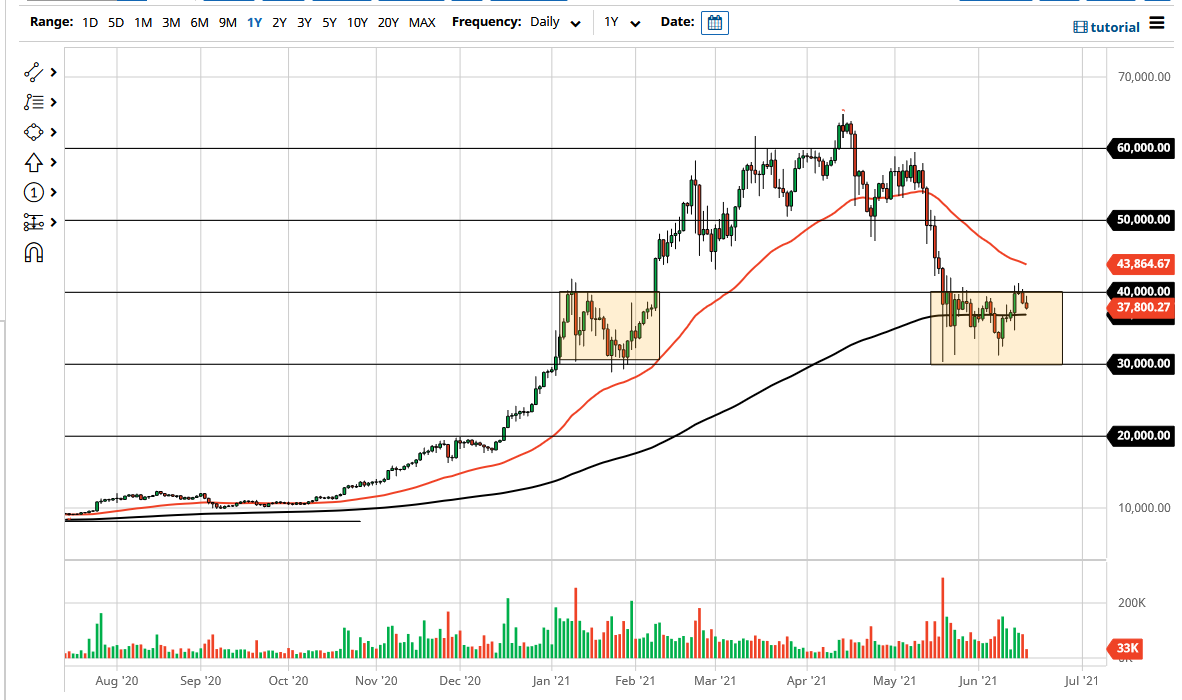

The bitcoin market rallied a bit during the trading session on Thursday, but as you can see, we have failed at the $40,000 level yet again. At this point we have to ask the question as to whether or not $40,000 is going to be a bit of the ceiling, or are we just simply trying to build up enough momentum to finally break out? That is the major issue with this market right now, because an argument could be made for either scenario.

When you look at this chart, you can see that the 200 day EMA sits just below current trading at roughly $37,000, and we are squared up to test that level again. We have sliced back and forth through it multiple times, so I do not foot as much into the idea of the indicator right now, other than the fact that it is flat, and we have formed a very significant and obvious consolidation range between the $40,000 level on the top and the $30,000 level on the bottom.

Because of this, I believe that you have plenty of time to make a decision on bitcoin, because it is winding itself up for a bigger move, but that does not mean that you have to put money to work right away. Simply put, if we break above the area just above $40,000, then we could go looking towards the $50,000 level. On the other hand, if we break down below the $30,000 level, we could see bitcoin really take it to the chin, perhaps dropping down towards the $20,000 level.

There are a lot of questions as to whether or not this thing is going to hold on, and quite frankly it is essentially anybody’s guess at this point. I would suggest that the longer the market stays in this general vicinity, the better off it is going to be for the buyers. However, some short-term traders may be willing to go back and forth in this area, but not myself, because crypto is far too volatile to day trade in my estimation. Look for the next break out and follow right along because it should be worth about $10,000 in either direction based upon simple support and resistance analysis as well as the fact that the market seems to really like these $10,000 increments.