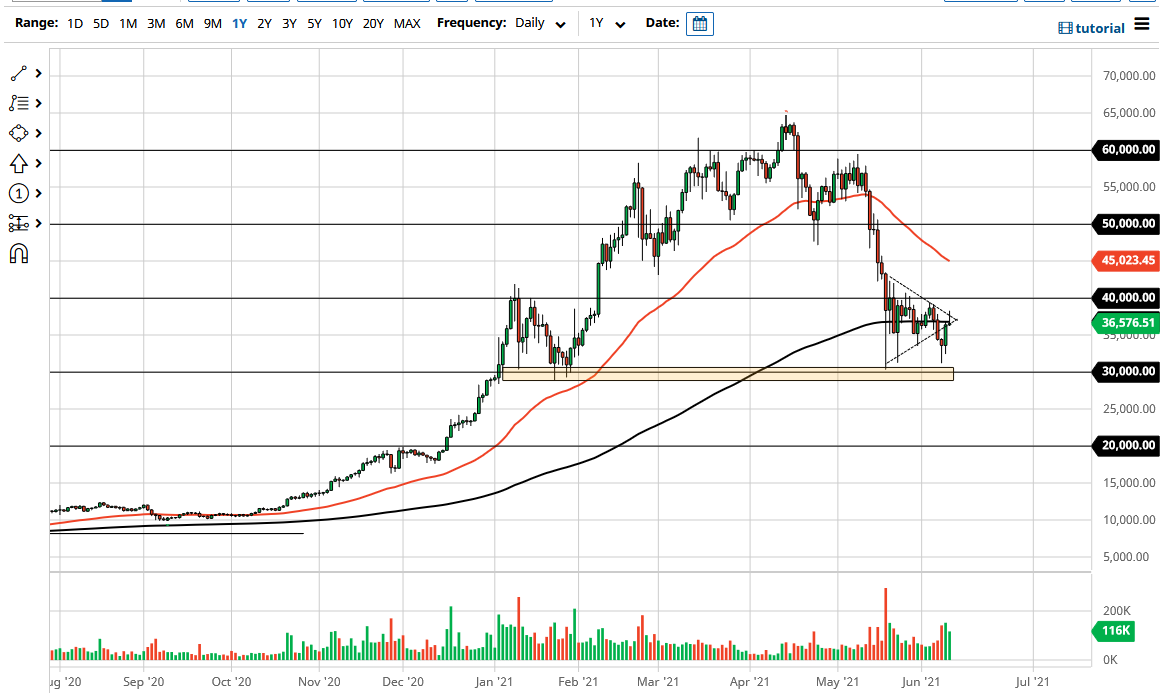

Bitcoin markets rallied again during the trading session on Thursday, just as buyers would like to see. However, you can see that we have given back some of the gains to form a bit of a shooting star. The shooting star itself is not a major concern but considering where it formed it is perhaps time to stand up and take notice. After all, the 200 day EMA sits right at that level, and it is of course right in the middle of the previous symmetrical triangle. The fact that we have broken down through the bottom of the market and then turned around to show strength but failed could in and of itself show that the market is ready to go lower.

It is interesting that the market has shown itself to be supported at the $30,000 level, but not able to turn around and break above the $40,000 level. That of course is a large, round, psychologically significant number that we have been tussling with for the last couple weeks, and therefore it is very difficult to imagine a scenario that we were able to break out above that market without some type of volume surge. We have not seen that, which in and of itself is somewhat ominous.

If we break down below the bottom of the candlestick, then it is very possible that we could go looking towards the $30,000 level again, which is an area that the market has respected multiple times. If we break down below there, then I do believe that the Bitcoin market falls another $10,000 to reach down towards the crucial $20,000 level, which would be important to say the least.

Bitcoin volatility has been off at the charts as of late, reaching as high as 120. That is an outrageous reading, and that suggests that we are going to continue to see selling pressure, and therefore I have no interest in buying Bitcoin anytime soon. In fact, we would need to see some type of major breakout above the $40,000 level on a daily close. With that in mind, I think at best we are probably going to see a bit of consolidation, but as we head into the weekend, lack of volume could see this market breaking down rather significantly. That being said, I would stay on the sidelines at this point.