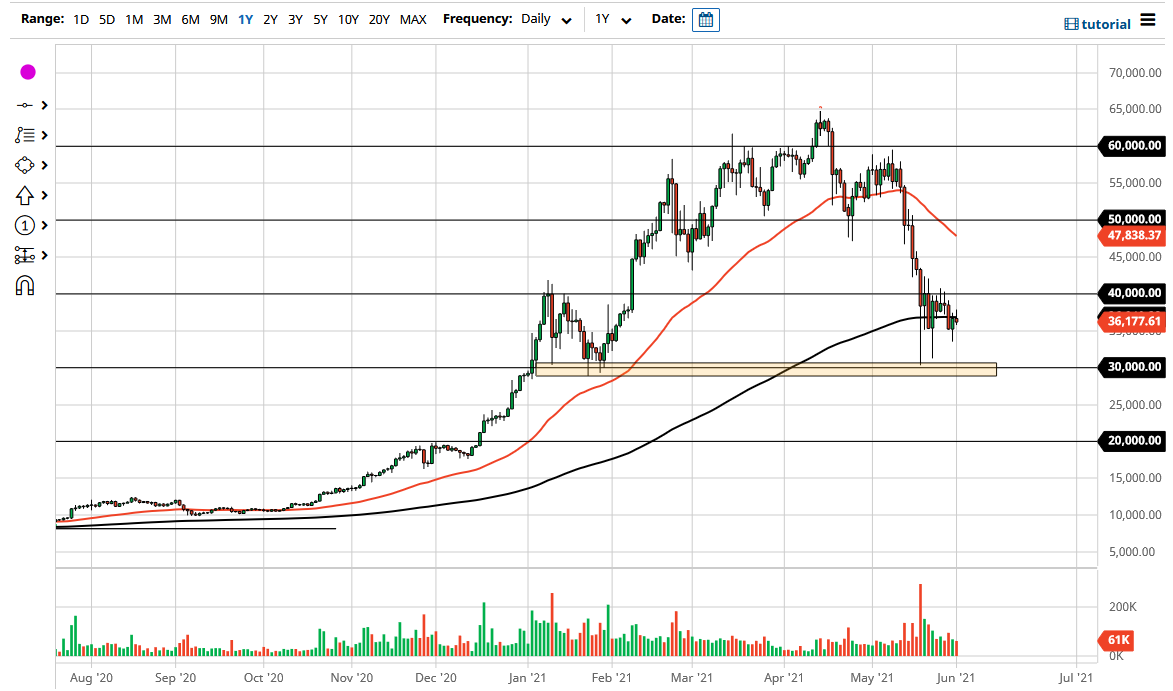

Bitcoin markets were a bit choppy during the trading session on Tuesday as we continue to sit at the 200-day EMA. This is a market that will pay close attention to that longer-term signal, and it is also worth noting that the 200-day EMA is flattening out. Ultimately, the 200-day EMA is sitting at the $30,000 level, which will be support that we have tested a couple of times. This is an area that has been important multiple times previously, and it is a large, round, psychologically significant figure.

To the upside, the $40,000 level above should be resistance, as it has shown itself to be over the last week or so. Ultimately, if the market were to close on a daily candlestick above that level, it could kick off a move towards $45,000 above, possibly even the 50-day EMA. Another thing that this would prove is that the overall attitude of the market is about to turn around. That could send this market back into a bullish run, but we would obviously have a lot of work to do near the $50,000 level to convince people. With that being the case, the market continues to see a lot of volatility in general, and I think that we are looking at a scenario in which we will have to make a bigger decision, and once we do, I will make the appropriate trade in kind.

If we were to break down below the $30,000 level, then I think it is likely that we would go looking towards the $20,000 level. That is an area that would be even more supportive, as it would wipe out the massive amount of froth that we had seen over the last several months. I would not be surprised at all to see Bitcoin continue to drop from here, so one needs to be very cautious. The position sizing will be crucial more than anything else, so you need to be aware of the fact that the market at the very least needs to go sideways to build up enough support and confidence to go long. I think in the short term, you have to look at this as a $10,000 range that the market is trying to stabilize in.