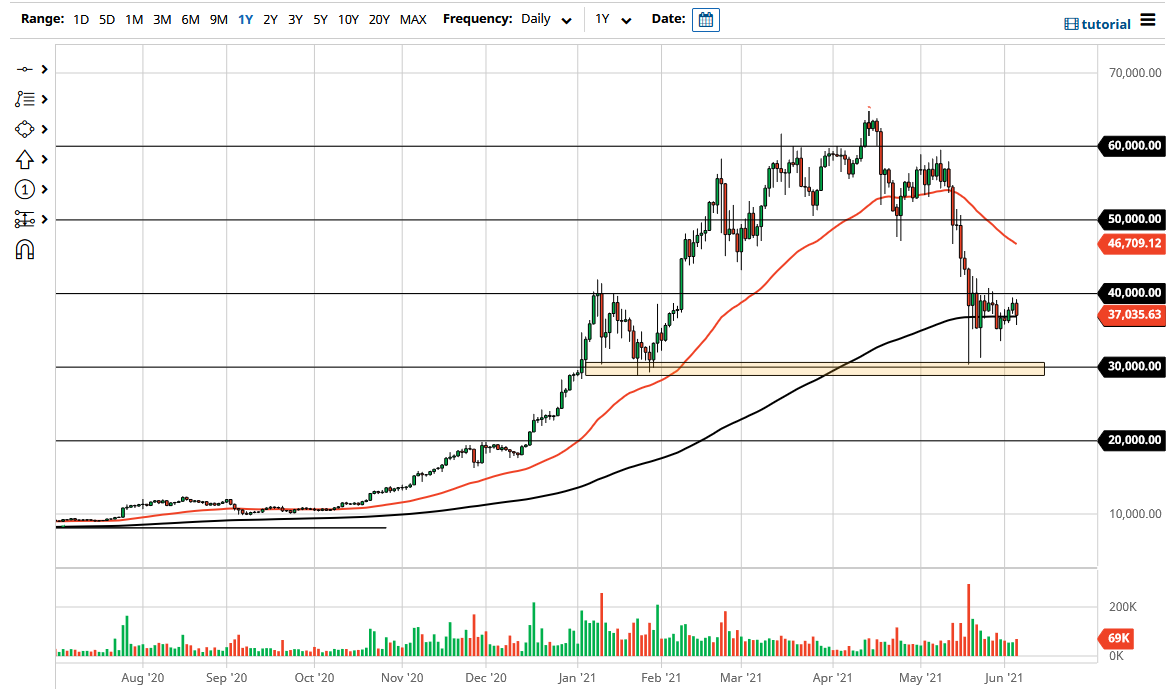

Bitcoin initially dropped during the trading session on Friday, dipping below the 200-day EMA. However, by the end of the session we have simply balanced just above it, and now it looks as if the market is still in its “wait-and-see” mode that it has been in for a while.

Having said that, the fact that the market has gone sideways for a little while is relatively bullish, at least in the sense that we stopped falling. I do believe that this market is consolidating at the moment, with the 200-day EMA acting as dynamic support. The $40,000 level above continues to offer resistance, as we have seen a couple of attempts to break above it and it is a large, round, psychologically significant figure. If we were to break above that level, then it would obviously be very bullish. To the downside, I believe that the $30,000 level is the bottom of the overall consolidation. Breaking down below that level would be extraordinarily negative and could open up the next leg lower.

At this point, it simply looks as if the market is trying to figure out what the next catalyst is, and whether or not it is “safe” to start buying again. In general, I think that the market is going to see a lot of noisy behavior, but sooner or later we will get some type of impulsive candlestick to start following. I think the fact that the volume is dropping probably tells you that we are simply waiting. I do not think that the market would be one that you should be jumping into with a lot of money or, God forbid, leverage, but I do think that you have the ability to start accumulating if you are a longer-term “buy-and-hold trader.” Otherwise, at best, you are looking at a back-and-forth type of range bound market, or perhaps may have to wait until we get the breakout or breakdown.

If we do get a breakdown below the $30,000 level, we will go looking towards the $20,000 level rather quickly. In fact, I think at that point the market would probably become very bearish again for quite a while like we did several years ago. That is not necessarily my base case scenario, but it is a very real possibility.