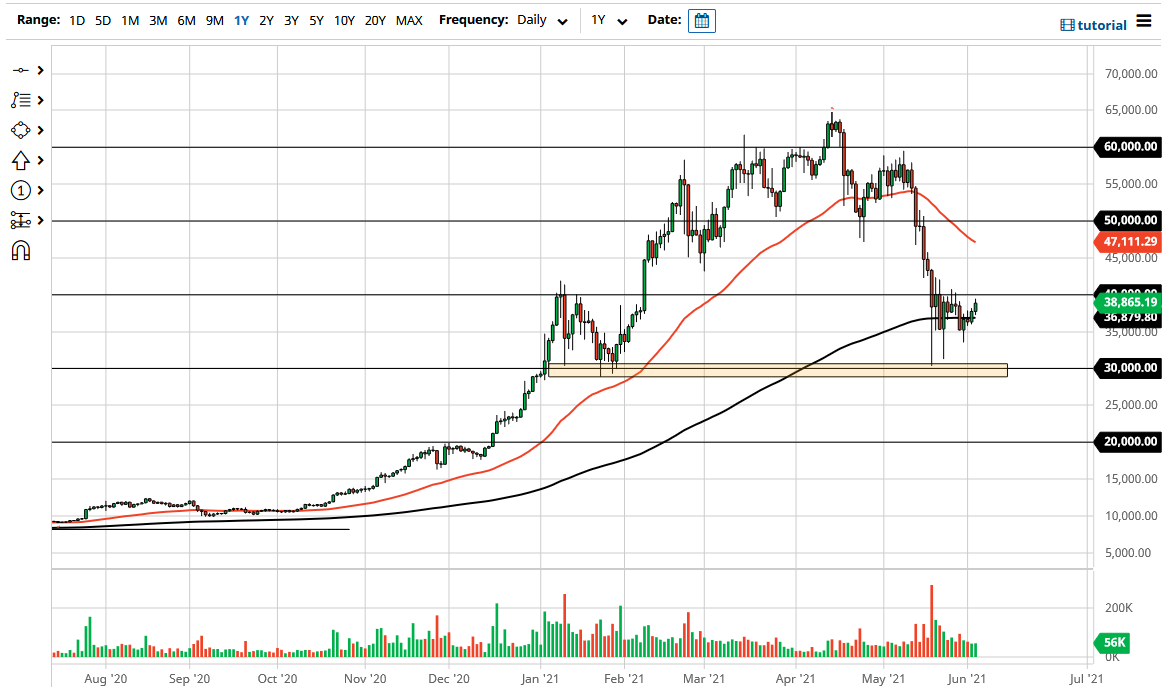

Ultimately, this is a market that is trying to build up some type of basing pattern, as we have seen such a massive selloff. We continue to hover right around the 200 day EMA, which of course is a major technical indicator that a lot of people will pay attention to. Nonetheless, we have not been able to hang onto any significant moves, so while the market was up over 2 ½% for the session, that pales in comparison to the massive selling that we had recently seen.

I do believe that the $30,000 level underneath is going to continue to be major support longer term, and because of this it is crucial that the market hangs on to that level. If it does not, we could very quickly find bitcoin trading down at the $20,000 level. The $20,000 level is an area that has been important in the past as resistance, so it would not surprise me at all to see this market offer a significant amount of support on the way back down. If for some reason we were to break down below the $20,000 level, then it is likely that we would see a complete “crypto winter” coming down the road.

The US dollar got a bit of a boost during the day, so the fact that bitcoin rallied in the face of that is a somewhat good sign, and with that being the case I look at it as a potential opportunity for the market to prove itself. Again though, it is not until we get a daily close above that $40,000 level that I would be completely convinced that we are about to turn things around. At that point, the 50 day EMA is reaching towards the $47,000 level, and that could offer a little bit of trouble. After that, we could be looking at the $50,000 level which of course has structural and psychological importance, with that an area being previous support and of course a good headline number. I think that we simply wait until we get some type of significant candlestick to get involved in one direction or the other. Currently, we do not have one.